Markets respond to political turmoil

Views & insightsWe examine how markets have reacted to political developments in Japan and the UK as well as the impact of AI.

Key highlights

- More U.S. workers are let go…: The Challenger Report, which summarises U.S. job cut announcements, showed an increase in job cuts.

- … but AI’s not to blame: Despite concerns over AI-related job losses, the Challenger Report showed that AI has only accounted for 3% of layoffs since 2023.

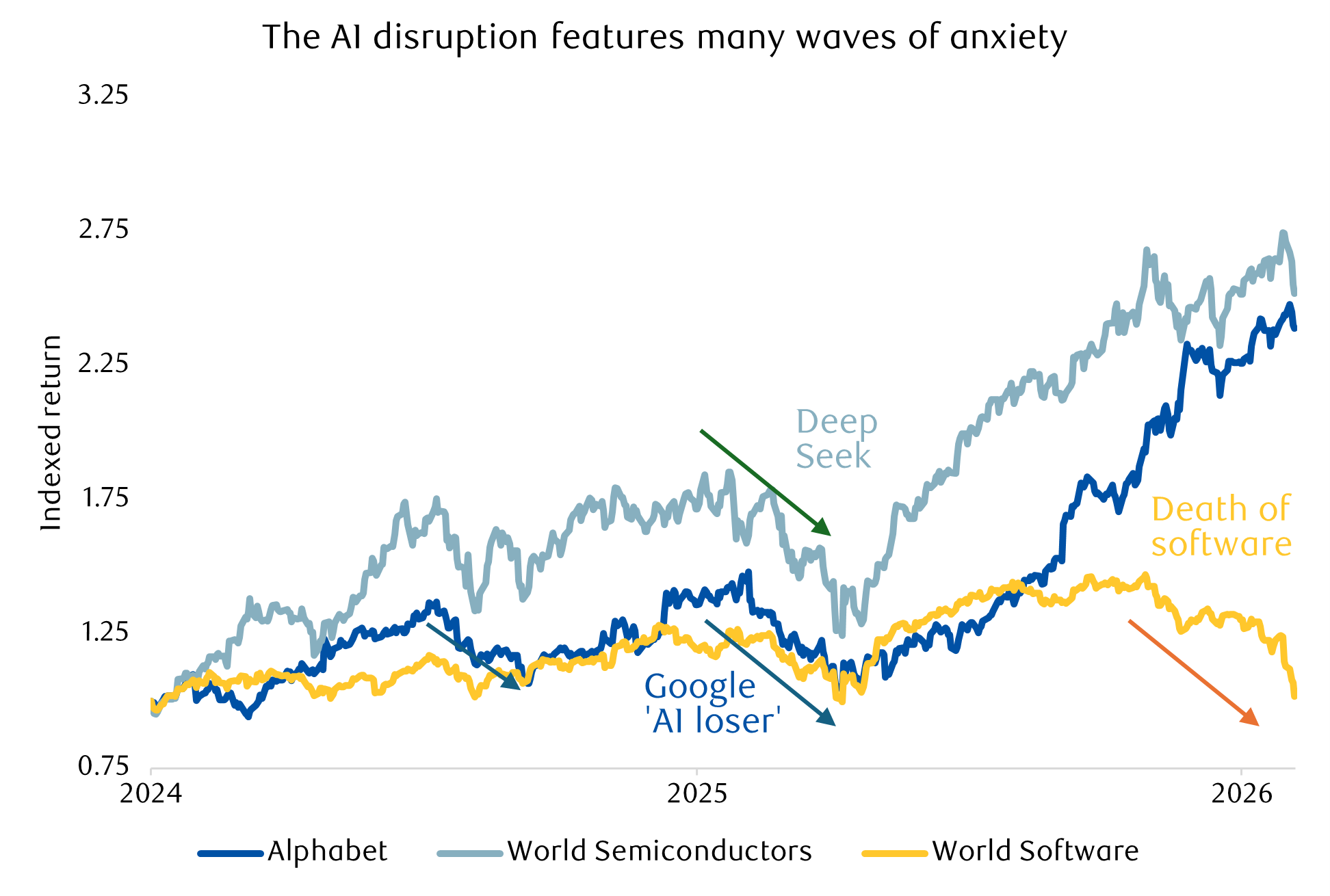

- Software stresses: The software industry saw a sharp share class decline over fears AI can replace many applications.

A rapidly disrupted world

Source: Challenger Report

Not all of the disorder stems from government, but some does; specifically, the controversy over U.S. Immigration and Customs Enforcement (ICE) agents causing fatalities. This has seen U.S. Congress deny funding to the Department of Homeland Security (DHS), which funds ICE. A compromise has been reached but it will be short lived, with DHS funding due to expire on 13 February.

The compromise came too late for some of last week’s anticipated jobs data releases, which have been delayed as a result. It’s a shame, because jobs growth has been slowing this year, and the interest rate outlook is uncertain. Compounding concerns, the week saw a further step up in the anxiety investors are feeling over the effects of AI on companies and workers.

However, some jobs data was released last week – including the Challenger Report, which summarises job cut announcements. The report showed an increase in U.S. job cuts.

There have been various reasons for layoffs over the last year, a lot of which related to federal spending cuts under Elon Musk’s Department of Government Efficiency (DOGE). But technology job losses, specifically in software, have been a regular feature.

It may seem ironic that the technology sector can bear the brunt of technological advances, but digital industries remain the most vulnerable to digital disruption. The Challenger Report has been tracking how many job losses are associated with AI, but the numbers have been comfortingly small. Since 2023, AI has been cited as the reason for just 3% of layoffs, although it’s likely job losses in other categories are at least partly enabled by AI.

The lack of hard jobs data came as Anthropic, one of the four main foundational AI models, released a series of products designed to deliver efficiencies in various industries. A document review and analysis plugin for legal documents was interpreted as a threat to existing legal data services from RELX and Thomson Reuters. The new plugin overlaps significantly with some review and drafting workflows but doesn’t seem to disrupt the companies’ crown jewel assets − their validated data sources.

Source: LSEG Datastream

Early evidence suggests the former, and was validated to some extent by comments from Sundar Pichai, CEO of Alphabet. He pointed out that 19 of the top 20 Software as a Service (SAAS) firms were using Gemini (Alphabet’s AI model).

Either way, this seems like good news for Alphabet, but the stock sold off last week despite delivering record profits and performing strongly on most metrics. Amazon’s results were also good but were received even more poorly.

The anxiety for both companies seems to be related to plans for capital investment. While the investment still seems to be supported by demand, and therefore doesn’t echo the speculative investment of the technology, media and telecommunications (TMT) bubble era, it nevertheless represents an increase in capital intensity for the hyperscalers, which will depress profitability going forwards. What investors don’t know right now is whether that increase in costs will be justified by even greater increases in revenue.

It’s worth remembering that this time a year ago, the release of the Deep Seek large language model, which seemed much more efficient than the existing foundational models, caused significant sell-offs in AI hardware providers (such as Nvidia).

A year before that, AI was seen as an existential threat to Google’s search business. Since then, Google has emerged as one of the greatest beneficiaries of AI.

Looking back, those times represented attractive investment opportunities. The same could well be true for software and legal data companies today. The bigger question is what it would take for the market to regain confidence in the value of these businesses, just like it was able to do for the hardware companies and Alphabet itself.

Coming up

- Jobs update: The delayed U.S. jobs report will arrive.

- Inflation update: U.S. inflation will be reported on Friday.

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.