4 September 2025

Taking income now could end up costing £00,000s in missed capital gains

Choosing investments that maximise income may seem like a good strategy – especially as you approach retirement – but it may undermine your financial goals in the long term, according to new research from RBC Brewin Dolphin.

The wealth manager’s analysis of several major indices compared to their ‘dividend aristocrat’ equivalents – stocks within a market that have increased the income they provide shareholders over long periods – suggests that savers could have been much better off investing in the standard market tracker.

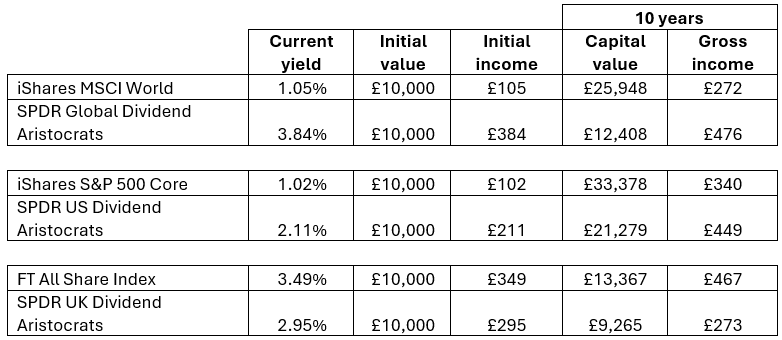

The figures are based on an initial investment of £10,000. For illustration purposes, the income from each index is shown as if it were the same at the start of the timeframe as it is now, with dividends taken as income rather than reinvested. These figures exclude charges and taxes, which would have reduced returns.

Figure 1: Gross income[1] and capital returns from world, US, and UK indices over 10 years

Source: Bloomberg

Over 10 years, while you would have had £279 more income per year by investing in the Global Dividend Aristocrats compared to the MSCI World (£384 versus £105). The value of your initial £10,000 investment would have grown to only £12,408 versus £25,948 for the standard index. The difference in capital growth means that, although your income would still be higher by the end of those 10 years, it would have only grown by 24 percent instead of 159 percent.

It is a similar story in the US market. While you would have started with £109 more income, you would have sacrificed £12,099 in capital growth (£33,378 for the S&P 500 compared to £21,279 from US Dividend Aristocrats). Your income would also have grown 233 percent with the S&P 500 tracker – albeit from a lower base – compared to 113 percent with the more income-oriented investment.

Perhaps surprisingly, the UK’s FT All Share index produces more income than its ‘high yielding’ equivalent, at 3.49 percent versus 2.95 percent. Not only would you start with a larger income, but you would also have made a capital gain of £3,367 compared to a negative return of -£735 by opting for UK Dividend Aristocrats. Your income growth would also have been in negative territory, shrinking from £295 to £273.

The differences are starker over longer periods. For example, investing £10,000 in the US Dividend Aristocrats from October 2011 to June 2025 (the maximum available period), you would have missed out on £24,448 of capital growth compared to the S&P 500 (£57,501 versus £33,053) for only an extra £110 of annual income (£587 versus £697).

Rob Burgeman, wealth manager at RBC Brewin Dolphin, said: “These numbers suggest that being too focused on income can have long-term consequences for your investments. Taking money now can come at a cost: it inhibits the ability of your capital to grow meaningfully over time. And remember that inflation can also ravage your income – £100 will not cover what it does today in 10 years.

“What’s going on beneath the surface is that many of the companies that pay high dividends are mature businesses in well-developed industries. They often have fewer options for making productive use of the cash, so they return it to shareholders. High-growth companies, which also tend to be higher risk, will instead reinvest that capital, which should make them grow in value and add to any income they provide.

“It is always good to find things you are too young for, whatever age you are. When it comes to investing, in your 60s, you can still afford to take some calculated risks – putting aside health conditions. Of course, if you’re 90 years old, your need for excess capital returns may be different, and income may be more appropriate, but even so, it might be better to sell down gains than focus too much on income-oriented investments.

“In any case, it’s not inconceivable nowadays that you are retired for as long as you work. With that, your requirements are going to evolve. In the beginning, there may be big expenditures in the form of trips, which may give way to a more local lifestyle as you get older. Later, there may be other large costs in the form of care. All of this needs to be reflected in your portfolio and the type of assets you hold to make sure you do not run out of money at a time when you may struggle to rebuild the capital.

“Your investments won’t necessarily evolve by themselves over the course of decades, so a good financial planner will help you manage that process. Bespoke portfolio management is about fitting your portfolio to your circumstances, because everyone’s lives and needs are different.”

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

– ENDS –

Five-year discrete performance for mentioned indices:

Source: Bloomberg

PRESS INFORMATION

For further information, please contact:

Siân Robertson: Sian.Robertson@brewin.co.uk / Tel: +44 (0) 20 3201 3026

Payal Nair: payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.6bn* billion in assets under management, it offers award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Its qualified investment managers and financial planners are based in over 30 offices across the UK, Jersey and Republic of Ireland, with a commitment to high standards of client service, long-term thinking and absolute focus on clients’ needs at the core.

As part of Royal Bank of Canada (RBC), RBC Brewin Dolphin is now able to draw on the strength of a global financial institution to enhance the services it provides to clients and to drive further innovation across the business.

*as at 31st October 2024.

Disclaimers

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 101,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 19 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/peopleandplanet.

[1] Gross income is the income you would have received before any tax is factored in, accumulated over 10 years without it being reinvested. Any income is, of course, variable and may change over time.