9 May 2025

- Over 56% of survey respondents plan to spend more of their pension

- Around 75% plan to do so on holidays, tying in with long-haul bookings data

- Majority plan to take financial advice, but substantial minority don’t

More than half of people approaching or already in retirement with significant savings plan to spend their pension, rather than pass it down to family members following the proposed changes announced in the Autumn Budget 2024 bringing pensions in to scope of inheritance tax, according to new research from RBC Brewin Dolphin.

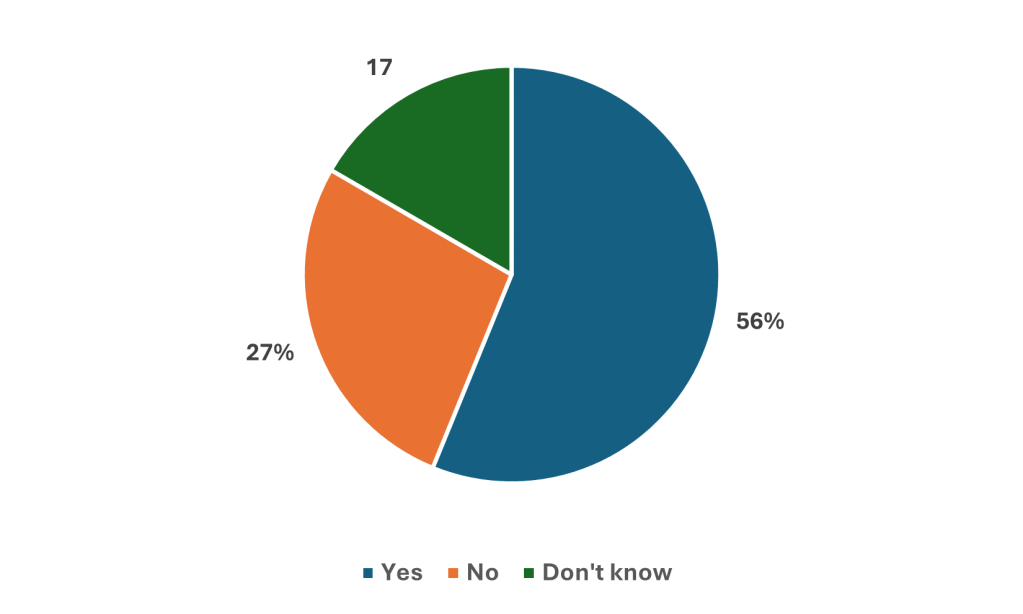

The wealth manager’s survey of people aged 45-years-old and over with pension pots of at least £300,000 found that 56% of respondents now intend to spend more of their pension following the announcements made in the Autumn 2024 Budget. Another 17% were unsure, while the remaining 27% don’t intend to change their plans.

Figure 1: Do you intend to spend more of your pension, rather than passing it down?

Source: Findoutnow, RBC Brewin Dolphin

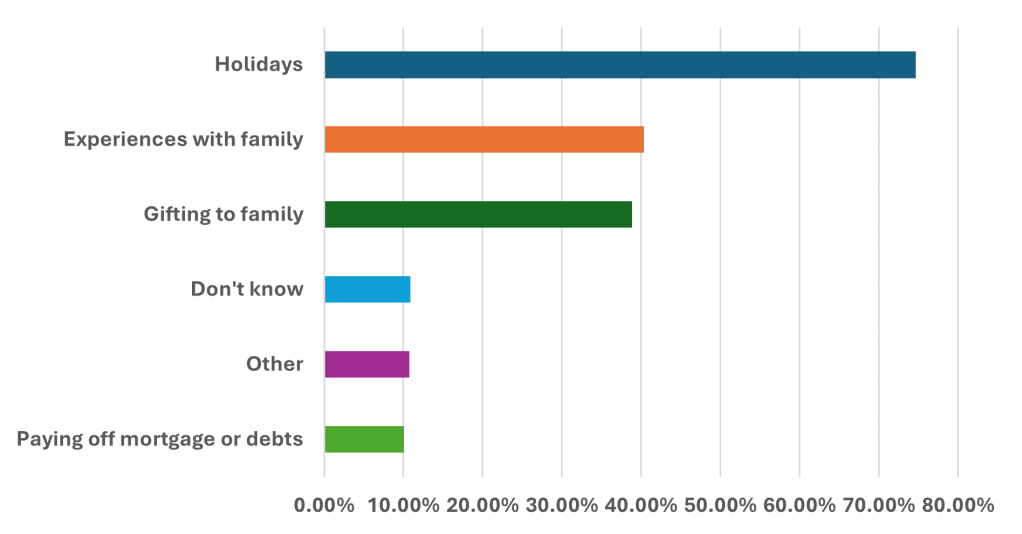

When asked what they now plan to spend their pension pot on, the vast majority of those surveyed, 75%, said they intend to go on more holidays. The finding coincides with the recent surge in bookings for long-haul holidays reported by a number of travel companies, including Kuoni which last month said they were 14% higher than at the same point in 2024[1].

Figure 2: What are you planning to spend more of your pension on?

Source: Findoutnow, RBC Brewin Dolphin

Another 40% said they planned to have more experiences with family members and a similar share (39%) said they intend to gift more to their family. Paying off mortgages or other remaining debts was the priority for 10%, while 11% were unsure what they would spend the money on.

Among the top ‘other’ answers were purchasing a new house, making home improvements, and buying a new car.

It is important to remember that the changes will not take effect until 6 April 2027 and that the government’s initial consultation on the proposed changes has only recently closed so it is advisable to wait for the detailed legislation before making any significant decisions on spending.

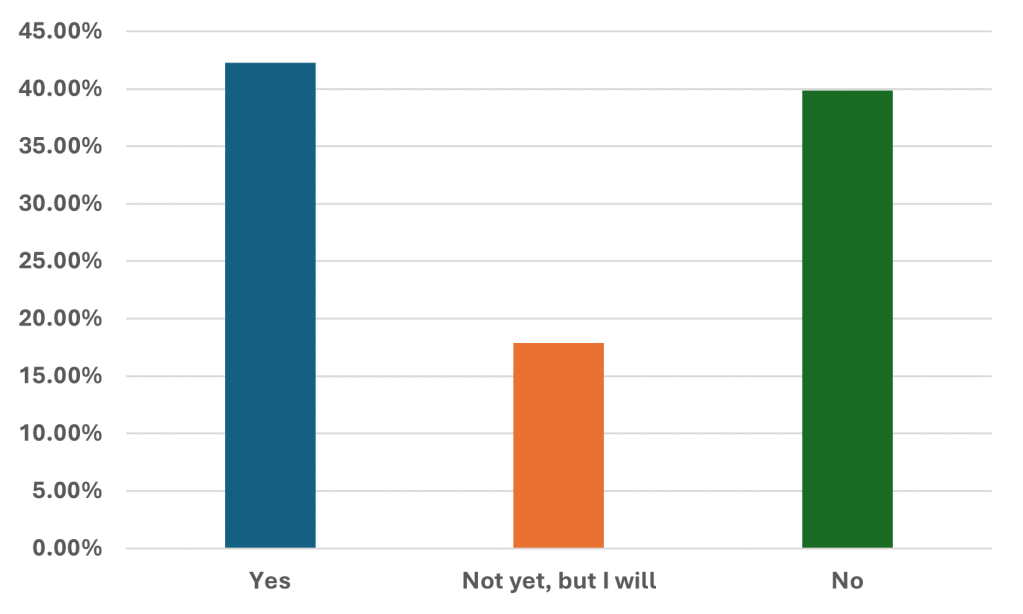

Encouragingly, the majority of respondents either have or intend to take financial advice about how increased spending from their pension pots will affect their retirement. However, a substantial minority, 40%, don’t plan on doing so.

Figure 3: Will you take financial advice about how this will affect your retirement?

Source: Findoutnow, RBC Brewin Dolphin

Daniel Hough, financial planner at RBC Brewin Dolphin, said: “The results of our survey back up what we have experienced in terms of enquiries since October’s Budget. Retirees and people approaching retirement are increasingly looking to spend more of their pension, rather than risk a big portion of it being lost to inheritance tax when they pass away.

“We have seen clients wanting to spend more of their retirement savings on experiences, like travel, and having an amazing time with their families. The fact that the vast majority of respondents are planning to spend more on holidays is unsurprising – we’ve seen a number of cases where parents or grandparents have decided to pay to take the whole family away on five-figure trips so that they can experience something special.

“There is, of course, nothing wrong with wanting to live as full a life as possible and spend money on your family so that they remember having an incredible time with you. But, there are also inevitably risks in doing too much of that. People need to be very careful not to go overboard and leave themselves short for the remainder of their retirement. “While it’s encouraging that the majority of wealthier people have or intend to take advice, the survey suggests that around 40% won’t. A financial adviser will be able to help you plan out your finances for retirement and see how increased spending can be accommodated, while leaving you well covered for the potential costs of later life. And we would encourage people not to let the prospect of paying more in tax be the main driver behind any significant spending decisions or lifestyle changes.”

– ENDS –

Surveyed conducted by Findoutnow on behalf of RBC Brewin Dolphin on 1,045 UK adults, 1,001 of which were aged 45+, with pension pots of over £300,000 between March 17th and March 23rd, 2025.

Disclaimers

The value of investments can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Siân Robertson Sian.Robertson@brewin.co.uk / Tel: +44 (0) 20 3201 3026

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

Georgia Embrey Georgia.embrey@rbc.com / Tel: +44 (0)7704 667 842

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.6bn* billion in assets under management, it offers award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Its qualified investment managers and financial planners are based in over 30 offices across the UK, Jersey and Republic of Ireland, with a commitment to high standards of client service, long-term thinking and absolute focus on clients’ needs at the core.

As part of Royal Bank of Canada (RBC), RBC Brewin Dolphin is now able to draw on the strength of a global financial institution to enhance the services it provides to clients and to drive further innovation across the business.

*as at 31st October 2024.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 98,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 19 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/peopleandplanet.

[1] Source: The Guardian