Why long-term investing matters

Investing Views & insightsFrom compounding to beating inflation, discover four reasons why investing over the long term is the wisest strategy.

9 October 2025 | 2 minute read

Investing for the long term gives your money the greatest chance of growing in value. But this means keeping calm during periods of significant stock market volatility – and remembering that, as history shows, markets typically recover.

|

|

||

Download: A guide to investingLearn how investing helps your money work harder in our jargon-free guide. |

||

Here are four reasons why investing over the long term is the wisest strategy.

1. Time in the market matters

As the old investment adage goes, it’s time in the market – not timing the market – which is key to returns. By delaying investing, or cashing in your investments early, you risk missing out on the best days in the market.

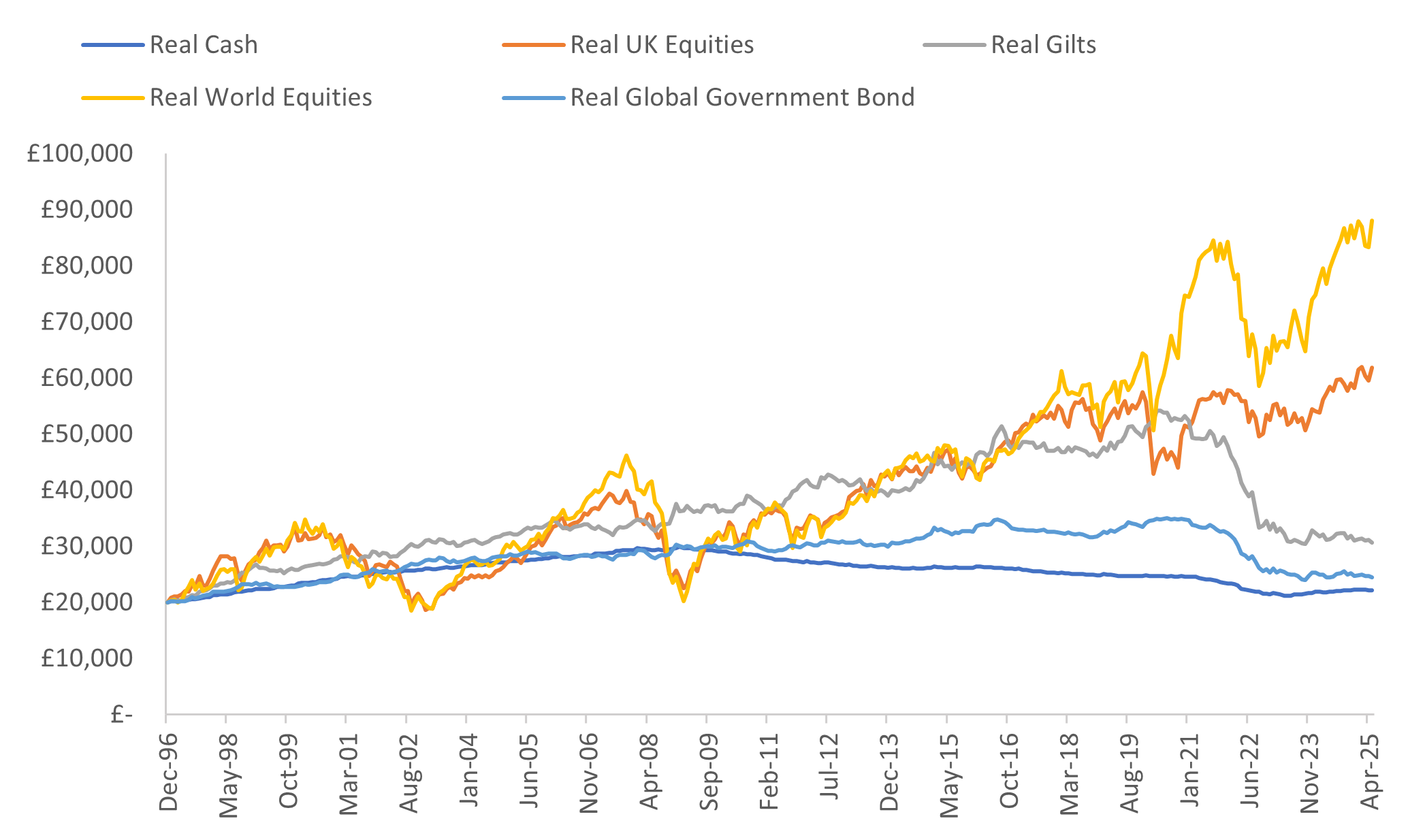

The graph below shows how different asset classes have performed compared to cash. Any balanced portfolio consisting of a mix of stocks and bonds, for example, would have outstripped cash returns by a good margin over the long term. Of course, investing comes with more risk than holding your money in a cash account, your investments may lose as well as gain value, and there are fees to consider. The best way to preserve your portfolio over the long term is to diversify your investment.

A wealth manager can act as a sounding board during periods of stock market volatility and help you remain focused on your long-term financial goals.

Source: RBC Brewin Dolphin/LSEG Datastream

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

2. Compounding matters

Compounding is extremely powerful when it comes to investing. Albert Einstein described it as the eighth wonder of the world. It is, simply, earning returns on your returns.

For example, somebody earning a nominal return of 5% per year net of fees would see their investments grow by a compounded return of 63% after 10 years. After 20 years, this rises to 165%, and over 25 years, it balloons to 239%. This demonstrates the cumulative effects that compounding has on capital.

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

3. Beating inflation matters

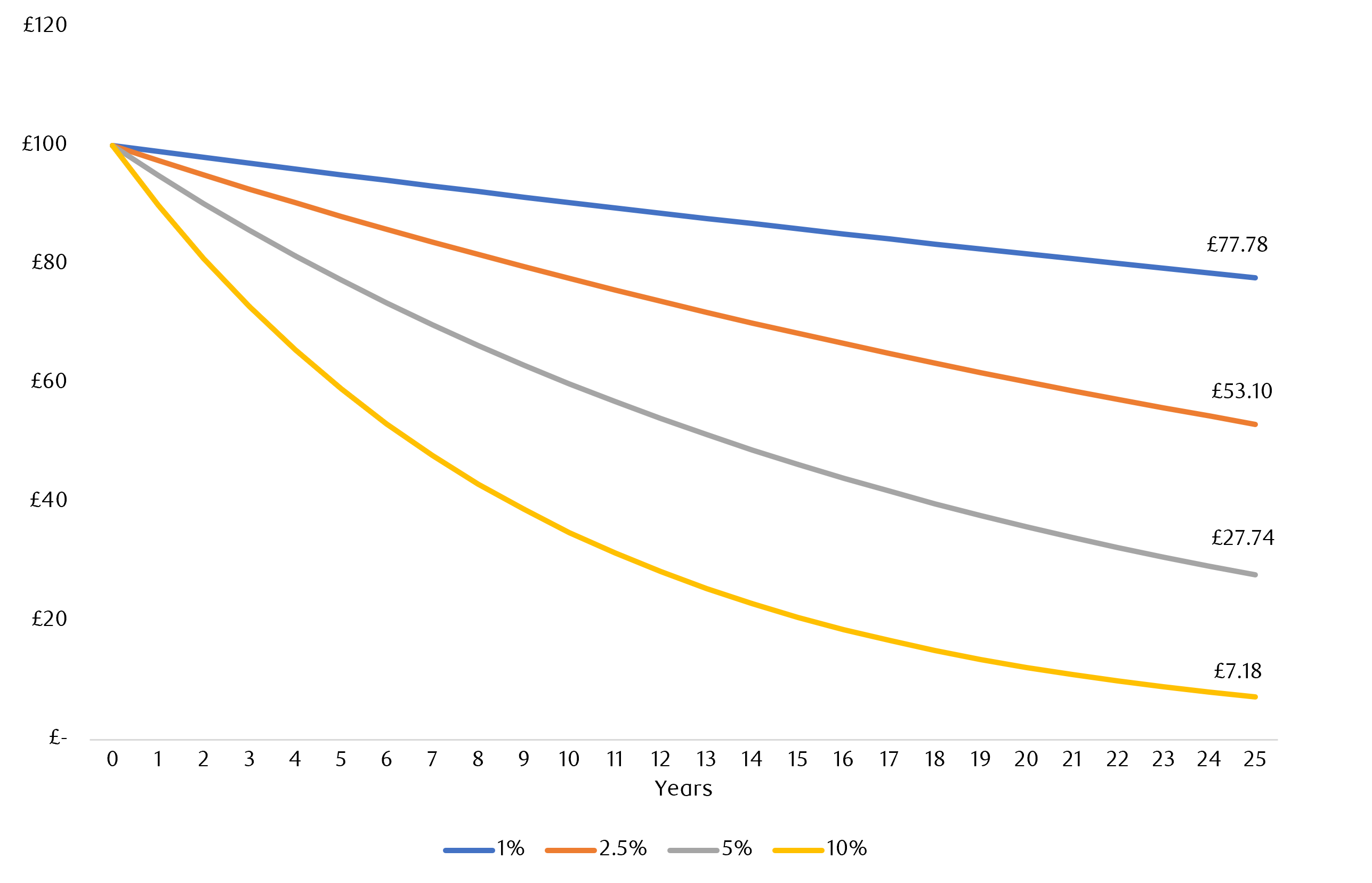

Inflation can erode the real value of savings over time. If we assume for simplicity’s sake that your money was earning no interest at all, then an inflation rate of 2.5% would reduce the real value of £100 to £53.10 after 25 years, while an inflation rate of 5% would reduce it to just £27.74.

Source: RBC Brewin Dolphin

For illustrative purposes only.

If you are prepared to accept the risk that comes with investing, and have time on your side, you give your money the greatest chance of growing and beating inflation over the long term.

4. Risk matters

Spreading your money across different asset classes across the globe, including equities, bonds and cash, can help to reduce the impact of volatility on your investments’ overall performance. This is because different assets tend to be negatively correlated, which means they will not usually react in the same way to sudden economic shocks.

A wealth manager can help you build a diversified portfolio of investments which suits your individual needs and risk appetite.

Find out more from our dedicated support team by calling us on 020 7246 1111. Opening hours are Monday to Friday 9am to 5pm.

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Are your retirement plans on track?

We’ll guide you through your options, show how much you need to save, and build a plan that helps you realise your ambitions.

Retirement planning