Why portfolio diversification matters

Investing Views & insightsStock market volatility over the last ten years underlines how important it is to have a diversified investment portfolio

20 November 2023 | 3 minute read

Recent stock market volatility means it’s more important than ever to ensure your portfolio is robust enough to withstand shocks.

Knowing which investments are likely to outperform or underperform in an uncertain economic environment isn’t easy. In fact, our research shows the chances of selecting the single best-performing asset class for ten years in a row are one in 25 billion!

The best way to preserve and grow your portfolio over the long term is to diversify your money across a range of asset classes and stay focused on your goals. Read on to find out why.

Odds of selecting the best asset class

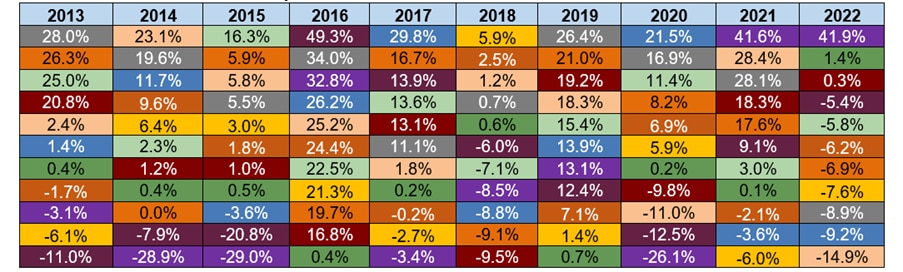

We conducted some research to find out the odds of selecting the single best-performing asset class every year for ten years. We based our research on the 11 asset classes we track, which include equities across a range of regions, cash, government and corporate bonds, commercial property, and commodities.

Our research found that the odds of picking the top performer for ten years in a row were one in 25 billion. You’d be more likely to win the EuroMillions jackpot, where the odds of winning are one in 140 million.

Over the last ten years*, seven out of the 11 asset classes occupied the top spot. Commodities were the top performer in 2021 and 2022, but they performed the worst in 2014, 2015, 2017 and 2020, demonstrating the volatility that comes with individual categories. The spread in performance – the differential between the best and worst performing asset classes – averaged 41.15% over the past decade.

Why diversification matters

The spread in the performance of different asset classes highlights the near impossibility of being able to predict what will happen in the future. That’s why it’s important not to rely on one type of investment for returns within your portfolio. Different asset classes tend to react differently to economic shocks, so by spreading your money you’ll benefit from the assets that perform well, while protecting yourself against the worst effects of the underperformers.

You can diversify your portfolio further by investing in a range of sectors and regions, as these may also perform differently to one another at any given time. During the Covid-19 pandemic, for example, ‘stay at home’ stocks boomed while leisure stocks languished. Emerging markets ex Asia equities struggled in 2013, 2014 and 2015, but were the top performing asset class in 2016.

What’s in favour today can become unpopular tomorrow, but holding the right spread of exposure to different assets can help you remain focused on your long-term goals and shield you from short-term noise.

The importance of advice

Knowing which asset classes to hold and in what proportion isn’t easy, and that’s where getting some financial advice comes in.

We’ll help you build and maintain a portfolio that has the right mix of assets for your individual needs and objectives, and which works hard to preserve and grow your wealth over the long term. We’ll also act as a sounding board during difficult times, helping you invest objectively and rationally and avoid making decisions in haste.

*Asset class total return performance

Source: Bloomberg

Key

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice