18 February 2025

The technology sector has driven the US market’s outperformance compared to other top tier global markets since the Covid-19 pandemic began five years ago, according to research from RBC Brewin Dolphin.

The wealth manager’s analysis of major indices from different regions found that the USA – as measured by its 500 largest companies – has delivered the strongest returns since the beginning of 2020, with a total return of 106.33%, or 15.63% per annum, in sterling terms1.

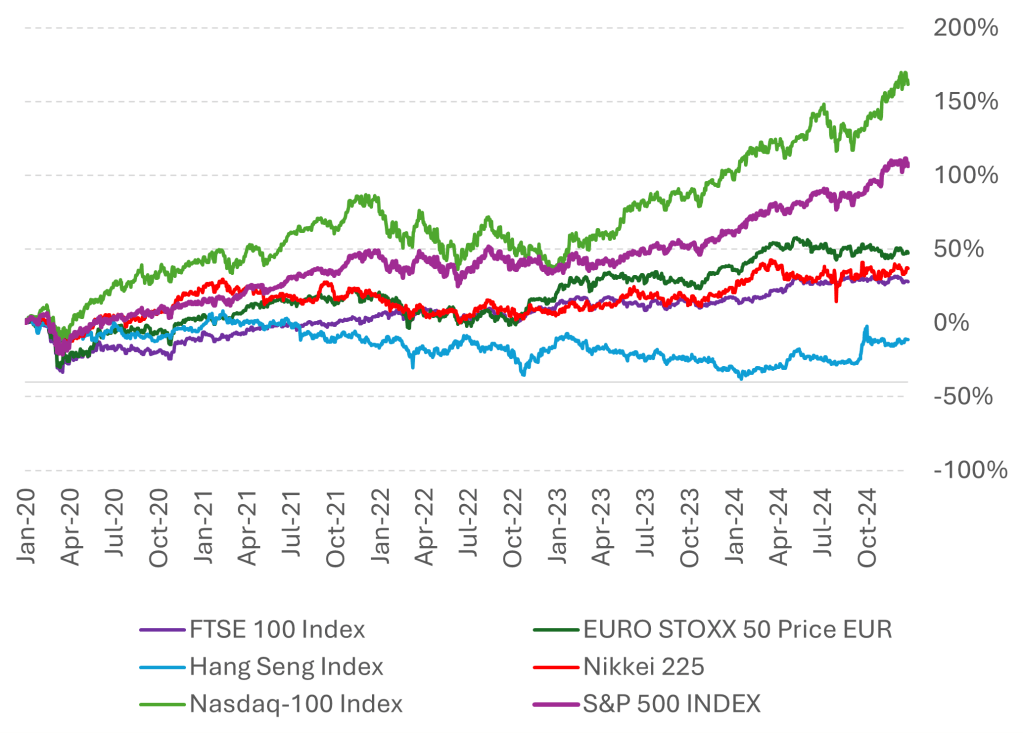

Chart 1: Total returns from selected major indices since 2020:

Source: Bloomberg, RBC Brewin Dolphin

By comparison, Europe’s Eurostoxx 50 returned 47.26% (8.07% per annum), Japan’s Nikkei 225 24.35% (36.92% per annum), and the UK’s FTSE 100 27.99% (5.01% per annum). The Hong Kong-based Hang Seng – used as a proxy for China – was in negative territory with a -11.36% total return, equivalent to -2.39% per annum.

However, the degree to which the US market’s performance has been carried by technology companies is captured by the more concentrated Nasdaq 100 index, which has a lot of crossover with the S&P 500. It delivered a total return of 161.73% over the same time period, or 21.28% on an annual basis.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “On the face of it, the US market has done much better than any of the other indices. But, if you look under the bonnet you can see that has largely been concentrated around a limited number of companies. In fact, recent research has pointed to the fact that more US companies are reaching 12-month lows than are hitting 12-month highs. Most are delivering similar returns to equivalent businesses in other countries.

“Tech has done remarkably well and the sector’s products have become even more integral parts of our lives over the past five years, through trends like hybrid and remote working. The large increases to the share prices of these companies have been based on strong growth, cashflow, and profitability – these are seriously large and impressive businesses, and it is difficult to see that changing.

“There seems to be no obvious catalyst for markets beyond the USA to narrow the gap. When the Covid-19 pandemic began five years ago, many people thought China going into it first would mean its economy would recover more quickly than others. However, it has struggled with demographic challenges, a crisis-hit real estate market, government intervention in the tech sector, and the more draconian lockdown measures that were put in place over a longer period of time.

“Europe’s problems also look unlikely to change in the short to medium term, which partially explains why share prices have not been so cheap for some time. The political situation is difficult in several countries and decision-making processes have become a bit sclerotic, as a result. And, other than a few notable exceptions like ASML, there are no real leaders in the tech industry based in Europe.

“Meanwhile, the UK has had its own set of issues, not least the structure of the FTSE 100. The main index is well-known to largely be made up of energy companies, financials, miners, and pharmaceuticals – all of which have their own challenges to contend with and seem unlikely to provide the huge growth that tech can.

“The renaissance of Japan is potentially the most noteworthy surprise from the main indices. After around 25 years of going nowhere, the Nikkei has had a better last five years, helped largely by government intervention. The tricky aspect of investing in Japan, however, has been the weakness of the yen, which has eaten away at returns for those who have not properly hedged. It feels safe to say, though, that the Japanese stock market is unlikely to slip back into the funk that characterised 1990-2015.

“Looking ahead, it is difficult to see the big tech companies that have driven markets since the pandemic being dislodged – if anything, they will likely only continue to grow. Even if some of them are broken up, the general consensus seems to be that it could prove positive for shareholders in some instances. Likewise, given how multinational they are, regulation might be difficult to enforce, even in the USA.

“What we could see in the next five years is the rise of AI broadening out to other sectors. For example, utilities will likely see a lot more investment in the next few years, given how energy-hungry AI and its infrastructure is. As more data centres are required, companies that provide the wiring, cooling, and hardware should see demand for their products and services rise. There are also big changes afoot in emerging markets like Brazil and Argentina, while China’s malaise has been to India’s benefit – so other opportunities could unfold.”

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.

– ENDS –

1 All figures taken from Bloomberg

Five-year discrete performance for mentioned indices (returns in GBP):

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| S&P 500 | 13.25% | 31.71% | -8.92% | 19.68% | 27.71% |

| FTSE 100 | -10.53% | 16.68% | 2.89% | 7.68% | 8.89% |

| Euro Stoxx 50 | 3.76% | 15.02% | -4.55% | 20.64% | 6.37% |

| Hang Seng | -3.68% | -13.68% | -1.81% | -15.22% | 25.67% |

| Nikkei 225 | 22.45% | -3.23% | -9.68% | 15.51% | 10.57% |

Source: Bloomberg

PRESS INFORMATION

For further information, please contact:

Siân Robertson Sian.Robertson@brewin.co.uk / Tel: +44 (0) 20 3201 3026

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

Georgia Embrey Georgia.embrey@rbc.com / Tel: +44 (0)7704 667 842

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.6bn* billion in assets under management, it offers award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Its qualified investment managers and financial planners are based in over 30 offices across the UK, Jersey and Republic of Ireland, with a commitment to high standards of client service, long-term thinking and absolute focus on clients’ needs at the core.

As part of Royal Bank of Canada (RBC), RBC Brewin Dolphin is now able to draw on the strength of a global financial institution to enhance the services it provides to clients and to drive further innovation across the business.

*as at 31st October 2024.

Disclaimers

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 98,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 18 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/peopleandplanet.