13 March 2025

On 30 October, the Chancellor, Rachel Reeves, delivered Labour’s Autumn Budget which announced a £40bn rise in taxes and was the biggest increase at a budget since 1993. While nothing has been revealed yet, RBC Brewin Dolphin’s Rob Burgeman (senior investment manager) and Ammo Kambo (financial planner) consider what changes might be announced during the Spring Budget on 26March and what this could mean for your personal finances:

Tax-free personal allowance

The tax-free personal allowance has been frozen at £12,570 since April 2021 and Reeves announced in the October budget that she plans to keep the freeze in place until 2028. Although the Chancellor has stated that Britain will not extend a freeze on the amount of money that people can earn tax-free beyond 2028-2029, if we were to see a freeze on income tax allowances and thresholds beyond 2028 it would be an efficient way to increase tax revenue but doesn’t appear like a traditional tax rise.

Ammo Kambo said, “Tax freezes combined with wage inflation will push those with rising incomes into tax brackets they would previously not have reached – this is known as fiscal drag to economists and is essentially a ‘hidden’ tax rise or a form of stealth tax. This can have a huge impact on household incomes as more people are ‘dragged’ into paying larger amount of tax on their personal income.”

If the basic tax-free allowance threshold rose in line with inflation, the personal allowance for income tax would be now £16,583.60 instead of £12,570; as since April 2021 inflation has been 31.93% – the annual equivalent of 7.48% compound. In simple terms, this would leave UK taxpayers £802.72 per year worse off.

Cash ISAs

The Chancellor is reportedly considering changes to the cash ISA regime – which currently allows savers to protect £20,000 of their money from tax each year. Reeves may reform the ISA framework to try and encourage savers to invest more of their money into stocks and shares, which could help to boost the UK economy. Reeves could therefore lower the cash ISA allowance or abolish it completely.

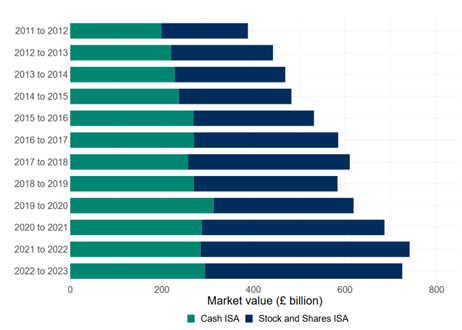

Adult Cash and Stocks and Shares ISA market values per tax year

Chart source: HMRC Annual Savings Statistics 2024

Rob Burgeman said, “The jungles drums are fairly quiet at the moment in terms of what might be in the spring budget. Typically, the heavy lifting is done in the Autumn statement and the Spring Budget is more a review of finances. However, these have deteriorated markedly in the last six months or so and there may, therefore, be some further measures.

The investment industry has been very vocal in its requests to reduce and restrict the limits on Cash ISAs. However, my opinion is that the most important thing is encouraging people to save and make provision for their own retirements – although endlessly tinkering with the rules and regulations, in the midst of a potential pension crisis, could further hinder this.

Reducing or abolishing the ISA cash limit could impact consumers’ ability to save in a tax-efficient manner and is unlikely to inspire some cash savers to invest in a stocks and shares ISA instead.

When we look at UK ISA data, at the end of 2022 to 2023, the market value of Adult ISA holdings stood at £725.9 billion.1 According to figures published by HMRC in 2024, stocks and shares ISA holdings account for 59.3% of the market value of ISA funds, a decrease from 61.5% in 2021 to 2022.2 Cash ISAs account for 40.5% of the market value, an increase from 38.4% in 2021 to 2022.

ISA holders by gender

| Women | Men | |

| Cash ISAs | 3.7m | 2.8m |

| Stocks and shares ISAs | 1.4m | 1.9m |

Not only could changes to the cash ISA regime discourage savers, it could also disproportionately impact women. Although the gender split of total number of ISA holders is approximately equal, more women opt to put their money in cash ISAs over stocks and shares ISAs, whereas a higher proportion of men opt for stocks and shares ISAs.3”

-ENDS-

Disclaimers

- The value of investments can fall and you may get back less than you invested. Information is provided only as an example and is not a recommendation to pursue a particular strategy.

- RBC BD does not provide tax or legal advice.

- Neither simulated nor actual past performance are reliable indicators of future performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy.

- Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

- Information is provided only as an example and is not a recommendation to pursue a particular strategy.

- RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.

PRESS INFORMATION

For further information, please contact:

Siân Robertson: Sian.Robertson@brewin.co.uk / Tel: +44 (0) 20 3201 3026

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

Georgia Embrey Georgia.embrey@rbc.com / Tel: +44 (0)7704 667 842

NOTES TO EDITORS

ABOUT RBC BREWIN DOLPHIN

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.6bn* billion in assets under management, it offers award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Its qualified investment managers and financial planners are based in over 30 offices across the UK, Jersey and Republic of Ireland, with a commitment to high standards of client service, long-term thinking and absolute focus on clients’ needs at the core.

As part of Royal Bank of Canada (RBC), RBC Brewin Dolphin is now able to draw on the strength of a global financial institution to enhance the services it provides to clients and to drive further innovation across the business.

*as at 31st October 2024.

ABOUT RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 98,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 18 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/peopleandplanet.