How to navigate the annual allowance taper

Pensions and retirement Views & insightsThe tapered annual allowance could limit how much tax relief you can claim on your pension contributions. Here’s how it works.

25 April 2025 | 4 minute read

If you earn a high income and pay into a pension plan, it’s important to be aware of the tapered pension annual allowance.

Most people can contribute up to £60,000 or 100% of their relevant annual earnings (whichever is lower) to pensions each year and benefit from tax relief. But if your income rises above a certain level – which is £200,000 for the current tax year – this allowance could be reduced or ‘tapered’. Without careful financial planning, you could find yourself subject to an unwelcome tax charge.

|

|

||

Download: A guide to saving for retirementJam-packed with essential information on how to enjoy a more comfortable life after work. |

||

Read on to find out how the tapered annual allowance works and what you could do to mitigate its impact.

How does the tapered annual allowance work exactly?

The tapered annual allowance effectively reduces the amount of money that can be contributed to a pension by you and/or your employer before having to pay tax.

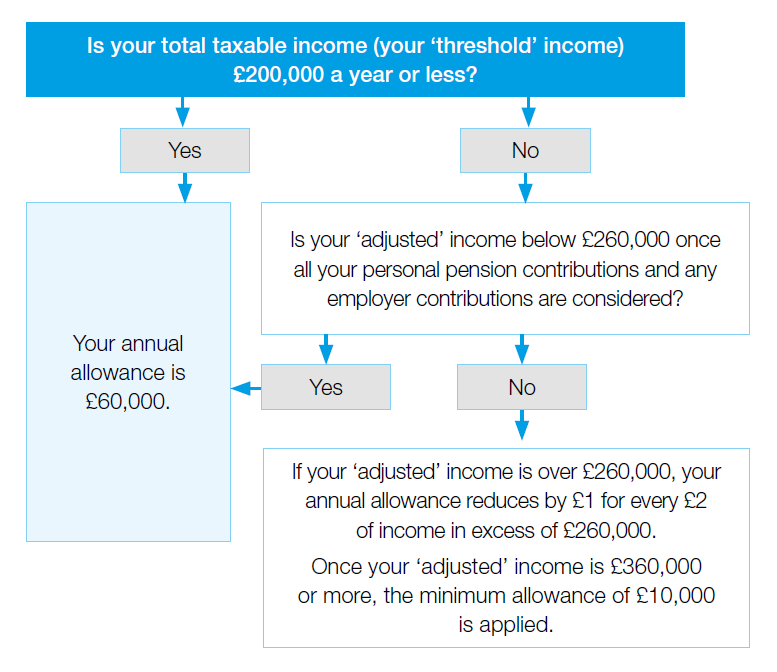

The taper doesn’t usually apply if your ‘threshold income’* is less than £200,000. If it’s above this level, you will need to check whether your ‘adjusted income’* is greater than £260,000 (for the current tax year).

The annual allowance reduces by £1 for every £2 that your adjusted income exceeds £260,000, to a minimum tapered allowance of £10,000.

Our diagram below demonstrates how to use the threshold and adjusted income measures to assess whether you are affected by the taper.

* The process for calculating ‘threshold’ and ‘adjusted’ income can be complicated. You should always seek advice if you think you may be subject to the taper.

How do I work out what my total annual income is?

If your earnings are close to either the threshold or adjusted income limits, you’ll need to work out accurate figures to know whether you’re affected by the tapered annual allowance.

To understand your threshold income, you’ll need to add together all your taxable income for the tax year. For example, your salary, bonus, any rental income, interest on savings, and any salary or bonuses sacrificed for pensions contributions since 9 July 2015. You then take away any personal pension contributions you have made into ‘relief at source’ and ‘net pay’ schemes.

Next, you ‘adjust’ your threshold income to include any employer contributions made into your pension. This is now your adjusted income. If it exceeds £260,000, you will be subject to a tapered annual allowance for this tax year.

The tapered annual allowance in action

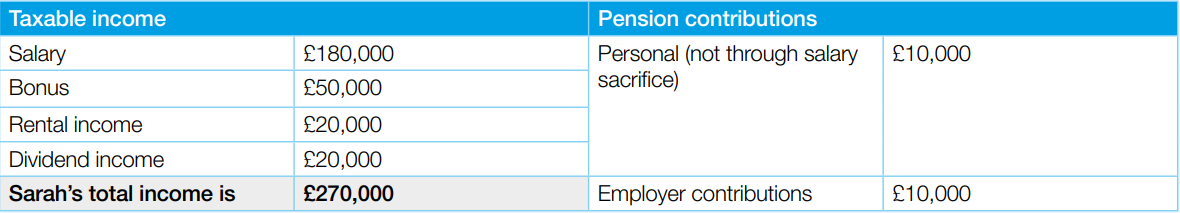

Let’s take a look at Sarah. She is head of operations for a well-known car company. Her taxable income and pension contributions are:

To calculate her ‘threshold’ income, Sarah adds up her taxable income: Salary £180,000 + bonus £50,000 + rental income £20,000 + dividend income £20,000, but takes away her personal pension contribution of £10,000. Sarah’s ‘threshold’ income is now £260,000.

As Sarah has employer pension contributions, and she contributes to her personal pension, she now has to work out her ‘adjusted’ income, including all pension contributions, in the following way: Sarah adds her £260,000 ‘threshold’ income + £10,000 personal pension contribution + £10,000 employer pension contribution to calculate her £280,000 ‘adjusted’ income.

As her ‘adjusted’ income is £20,000 over the £260,000 ‘threshold’, her annual allowance is tapered down by £1 for every £2 above the ‘threshold’. In Sarah’s case this is £20,000/2 = £10,000.

Sarah’s new tapered annual allowance for this tax year is £50,000. It has been calculated by taking the £60,000 annual allowance and taking away her ‘adjusted’ excess income of £10,000.

What should I do if I think the tapered annual allowance affects me?

If you think your annual income level falls within the boundaries of the tapered annual allowance, it’s important to understand your exposure to avoid incurring an unexpected tax charge. A financial adviser can help you work out what your annual allowance is and advise on adjusting your contributions accordingly.

You might be able to ‘carry forward’ any unused annual allowance from the previous three tax years to increase the amount you can build up in pensions in the current tax year. However, the rules are complex, so it’s important to seek advice.

Other tax reliefs might be available to help you minimise your exposure to the tapered annual allowance. For example, you could reduce your gross income by using salary sacrifice to contribute to charities or purchase childcare vouchers or protection insurance through work schemes.

Our advisers can help you use other tax-efficient saving vehicles, such as Individual Savings Accounts (ISAs), to save for the future. Although your contributions will be out of your net income, your investment gains will not incur tax while invested or when you make withdrawals.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice