Three themes driving investor sentiment

Views & insightsSoftware sell-offs, U.S. inflation and U.S. labour market data, we break down the latest market drivers.

Key highlights

- Markets flip from AI winners to ‘anti-AI’ stocks: Consumer staples, energy, and healthcare rally as investor anxiety peaks.

- RELX results expose market confusion: Companies with proprietary data are AI enablers, not victims of disruption.

- Political risks rise: U.S. tariff rebellion, UK leadership crisis, and Japan’s Liberal Democratic Party (LDP) supermajority reshape market dynamics.

To AI or not to AI? That is the question…

Source: LSEG Datastream

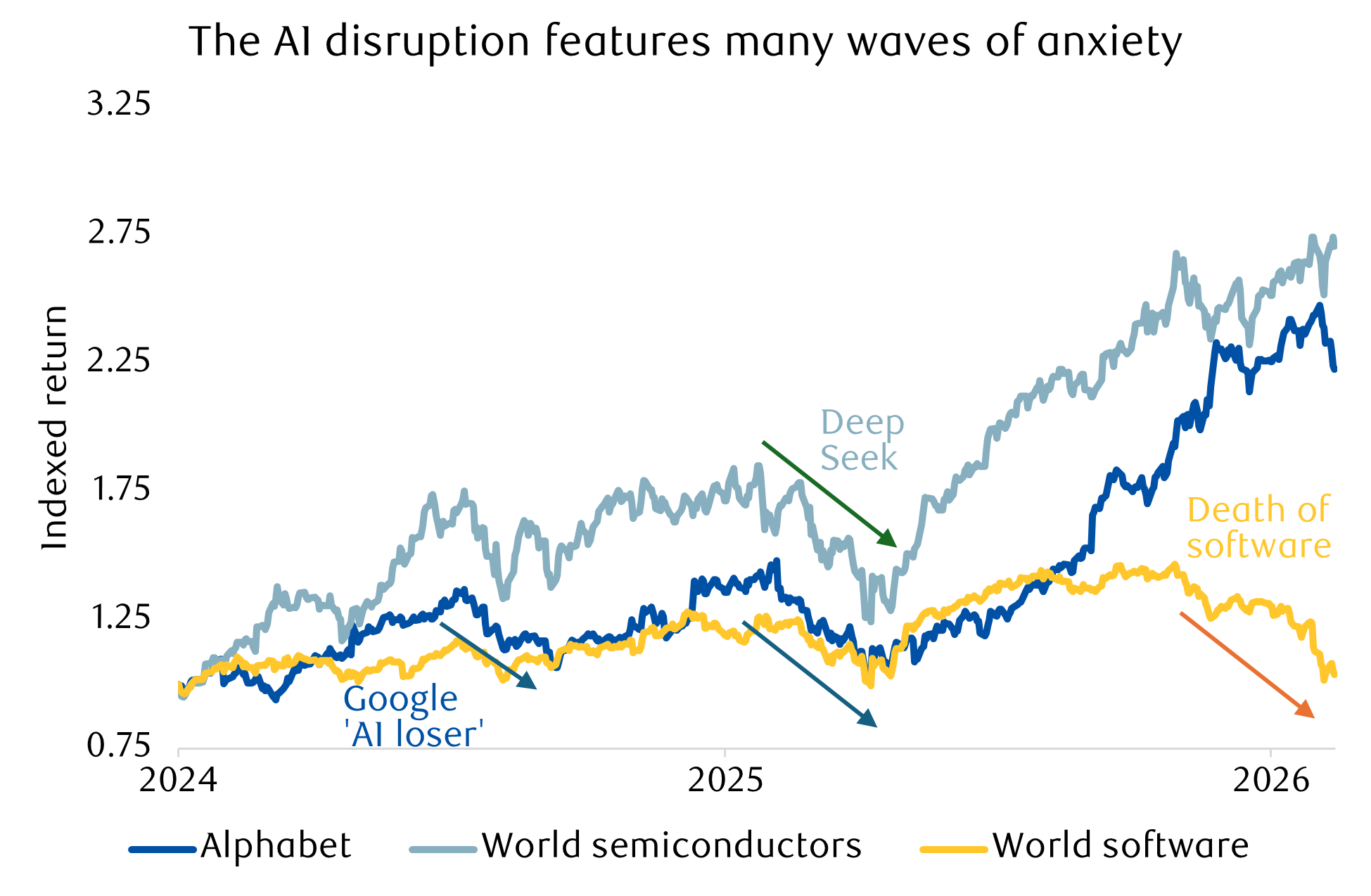

The equity market continues to exhibit bipolar tendencies and that was characterised last week by a continuation of the anti-AI trade (stocks which are seen as being immune to disruption by AI). Many of these, ironically, have been last year’s laggards: consumer staples, energy, healthcare.

It’s not unusual for out of favour areas to rebound quickly, this is the so-called ‘pain trade’, whereby the market seems prone to perform in a way that causes the maximum pain to the most people. This is why looking at investor positioning is particularly important. But the last few years seem to have experienced particularly abrupt waves of anxiety and euphoria.

Another factor explaining the ‘pain trade’ is changes in market structure: the rise of retail investors, more passive investors, and increased use of thematic investments create pools of money which then ebb and flow, seemingly on vague narratives.

And then there are coincidental factors − increasing tensions over Iran have contributed to a rising oil price. But still, uncertainty over the effect AI will have on the market for stocks, products, and people is vast.

OECD data shows economists are broadly bullish on AI’s productivity impact − McKinsey projects annual gains of 3.4% in optimistic scenarios. Yet we face a paradox: despite two years of U.S. productivity acceleration, growth remains modest and far below the internet boom era. This gap reflects the ‘Solow Paradox’ − innovations often take years to show up in official statistics due to adoption costs, learning curves, and implementation delays. The high productivity growth in the internet boom was coincidental, reflecting benefits from the 1990s growth of personal computers, office applications, and globalisation, rather than the rudimentary websites, which were just starting to generate revenues (and not profits).

However, it seems the AI benefits have arrived earlier than previous innovative waves and early market signals suggest they are already having real impact. Jobs data shows early career hiring collapsing in AI-exposed roles (software developers, customer service), and employer surveys reveal 32% expect workforce reductions from AI − double those expecting growth.

The tension is clear: markets expect major disruption, but productivity gains have not yet materialised at scale.

RELX results highlight the controversy

A company which was in the crosshairs and reported earnings last week was RELX.

The company reflects the market psychosis perfectly: an AI beneficiary a year ago, it has lately been seen as an AI loser, despite no change in operational performance or strategy. The broad potential AI benefits stem from automating certain workflows, many of which RELX facilitates and where hundreds of software companies compete, but RELX is positioned upstream of this disruption.

RELX controls the proprietary content and data that makes AI tools more valuable, not less. Their algorithms that have accumulated over decades, judgements, and interpretations are embedded into their 300+ specialised workflow tools. Its tool Protégé, for example, is distributed through twenty-five partner platforms like Harvey AI. It already runs on Claude, so if Claude gets better, Protégé gets better. RELX doesn’t compete in the crowded workflow software market; it enables it.

This is crucial. As AI drives productivity by automating repetitive tasks across law, publishing, and scientific research, demand for expert-curated, proprietary content increases. Large law firms using 100+ software tools still need RELX’s specialised data and judgement layers to make those workflows meaningful and defensible.

So, although Google’s search was initially seen as being disrupted by AI, instead Google search is now seen as an enabler of Google’s Gemini AI model. And just as DeepSeek was seen as a threat to AI model and hardware providers, instead it’s an enabler of greater use of AI.

The pace of change is extraordinary, and the uncertainty is high, but the market missteps will be many. Companies solving this productivity challenge need trustworthy, specialised content and interpretations that AI cannot easily replicate. So, companies like RELX should be attractive with 90% proprietary data accumulated and domain expertise giving them a moat as essential infrastructure for the AI productivity transformation, not victims of it.

Politics give and take from markets

There were some interesting political happenings last week which impacted markets. The least directly impactful was the House of Representatives (the House) joint resolution ending the emergency tariffs on Canada. It’s not directly impactful because nothing will come of it. The bill will likely be passed by the Senate and will then go to the president’s desk, where it will be vetoed.

The president can veto any piece of legislation coming from Congress. However, Congress can force the legislation through if it obtains a two thirds super majority. There’s no real prospect of that happening because the vote was largely along party lines and only managed to narrowly pass because six Republicans joined with the Democrats in an afront to the president.

These acts of self-harm with the ruling party are unhelpful in a mid-term year, but they reflect the way in which tariffs are unpopular in specific districts, something which will be reflected in November when the full House and a third of the Senate are up for election. Currently there is an estimated 84% chance that the Republicans lose the House to the Democrats, but the margin of loss matters, creating a huge incentive to keep the economy strong in this election year.

Japanese Prime Minister Sanae Takaichi enjoyed a much easier ride as her Liberal Democratic Party (LDP) and its coalition partner, the Japan Innovation Party (Ishin), achieved a strong victory in the lower house election with LDP alone securing the two-thirds supermajority. This allows them to override the upper house and initiate constitutional amendments.

Markets reacted positively to the election results with equities and the yen both rising. Nick Gwee of our Asia team says the two key pillars of Takaichinomics are: new measures against rising prices and strategic investment in select sectors.

Areas they expect to benefit under the strong LDP mandate include defence, AI semiconductors, and nuclear energy. Consumer stocks should also benefit as private consumption potentially improves as the government weighs in on inflation.

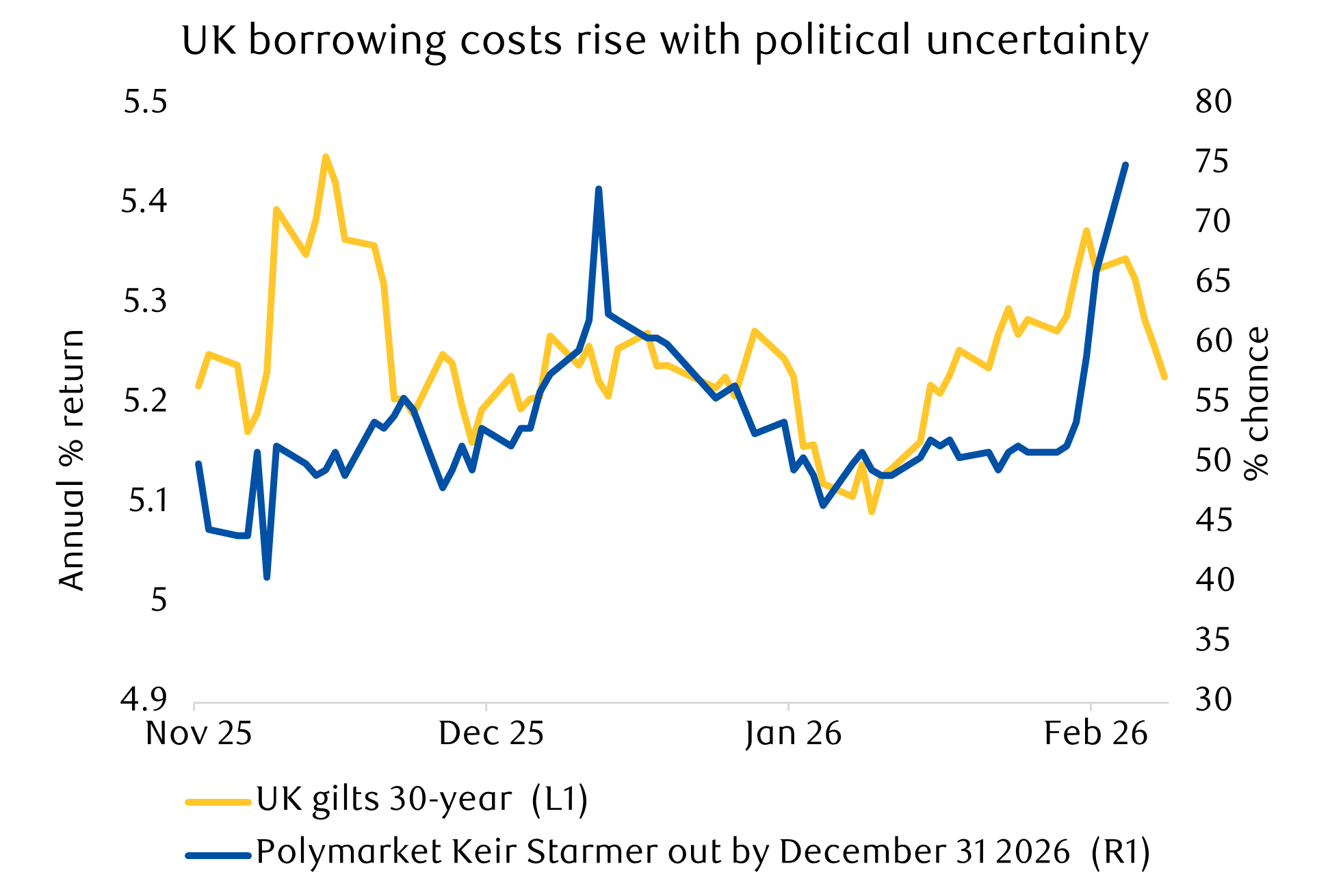

The UK leadership crisis

Source: Bloomberg

There has been scandal surrounding his appointment of Peter Mandelson as ambassador to the U.S. The revelations − which centre around Mandelson’s links to Jeffrey Epstein, and leaks of sensitive government information − rattled sterling and gilt yields due to concerns a new Labour prime minister might increase fiscal spending. Though markets have retraced these moves, political risk remains elevated, and the prime minister’s position is precarious.

Coming up

- Metals in focus: Earnings results from Rio, BHP and Glencore will be in focus with commodities having been a strong performer until recently.

- UK data: Inflation data will inform the outlook for interest rates and house prices may underline the turnaround being seen in central London property after an uncharacteristically weak period.

- The Munich Security Conference: With defence spending a major political focus for countries outside the U.S. and the future of NATO seemingly always being pondered, the conference has tended to be a catalyst for such discussion.

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.