Middle East conflict: Oil prices surge, then retreat

Views & insightsOil prices rose sharply amid heightened tensions, but a ceasefire saw prices return to pre-conflict levels.

Chief Strategist, Guy Foster, discusses how the conflict in the Middle East has evolved and its impact on the economy. Plus, Head of Market Analysis, Janet Mui, discusses the latest interest rate decisions from the UK and U.S.

Download Markets in a Minute PDF

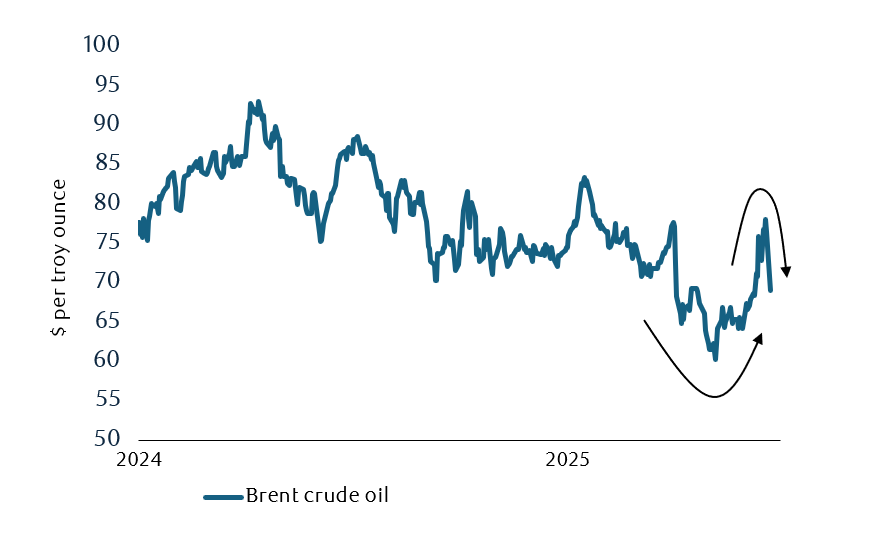

Oil reflected the Middle East crisis with prices rising by around $10, but that has largely dissipated

Source: LSEG/Bloomberg

It’s been a dramatic few days in the Middle East with some broadening of participation and targets. Over the weekend the U.S. struck three uranium enrichment facilities in Iran, and we wait to hear how effective those strikes were. Thereafter, Iran retaliated with missiles launched at a U.S. air base in Qatar. Those attacks were easily intercepted, and the base had already been evacuated as a precaution. The event was considered to be stage-managed to allow the Iranian regime to credibly claim they had responded.

Over the course of the crisis, around $10 of risk premium had been incorporated in the prevailing oil price. That had the potential to add 0.3% to 0.4% to U.S. inflation and detract a similar amount from growth. Prior to the incursions, the oil market was over-supplied and prices had been weak. OPEC seemed unwilling to defend the price.

Following the U.S. action and the stage-managed Iranian response, President Trump announced a ceasefire had been agreed. The price fell below the level at which it was trading prior to Israel’s initial attacks. In the short-term, hopes are high that this crisis is resolved however, critically, questions remain over whether the ceasef fire is being observed. Over the longer term it remains to be seen whether the U.S. action is enough to discourage, or ensure the end of, Iran’s nuclear ambitions.

Core inflation has been gradually decreasing despite tariffs (so far)

Source: LSEG Datastream

Despite anxiety over U.S. tariffs in the last few months, the U.S. economy remains in reasonable shape.

The headline U.S. retail sales growth was below expectations, but this seems to be driven by the usual one-off elements. For example, when the weather takes a turn for the worse, consumers delay their buying and that affected the U.S. during May as seen in the weather sensitive building materials and garden equipment sales sector.

However, despite the anxiety, the American economy has continued to function normally. Consumers have yet to be subjected to the burden of tariffs. They can worry about them, but they aren’t changing their spending habits. Going forward, that could change when prices eventually start to rise, not least because now there’s an increase in the all-important gasoline price to contend with.

Uncertainty over this left the Federal Reserve on hold, but they’re still effectively endorsing the markets’ expectations of two more interest rate cuts this year. Beneath the surface though, that level of conviction appears to be dropping and the case for just a single cut grows louder. This declining expectation of interest rate cuts would normally weigh on the dollar, but it hasn’t been trading in line with interest rate expectations recently. Added to which, the dollar remains very overvalued relative to other major currencies, so the case for a weak dollar remains intact.

Interest rates have been cut, but inflation remains a problem in the UK

Source: LSEG Datastream

The UK also saw weak retail sales, which adds to a pattern of weaker economic data that has been coming from the UK.

House prices were strong at the start of the year, but now they’re slowing. Employment has been on a downward trend which seems to have accelerated. Added to which, interest rates were raised very sharply between 2022 and 2023. So, there would seem to be ample opportunity to continue cutting rates, and a growing rationale for doing so.

However, the challenge facing the Monetary Policy Committee (MPC) is that core Consumer Price Index (CPI) remains too high at a time when inflation has spent much of the last three years well above the inflation target, a fact which is increasingly becoming enshrined in consumers’ expectations of inflation. As such, it remains the imperative of the Bank of England (BoE) to continue to see validation of its rate cutting stance as it progresses with monetary easing.

The BoE held interest rates this month but is expected to cut them again in August. Lower interest rates would support the UK bond market and lower bond yields would be helpful for the Chancellor, Rachel Reeves. Public finance data suggested that she had some success reining in government expenditure following the Spring Budget, however higher bond yields mean that interest costs are due to eat away at her fiscal headroom and raise the risk of further tax increases in the autumn.

Coming up…

- Big meetings: World leaders will be getting together with an EU summit and the World Economic Forum’s Annual Meeting of the New Champions in China. However, it’s the NATO summit held in the Hague, that President Trump is due to attend, which will be watched closely. There’ll be a huge focus on defence spending commitments and any questions over the strength of NATO’s mutual defence commitment.

- Consumer confidence: The Conference Board survey of consumer confidence should show a further slight recovery, as tariff chaos somewhat recedes from the headlines, and ahead of the survey capturing higher gasoline prices caused by the conflict in the Middle East.

- Temperature check: Up to date estimates of economic performance will come from the purchasing managers indices as well as the earliest indications of inflation during June.

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.ed herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.