The hidden cost of ‘pound-cost ravaging’ for retirees

Market news Views & insightsTransitioning from saving to spending requires careful planning. Avoid pitfalls like pound-cost ravaging and secure your financial future confidently.

4 September 2025 | 3 minute read

Key highlights

- Be strategic: Decisions in the first years of retirement, like managing withdrawals during market downturns, can greatly affect how long your savings last. Setting aside a cash reserve and staying flexible with withdrawals can reduce risks.

- Avoid pound-cost ravaging: Withdrawing funds during a market downturn early in retirement can compound losses, shrinking your portfolio and limiting future growth.

- Balance your retirement spending: Overestimating returns or underestimating longevity can strain finances, while excessive frugality may limit enjoyment. A tailored financial plan, supported by expert advice, helps strike the right balance.

Having spent years working hard and saving carefully to build long-term financial security, your retirement marks the start of the decumulation phase – a time to transition from growing your wealth to using it to support the life you’ve always envisioned.

Yet your actions in the first few years of retirement can have a significant impact on how long your money lasts, potentially undermining your financial security.

Even with careful consideration of factors such as longevity and inflation, it’s easy to get caught out by negative pound-cost averaging, or ‘pound-cost ravaging.’ This occurs when you need to sell larger portions of your investments to maintain a steady income during times when markets are falling. This can reduce the overall value of your investments more quickly.

With various income sources available, such as a general investment account, self-invested personal pension, ISAs, offshore bonds and more, receiving expert advice on where to draw funds from is key.

Understanding pound-cost ravaging

Pound-cost ravaging, occurs when you withdraw funds from your investment portfolio during a market downturn. Since your investments are worth less, you need to sell more units to generate the same level of income. Those extra sales crystallise losses that might otherwise have been recovered if left untouched. If this happens early in your retirement, there is also a compounding effect, with less capital available in your portfolio to benefit from growth over time.

This erosion can be especially harmful in the early years of retirement, when your investment horizon still stretches decades ahead.

“If markets fall in the first year, it can create a hole in your retirement plan that can grow over time,” says Rob Burgeman, wealth manager at RBC Brewin Dolphin. “A bad first couple of years can make all the difference, as people who retired in 2007 or 2019 may have been unfortunate enough to find out.”

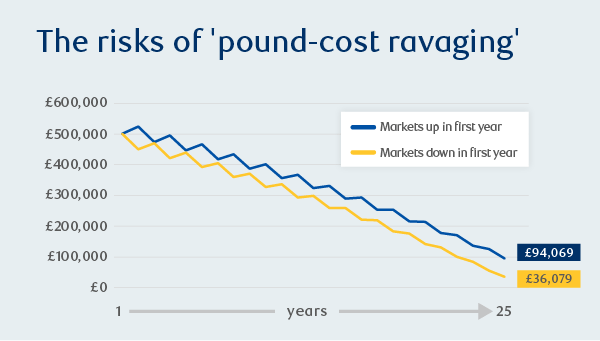

The chart below illustrates the impact pound-cost ravaging can have on your retirement portfolio, revealing the remaining value of a £500,000 portfolio after 25 years of 5% annual withdrawals, depending on whether markets rose or fell in the first year.

First year up: Assumes markets rise 10% and fall 5% in alternating years over 25 years – averaging out at an annual return of 5.23%, net of any costs or investment fees, and making 5% withdrawals of the original sum every year (£12,500). First year down: Assumes the same scenario but markets drop by 5%, following the same pattern of rising 10% and falling 5% in subsequent years over 25 years. Source: RBC Brewin Dolphin.

The effects of pound-cost ravaging can subtly impact even the healthiest portfolios. However, with the right steps and the support of a skilled wealth manager, you can safeguard your future and stay confidently on track.

Avoiding the pitfalls

Pound-cost ravaging is not the only factor to consider when planning your retirement spending. Overestimating investment returns, underestimating longevity, or ignoring inflation can all have long-term consequences, while failing to account for unexpected expenses such as healthcare, family support or home repairs and renovations could also leave your finances strained.

On the other hand, some retirees become overly frugal, fearful of running out of money, and fail to fully enjoy the savings they worked so hard to accumulate.

Striking the right balance means having a clear sense of purpose and a financial plan to match, ideally one prepared with professional advice. As Burgeman puts it: “Retirement is a deeply personal journey. The key is to understand what you want to achieve and then create a spending plan that supports those aspirations.” Consulting a wealth manager who has the requisite experience and cashflow modelling tools can help set realistic expectations.

To avoid pound-cost ravaging, it’s wise to keep an eye on markets and avoid sticking too rigidly to a fixed withdrawal plan. While consistency can feel reassuring, in retirement, flexibility is your ally. Setting aside a cash reserve to help you adapt your spending year by year can extend the life of your savings without meaningfully compromising your lifestyle.

Depending on conditions when you retire, it could also be worth considering delaying retirement, deferring state pension payments, or using other income sources where possible, before tapping your investments.

All these options could give your portfolio more time to grow by avoiding the need to make withdrawals during volatile periods.

An illustrative example

To see how this works in practice, consider Sarah and David, a recently retired couple in their late 60s.

With a combined portfolio of £1.5 million, they were in a strong financial position. Sarah dreamed of travelling more and exploring new destinations, while David looked forward to a quieter life with plenty of time for golf and gardening. They also hoped to support their grandchildren’s education and leave a meaningful legacy for their children.

While they had put themselves in a good position through a lifetime of saving, the couple were aware that managing their money in retirement would require different thinking from how they had built it. With the help of their RBC Brewin Dolphin wealth manager, they mapped a financial plan tailored to their long-term goals, factoring in inflation and market fluctuations.

- Protecting against volatility: One of the first concepts their wealth manager explained was pound-cost ravaging – the risk of depleting investments faster by withdrawing funds during market downturns. To protect their nest egg from market volatility, they decided to set aside two years’ worth of expenses in cash – enough to weather market downturns without touching their core investments.

They also adopted a flexible withdrawal strategy. In years when markets performed well, they withdrew a little more to fund Sarah’s travel adventures; while in leaner years they lived more modestly, drawing on their cash reserve instead of core investments. - Diversifying for stability: To further protect their finances, their portfolio was allocated across a range of assets, from equities to bonds and alternatives, to spread risk and reduce volatility.

- Planning for the future: Beyond managing their day-to-day spending, Sarah and David worked with their wealth manager to establish a trust and refine their estate plan so they would leave a financial legacy for their family.

These decisions not only helped safeguard their lifestyle but gave them confidence to enjoy their retirement years.

Next steps

With the right strategies, you can secure a fulfilling financial future. A wealth manager can simplify the process by creating a personalised retirement plan, stress-testing your income assumptions, and guiding you through the financial and practical aspects of retirement – giving you confidence that your future is in expert hands.

Find out more from our dedicated support team by calling us on 020 7246 1111. Opening hours are Monday to Friday 9am to 5pm.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Neither simulated nor actual past performance are reliable indicators of future performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

Tagged with

Are your retirement plans on track?

We’ll guide you through your options, show how much you need to save, and build a plan that helps you realise your ambitions.

Retirement planning