Markets’ balancing act: Lessons from a turbulent quarter

Views & insightsWe analyse the lessons from Q4 to uncover key insights on what’s to come in 2026.

7 January 2026 | 6 minute read

Janet Mui

Head of Market Analysis

RBC Brewin Dolphin

Key highlights

- The Fed’s balancing act: With inflation easing and growth steady, the Fed’s rate cuts boosted risk assets, broadening market gains beyond big tech.

- AI’s momentum: It’s fuelling markets, but being selective is key – focus on strong fundamentals over speculation.

- An undervalued opportunity? UK equities and gilts offer both value and diversification amid global uncertainty.

The final quarter of 2025 presented investors with a complicated backdrop. Amid a temporary U.S. government shutdown, scrutiny over the scale and sustainability of AI investment, and a cooling U.S. labour market, investors faced a maze of uncertainty.

Despite these challenges, markets proved resilient, largely due to three forces: AI innovation momentum, intact economic fundamentals, and a Federal Reserve (the Fed) that has begun to ease policy. These themes helped markets look past the noise of Q4 and will continue to shape the outlook for 2026.

AI: Beyond the hype – where substance meets opportunity

AI remained the dominant force behind market performance in the fourth quarter. Stocks tied to AI surged, but so did questions about valuations and overinvestment. Being selective is critical – not all parts of the AI ecosystem will thrive equally.

Here’s the paradox: while earnings growth among AI-exposed companies stayed robust and demand for AI infrastructure and services remains strong, markets began differentiating between substance and speculation. Companies with strong balance sheets and scalable models thrived, while debt-heavy players faced scrutiny of their capital discipline and financing structures.

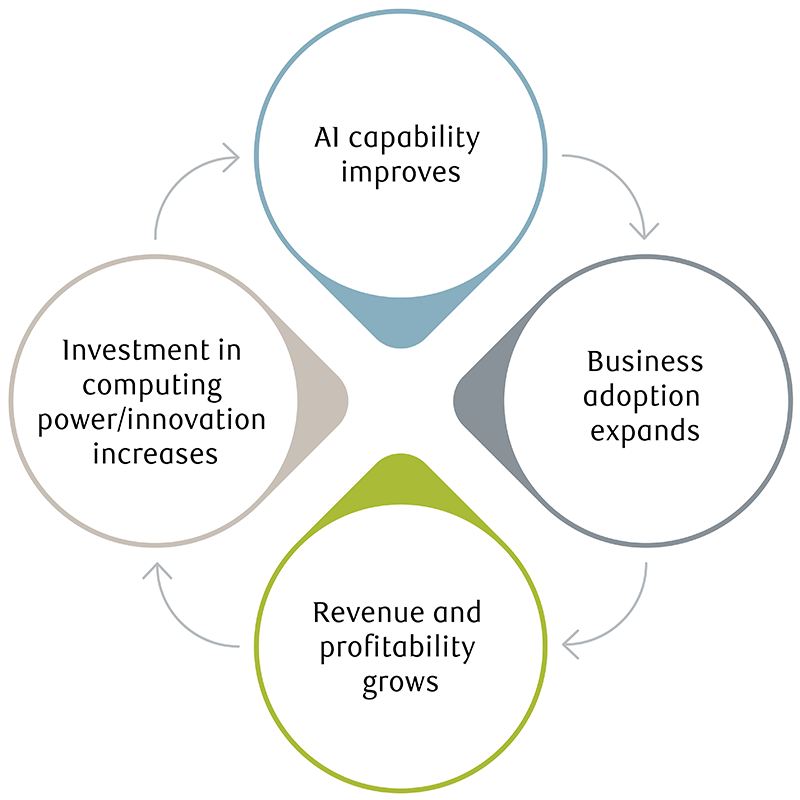

What distinguishes the current AI phase is a self-reinforcing cycle:

This dynamic helps explain why AI spending has remained resilient even as investors become more discerning about costs and returns.

From an investment perspective, AI remains transformational and is still in its early stages. Exposure continues to make sense, but it needs to be grounded in solid fundamentals rather than unproven promises. As expectations rise, tangible earnings and returns will become non-negotiable, a defining theme for 2026.

The Fed: America’s cheerleader

Assessing the U.S. economy in Q4 required more nuance than usual. A temporary government shutdown distorted the flow of economic data, making it harder to draw firm conclusions from individual releases. As more complete data emerged, attention has now shifted back to the underlying trends rather than the noise.

Those trends point to an economy that’s slowing, but resilient. Growth momentum has softened, and parts of the data have weakened, yet there’s little evidence of an outright contraction. Importantly, the Fed upgraded its GDP outlook, reinforcing confidence in the economy’s stability despite pockets of weakness.

The labour market remains central to this adjustment. Hiring has slowed, job openings have declined, and wage growth has eased from elevated levels. Part of this cooling reflects heightened uncertainty earlier in Q4, including the government shutdown and lingering questions around trade policy, which likely encouraged caution among employers. As these uncertainties fade, the deterioration of the labour market may stabilise.

Elsewhere, resilience has been more evident than many feared. Consumer spending has moderated but hasn’t stalled, supported by real wage growth as pay increases continue to outpace inflation. Meanwhile, easier financial conditions – lower interest rates and rising equity markets – have had a positive wealth effect on households.

Monetary policy has played a key role in supporting this cautious optimism. At its December meeting, the Fed delivered its third rate cut of the 2025. With its inflation forecasts downgraded and the neutral rate estimated near 3%, further interest rate cuts are possible too.

This environment – historically favourable for risk assets – catalysed a broadening of market gains in Q4. Beyond tech giants, U.S. small- and mid-cap stocks surged to new highs, marking a healthier dynamic for investors concerned about concentrated returns.

Risks do remain though. A more stagflationary environment could emerge if the labour market weakens further amid persistent inflation. Equity markets have also become an important transmission channel for the economy: rising prices support confidence and spending, but any sharp correction could work in reverse.

Gold’s stellar performance in 2025 provides useful context. Amid lingering concerns around inflation, fiscal sustainability and policy uncertainty, its rise reflects continued demand for assets that sit outside traditional financial and political systems. Against this backdrop, gold remains a valuable portfolio diversifier.

The UK: Turning the page on the Budget

UK-based investors will be relieved to see the back of a quarter dominated by Budget speculation, scaremongering, and a pervasive sense of gloom.

Pre-Budget fears of drastic tax rises and economic harm proved overblown. While tax increases were announced, many were deferred towards the latter part of Labour’s term, softening their immediate impact. Improved fiscal headroom also reduces the likelihood of another tax-raising Budget next year, easing uncertainty.

That said, the underlying economic backdrop remains challenging: stagnant growth, rising unemployment, and retail sales volumes below pre-pandemic levels. High interest rates, elevated inflation, and ongoing policy uncertainty have weighed on household spending and confidence.

There are, however, early signs of stabilisation. Easing labour market tightness is helping to slow wage growth, which may temper inflation. Recent business surveys, including December Purchasing Managers’ Indexes, also point to tentative improvements in activity, suggesting the economy may be finding a floor after a prolonged period of weakness.

For investors, the UK’s appeal lies in diversification. Even after strong returns this year, UK equities continue to trade at a discount to global peers and offer attractive income characteristics. They can also help balance portfolios that are otherwise heavily exposed to U.S. growth and technology themes.

Meanwhile, UK gilts continue to boast some of the highest yields amongst developed economies. And given the weak economic backdrop, there’s scope for UK interest rates to fall again, further boosting returns.

What this means for investors

We remain cautiously optimistic for 2026. Structural growth drivers like AI, a resilient U.S. economy, and more supportive monetary policy should provide a solid foundation for gains. However, higher valuations and persistent growth risks remain. Returns are likely to be positive but more measured than 2025, and volatility will persist. This makes diversification and a balanced approach essential.

About the author

Janet Mui

Head of Market Analysis

Janet Mui, CFA is Head of Market Analysis at RBC Brewin Dolphin and a voting member of the Asset Allocation Committee. She is part of the investment solutions team which generates central investment guidance and manages a range of risk-rated portfolios.

The value of investments, and any income from them, can fall and you may get back less than you invested. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.