Sustainable drawdowns

Regulation Views & insightsLynne Lamont, Senior Director, Head of Charities UK, explores how to find the balance between giving and growing.

15 December 2025 | 6 minute read

Lynne Lamont

Senior Director, Head of Charities – UK

RBC Brewin Dolphin

Many charitable organisations have long relied on returns from their long-term investment reserves to support their beneficiaries and meet their charitable objectives.

Historically, income was plentiful and formed the majority of withdrawals. With a move to more global strategies, the dominance of growth-focused companies, and fluctuations in bond yields and interest rates, the level of income naturally available from a well-balanced investment portfolio has decreased in recent years.

Over the last ten years, U.S. equities have been the best performing asset class and significant capital gains have been accrued by investors. This growth is largely due to the growth of U.S. technology stocks, of which few pay any income. As these stocks have grown larger, and the underlying indices more concentrated, the overall income yield has fallen. Indeed, at the start of 2025, the S&P 500 index yield fell below 1%.

Charities with globally diversified investment portfolios are enjoying the impact of the overall returns, with portfolio values rising. At the same time however they are facing a significant dilemma as despite an increase in the capital value of invested reserves, the level of income being naturally generated has fallen.

No charity aims to accumulate gains in perpetuity. Indeed, any growth in the value of the long-term reserves should encourage the charity to increase its level of charitable activities today whilst being mindful of the need to provide support beneficiaries over the long-term. This dilemma therefore necessitates that consideration is given to not just income distribution but drawdowns more widely. This can help ensure that a sustainable level of funds, comprising both income and capital gains, can be distributed today, while preserving the long-term real value of the invested assets.

The inherent complexities of market and economic conditions can make it challenging to determine and maintain a sustainable spending strategy. This is a discussion that we’ve had around many boardroom tables with clients in recent years as they aim to ensure that support to beneficiaries can be maintained, or indeed enhanced, over the long-term.

It’s therefore essential for charities to consider the opportunities that are presented by establishing a sustainable drawdown strategy.

The importance of a sustainable drawdown strategy

By adopting a balanced approach to drawdown, charities can typically:

1. Meet their charitable objectives:

By releasing a portion of their capital gains, charities can raise additional funds to support their beneficiaries, supplementing the income generated.

2. Help reserve the real value of their portfolios:

A sustainable drawdown rate helps charities focus on protecting the long-term purchasing power of their investments, helping to ensure that future beneficiaries can be supported to the same extent as those today.

3. Manage portfolio resilience:

By establishing a sustainable level of drawdown over the long-term, charities can reduce the risk of depleting their reserves, which could compromise their ability to respond to future challenges or opportunities.

4. Enhance overall gains by avoiding an income bias within an investment strategy:

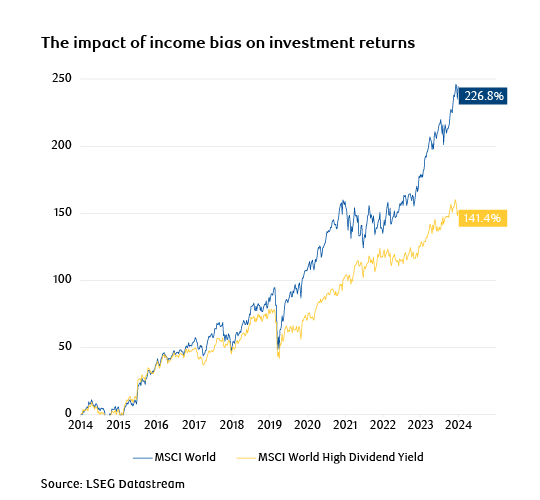

Over the last ten years, on average, stocks paying a higher-than-average level of income have lagged stocks paying lower levels of income. An income bias to investment can also draw investors into certain higher yielding regions and sectors, meaning that more growth-focused areas are underrepresented in portfolios which can lead to lower overall returns.

Key considerations for charities

To determine a sustainable drawdown rate, charities should consider the following factors:

Risk tolerance:

Charities must balance their need for returns with their risk tolerance. This is generally determined by their investment time horizon, and their capacity for short-term loss in pursuit of long-term returns.

Governing documents:

The governing documents of a charity may state restrictions in how capital and/or income from an endowed portfolio can be distributed.

Distribution aspirations:

Charities should assess the level of support they wish to provide to beneficiaries on a regular basis and discuss with their investment manager the best way to achieve this level. Some spend may be essential whilst other areas of support are optional.

Long-term goals:

Charities should consider their long-term objectives and how their drawdown rate may impact their ability to achieve these goals. It’s important to consider future plans, including the possibility of larger ‘one-off’ withdrawals of capital.

Best practices for charities

To establish a sustainable drawdown rate, charities can follow these best practices:

1. Conduct regular portfolio reviews

Charities should regularly assess the suitability of their investment strategy with their investment manager in light of market and economic conditions.

2. Establish a clear drawdown policy:

Charities should develop a clear policy outlining their drawdown rate and how they reached such a level. This should be reviewed and updated at least annually.

3. Consider the wider funding environment and needs of beneficiaries:

Charities may need to evolve their strategy as the demand for support or services and/or other funding sources vary through time.

4. Managing a drawdown strategy:

The realisation of capital gain needs to be managed and planned for so that a charity is never relying on generating capital gain over a future time period to support beneficiaries. By considering the factors outlined above and following best practices, charities can establish a sustainable drawdown rate that meets their needs today and supports their long-term objectives.

Conclusion

For charities, making the most of their investments without compromising their mission is a delicate balancing act.

By building a strong, trusted and understanding relationship with your investment manager, trustees and executives can develop a tailored and fit-for-purpose drawdown strategy, which can help ensure that portfolio returns can be maximised without distribution levels being compromised. This approach not only helps them achieve their goals but also supports their investments in continuing to thrive over time. By following these practical steps, charities can maintain a sustainable balance between giving and growing, supporting their beneficiaries for years to come.

Speak to one of our Charity Wealth Managers today to help ensure that your investments are working as hard as they can for your organisation.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations.