Three reasons to maximise your ISA before 5 April

Investing Views & insightsFind out why maximising your ISA before the tax year end could help you navigate changes to CGT and the dividend allowance.

9 January 2026 | 6 minute read

The past few years have seen increases to capital gains tax (CGT) rates, and significant reductions to the annual CGT exemption and dividend allowance. With this in mind, it could be more important than ever to maximise your £20,000 Individual Savings Account (ISA) allowance by 5 April.

The cuts mean that anyone with investments outside an ISA wrapper could pay significantly more tax this tax year than they did previously.

Here are three reasons to top up your stocks and shares ISA today.

|

|

||

Download: A guide to tax-efficient investingFind out how to invest more tax efficiently and reach your goals in our comprehensive guide |

||

Here are three reasons to top up your Investment ISA today.

1. ISAs offer tax-efficient income and growth

If you hold investments inside an ISA, any profits (‘gains’) you make are exempt from CGT. Dividends from investments held inside in an ISA are also tax free. This has always been the case. However, the government’s decision to increase CGT rates – having already reduced the CGT exemption to £3,000 and the annual dividend allowance to £500 – makes ISAs an even more important tax planning tool.

If you hold investments outside an ISA and realise gains in excess of your CGT exemption, those gains will be taxed at up to 24%. Any dividend income you receive above your dividend allowance will also be taxed – at 8.75% if you’re a basic-rate taxpayer, 33.75% if you’re a higher-rate taxpayer (increasing to 10.75% and 35.75%, respectively, from April 2026) or 39.35% if you’re an additional-rate taxpayer.

There are several ways of managing CGT and dividend tax, but holding investments in an ISA is by far the simplest option. And you don’t need to declare ISAs on your tax return, helping to reduce your day-to-day admin.

Our case study shows that neglecting to use just one year’s ISA allowance could potentially cost you thousands of pounds in tax in the future.

Michael is a higher rate taxpayer and uses his £20,000 annual ISA allowance in full each year by moving money across from his taxable General Investment Account. Forgetting to do so this tax year could cost him almost £1,600 in tax when he sells the investment in ten years.

Here’s how this may look:

Investment value in ten years (4% return after charges): £29,604

Capital gain: £9,604

Annual CGT exemption: £3,000

Taxable gain: £6,604

Tax @ 24%: £1,584.96

Calculations are based on tax rates and allowances as at February 2025.

This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Forecasts are not a reliable indicator of future performance.

2. It’s a ‘use it or lose it’ allowance

Another reason why it’s important to top up your ISA now rather than delay is that your £20,000 annual ISA allowance is a ‘use it or lose it’ allowance. This means you can’t carry forward any unused portion to the next tax year.

Considering CGT and dividend allowances have become much less generous over the past few years, the more of your investments that you can shield in an ISA, the better.

3. Shares tend to beat cash over long periods

You might wonder whether it’s worth holding your excess savings in a cash ISA instead of a stocks and shares ISA, especially at times when interest rates are higher. Cash ISAs are also tax efficient because interest is paid free of tax. However, while rates on cash ISAs look more attractive than in recent years, history shows that over long periods the stock market typically performs more strongly than cash.

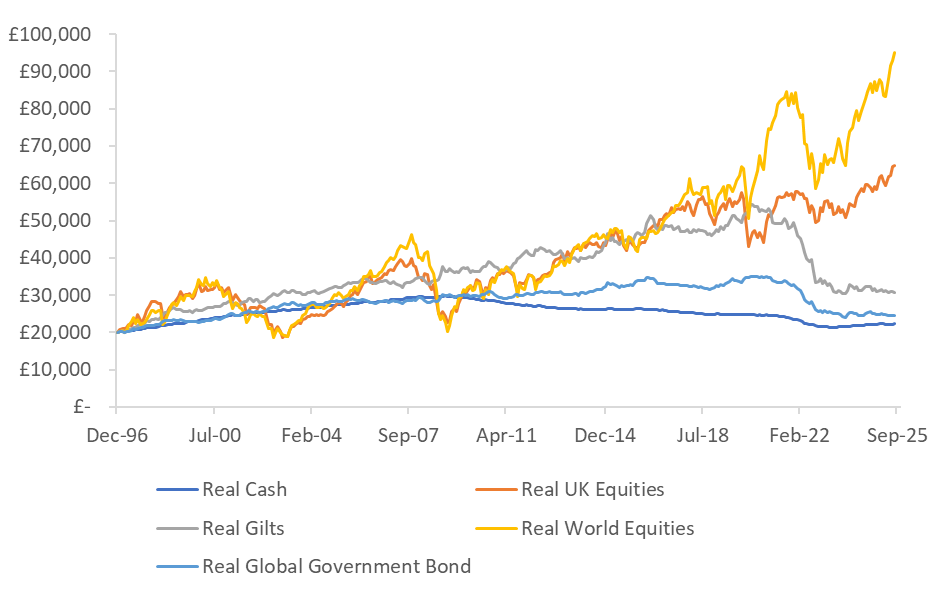

The graph below shows how different asset classes have performed compared to cash. Any balanced portfolio consisting of a mix of stocks and bonds, for example, would have outstripped cash returns by a good margin over the long term. Of course, investing comes with more risk than holding your money in a cash account, your investments may lose as well as gain value, and there are fees to consider. To better preserve your portfolio over the long term, it’s recommended to diversify your investments.

This graph is for illustrative purposes only. A typical investment strategy would consist of a mix of assets i.e. equities, bonds and cash which would result in a lower performance.

Source: RBC Brewin Dolphin/LSEG Datastream

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

The almost 30-year period illustrated in the graph above (December 1996 to September 2025) saw the Bank of England base rate hit 7.5%1 and the stock market experiencing some significant downturns, including the bursting of the dot-com bubble, the global financial crisis and the Covid-19 pandemic. While we can’t predict what will happen over the next two decades, history suggests that stock market returns far exceed those on cash over long periods.

It’s also important to note that from 6 April 2027, the cash ISA allowance will be cut from £20,000 to £12,000 for under 65s. Those aged 65 and over will retain the full £20,000 cash ISA allowance. The stocks and shares ISA allowance will remain at 20,000 per tax year.

Next steps

Understanding how to make the most of your money isn’t always easy, and that’s where getting some financial advice comes in. We’ll check your portfolio suits your individual circumstances and is robust enough to deliver performance over the long term. We’ll also explain how to maximise your tax allowances and exemptions, so that more of your hard-earned wealth goes towards your future. That way, you’ll feel confident you’re making the right decisions with your money.

Find out more from our dedicated support team by calling us on 020 7246 1111. Opening hours are Monday to Friday 9am to 5pm.

1 https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

Disclaimers/risk warnings These sit at the bottom of the article. See: Risk warning checklist.pdf The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice