8 financial resolutions for 2026

PerspectiveMake sure your finances are built on strong foundations with these resolutions for the new year.

14 January 2026 | 7 minute read

Substantial changes to personal taxation and investment in the 2025 Autumn Budget make it more important than ever to review your finances.

From assessing your investments and pensions to maximising use of personal allowances to manage tax bills, a periodic review of your financial position ensures all your arrangements work best for you and your family.

1. Assess your spending and saving habits

Persistent inflation over recent years means it’s imperative to have a thoughtful budgeting plan in place, to help protect your purchasing power and boost financial resilience. By refining your budget, you gain clarity on discretionary spending – freeing up resources to advance meaningful savings goals or accelerate any debt repayments.

It’s generally considered prudent to have around six months’ worth of essential expenditure in an easy-access savings account. If you already have a rainy-day fund and are saving for goals that are at least five years away, then it’s worth considering the merits of diversifying investments. Investing in equities on the stock market, for example, can be an effective way to grow wealth over the long term.

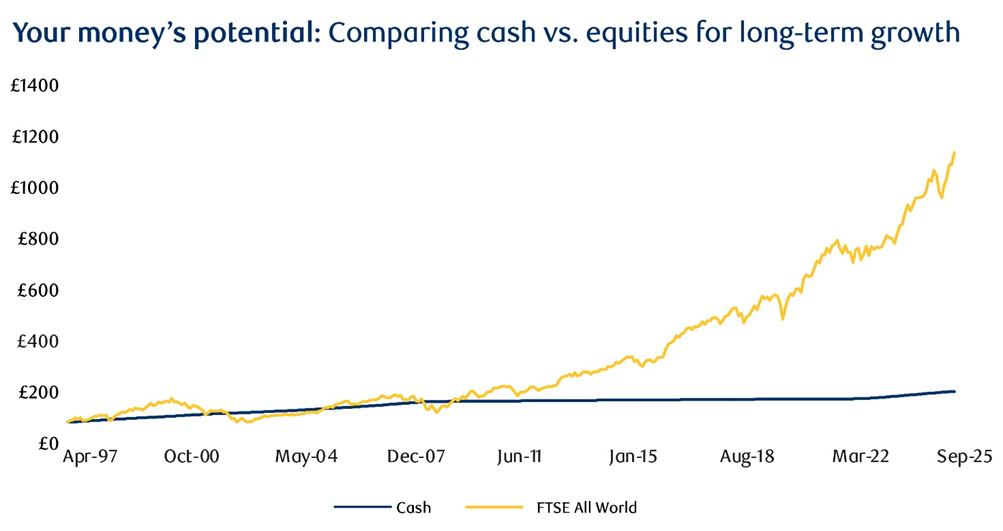

The chart below shows a simplified example of how £100 held in cash savings compares to an investment in equities (FTSE All World Index) over nearly three decades. Of course, investing comes with more risk than holding your money in a cash account, as your investments may lose as well as gain value, and there are fees to consider. The best way to preserve your portfolio over the long term is to diversify your investments.

Source: RBC Brewin Dolphin/LSEG Datastream. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges, which will reduce illustrated performance.

2. Revisit your financial goals

The new year is a good time to reconsider your financial goals – what you would like to achieve over the short, medium and long term. Your goals might have changed since your last annual review, in which case you may need to speak to your wealth manager and adjust where you’re saving your money and/or the level of investment risk in your portfolio.

We can look at whether you’re on track to achieve your goals and, if not, the changes you might wish to consider making. We can also build an investment portfolio that suits your individual needs and works hard to help you preserve and grow your money over the long term.

3. Make the most of your tax allowances

There are a whole host of tax allowances and exemptions to make use of each year. Many people wait until the end of the tax year to maximise their allowances, but sometimes the sooner you act, the better your chances of achieving your financial goals.

Currently, you can invest up to a maximum of £20,000 into Individual Savings Accounts (ISAs) each year to benefit from tax-efficient income and growth. However, from April 2027, the annual savings limit in cash ISAs will reduce to £12,000, but only for those aged under 65. The annual limit for stocks and shares ISAs will remain unchanged at £20,000.

Withdrawals from ISAs are tax-free, which makes them a useful investment vehicle for pre-retirement goals, as well as a tax-efficient source of income in retirement.

Other individual allowances for the 2025/26 tax year include the capital gains tax (CGT) exemption and the dividend allowance, which are £3,000 and £500, respectively.

| Allowance/rate | Amount/percentage | When it applies |

| Dividend allowance | £500 | Annual tax-free dividends |

| CGT exemption | £3,000 | Annual tax-free gains |

| Basic-rate CGT | 18% | CGT rate if your gains and taxable income fall within the basic rate income tax limit |

| Higher/additional rate CGT | 24% | CGT on gains above the CGT exemption for higher or additional-rate taxpayers |

4. Check your pension is on track

If you haven’t checked the value of your pension pot(s) recently, this is the time to do so.

- For those in work, understanding how much money you’ve saved up in pensions will help you work out whether you’re on track to achieve your retirement ambitions. Your wealth manager can help you calculate the projected value of your pension at retirement and the amount of annual income this is likely to produce.

If there’s a shortfall, you might want to see if you can top up your pension. Pensions can be a tax-efficient way of saving for the future, as tax relief is available on personal pension contributions. Assuming full relief is claimed, a £100 pension contribution effectively costs just £80 if you’re a basic-rate taxpayer, £60 if you’re a higher-rate taxpayer or £55 if you’re an additional-rate taxpayer.

From April 2029, the government will charge National Insurance contributions on pension contributions made through salary sacrifice above a new £2,000 annual threshold. However, like other types of pension contributions, they’ll still be exempt from income tax (subject to the normal limits). - For those in retirement: most unused pension pots and death benefits are set to be included in your estate for inheritance tax purposes from 6 April 2027. This shift aims to ensure pensions primarily support retirement income rather than inheritance strategies. If you’ve built up substantial pension savings, these changes could reduce the amount of wealth passed to your loved ones. Reviewing your pension withdrawal and legacy strategies with your wealth manager can help you manage tax implications and align your wealth with your retirement needs and gifting goals.

5. Review your protection

Having the right protection is crucial to ensure you and your family’s finances hold up in the event of unexpected illness, injury or death. Even if you already have protection, the new year is a good time to check that it still reflects your circumstances. If the level of cover is too low, your loved ones could be at risk of financial hardship should the worst happen to you. Your wealth manager can help you check that you have the right policies and level of cover to suit your individual needs.

6. Establish a lasting power of attorney

Accidents or illnesses can happen at any age and, in the worst-case scenario, may leave you unable to manage your own affairs. Setting up a lasting power of attorney (LPA) enables you to choose people you trust to make decisions about your health and finances, should this become necessary in the future. Without an LPA, your loved ones may have to go through a lengthy court process to access things like your bank account(s), to make essential payments for your care.

7. Make or update your will

Making a will is one of the most important things you can do. It ensures your assets go to who you want after your death, and that your wishes are carried out as you intended. If you’ve already made a will, consider whether it needs updating – for example, if your personal circumstances have changed. Making or updating your will could make a big difference to the future of those you care about.

8. Talk to your wealth manager

Deciding where to invest, how much to save for retirement, and what you can safely spend during retirement is complex. Your wealth manager is the perfect person to consult if you’re uncertain about how any of the changes announced in recent Budgets could affect you and your family, or even if you simply want to gain the most benefit from your annual financial review. It could make a real difference to your financial future and give you the peace of mind that you’re making the right decisions for you and your family. Your idea of tomorrow happens here.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Information is provided only as an example and is not a recommendation to pursue a particular strategy.