Saving for university: it pays to start early

Investing Views & insightsDiscover how much university really costs, why it pays to plan ahead, and where to invest your money for long-term growth.

20 November 2024 | 3 minute read

Saving for your child’s university education may seem a challenge when the price of energy bills, petrol and food has been soaring.

But the good news is you don’t need to save thousands of pounds a month to build up a reasonable pot of money. Investing relatively small amounts of money on a regular basis could enable your child to graduate free from debt – so long as you start early enough.

Read on to find out how much university costs, why it pays to plan ahead, and where to invest your money for long-term growth.

How much does university cost?

University tuition fees in England, Wales and Northern Ireland cost up to £9,250 per year1, or £27,750 for a three-year course. For those who live in Scotland and go to university in Scotland, fees are £1,820 a year, but these are usually covered by Student Awards Agency Scotland (SAAS)2.

Other costs to consider include rent, bills, groceries, transport, entertainment, and course materials. In total, a typical UK student can expect to pay around £1,078 per month on living costs3. Assuming your child pays these costs for nine months of the year, this would add up to just over £29,100 for a three-year course or just over £38,800 for a four-year course (undergraduate degrees are typically three years, except in Scotland where they are usually four years).

In total, you could be looking at a figure of around £56,850 if your child goes to university in England, Wales or Northern Ireland, or just over £38,800 if they qualify for SAAS funding in Scotland. In 15 years, these figures could be just over £76,510 and just under £52,220, respectively – this assumes an illustrative annual inflation rate of 2%.

Why does planning ahead matter?

These are daunting sums of money, but they could be achievable if you plan early enough.

Our analysis shows that if you invested £320 a month over 15 years, you could build up a pot worth just under £73,000. This assumes you achieve an annual return of 3% after inflation (assumed at 2% annualised rate) and fees. This could cover three years’ worth of tuition fees in England, Wales or Northern Ireland, plus living costs, in 15 years’ time.

For Scottish students, investing £200 a month could enable you to build up a pot worth just over £45,550, which may be more than enough to pay for four years of living costs in 15 years’ time.

Remember, this figure is dependent on achieving a ‘real’ (inflation-adjusted) return of 3% on your money each year. It’s unlikely you could achieve this return by leaving your money in a cash savings account, so you may wish to consider investing at least some of your money in the stock market.

Where should I invest my money?

Although the stock market is volatile, history shows that over periods of ten or more years it tends to perform more strongly than cash and grow above the rate of inflation. By investing over the long term, you could help your money work harder for a young child’s future.

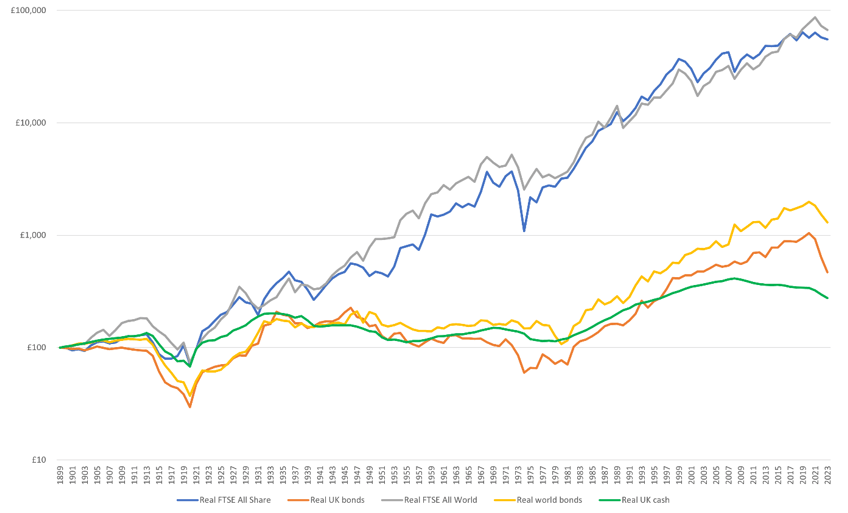

The graph below shows how different asset classes have performed compared to cash. Any balanced portfolio consisting of a mix of stocks and bonds, for example, would have outstripped cash returns by a good margin over the long term. Of course, investing comes with more risk than holding your money in a cash account, your investments may lose as well as gain value, and there are fees to consider. The best way to preserve your portfolio over the long term is to diversify your investment.

Source: RBC Brewin Dolphin / LSEG Datastream

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

One of the simplest ways to invest for a child is through a Junior ISA. You can invest up to £9,000 a year for each of your children, and growth and income is tax free.

The key thing to remember is that the earlier you start, the better your chances are of making a valuable contribution towards your child’s university fees. Not only will you be saving for a longer period, but you’ll also have longer to potentially benefit from investment growth and compound returns. Compounding is where you get a return on your returns as well as on your initial capital, and it is particularly powerful over long periods.

|

|

||

Invest for your child’s future todayFrom just £500, our Junior Investment ISA offers access to a range of investments chosen by our in-house experts. Open an account online in a few simple steps. |

||

Next steps

Understanding how much you can afford to save for your child and where to invest it isn’t always straightforward – and that’s where getting some financial advice comes in. Imagine a lifetime plan that means those you care about are financially secure. At RBC Brewin Dolphin, we can help you balance saving for children with your other financial goals, so you feel more confident that everything is on track.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Neither simulated nor actual past performance are reliable indicators of future performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice