15 March 2024

- RBC Brewin Dolphin’s Freedom of Information (FOI) request reveals more than 13,000 individuals were hit with retrospective taxes, according to latest annual figures.

- Families fell foul of a HMRC rule which requires up to 40% inheritance tax to be paid on lifetime gifts in the event of the giver dying within seven years.

- Top 50 “failed gifts” – where the donor sadly died within the seven years – averaged £3.6 million after allowances and exemptions, leaving the recipients with unexpected tax bills of up to £1.4million

- The wealth manager is urging families to consider long-term family wealth planning alongside insurance policies which cover surprise inheritance tax bills.

London 15 March 2024 — Some of the UK’s wealthiest families were landed with retrospective tax bills in the region of £1.4 million on lifetime gifts, according to latest annual figures.

The families tried to make use of a rule allowing individuals to make gifts of unlimited value which become exempt from inheritance tax if the giver survives a further seven years, known as a “potentially exempt transfer” (PET).

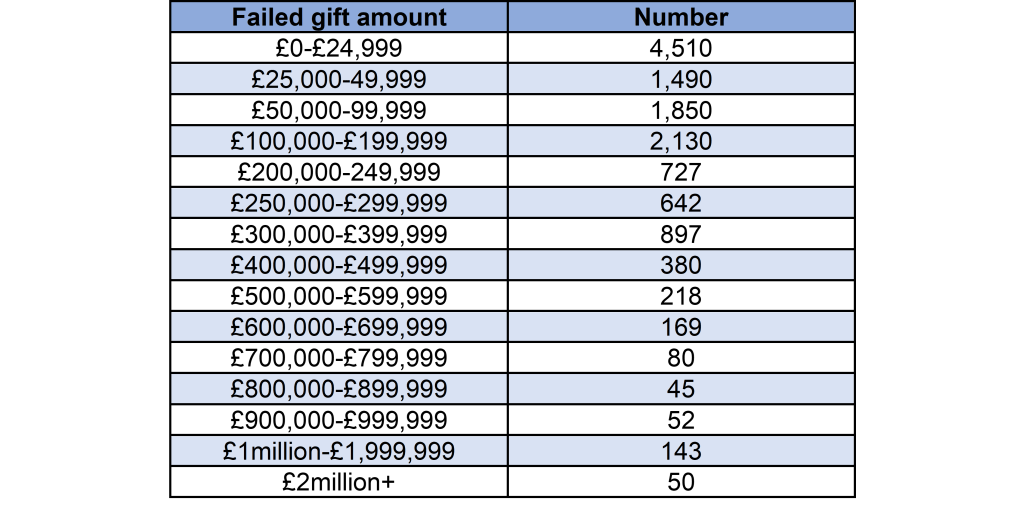

But a Freedom of Information (FOI) request from wealth manager RBC Brewin Dolphin to HMRC has revealed that 13,380 of these gifts became the subject of inheritance tax (IHT) charged at up to 40% after the donor sadly died within the seven years.

According to the dossier,the top 50 “failed gifts” in 2020-21 averaged £3.6 million after allowances and exemptions. A gift of this size would trigger an eye-watering tax bill of up to £1,452,000 if the PET failed in the first three years.

The average “failed gift” stood at £156,000 after allowances and exemptions, meaning a recipient paying 40% inheritance tax on that sum faced a bill of £62,400 if the PET failed in the first three years.

Carla Morris, financial planner at wealth manager from RBC Brewin Dolphin, commented: “Inheritance tax is paid by a few but feared by all. Many people resent having to pay tax on income that has already been taxed, especially at a time when they are grieving.

NOTE: Figures are after allowances and exemptions

“Gifting when you are alive has become an integral part of estate planning and can help mitigate exposure to inheritance tax later on, but it’s important to understand the rules and have the right counsel.

“For the gift to be completely tax exempt, the giver must survive the event by seven years.

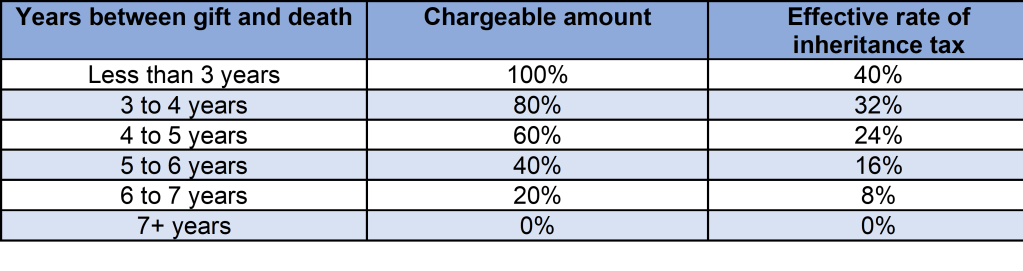

“If the donor – usually a parent or grandparent – dies within the seven years then inheritance tax, on the amount in excess of the available nil rate band, is payable by the recipient on a sliding scale of 8-40% depending on the passage of time that has passed between the gift being made and the donor passing.

“This news can come as a massive shock to people who are already mourning the loss of a loved one. That’s why we would urge clients to plan well ahead of time or consider insurance policies which meet these bills.”

Long-term family wealth planning

The seven-year clock starts ticking on the day the gift is made. Gifts in the first three years are charged at 40%, and after that, for gifts over £325,000, taper relief kicks in as demonstrated in the table below.

Inheritance tax on gifts above £325,000

Carla Morris said: “It makes sense to sit down with a financial planner early if you want to plan your gifting in the most tax efficient manner.

“Leave it until your 80s, and the risk becomes far greater that you won’t survive the full seven years.”

IHT bills double

Prime Minister Rishi Sunak is understood to be considering an overhaul of IHT charges, reportedly dubbed “the most hated tax in Britain[1]” by one of his own advisers.

It is estimated that inheritance tax revenues will more than double from their current level of £7 billion annually to £15 billion by 2032-33.[2]

IHT is currently charged at 40% for estates worth more than £325,000 with an extra £175,000 allowance towards a main residence if it is passed to direct descendants.

Married couples or civil partnerships can share their allowance, meaning they can pass on £1 million to their children without any tax. Co-habiting couples do not benefit from transferable allowances.

Using trusts to mitigate IHT

RBC Brewin Dolphin is encouraging clients to consider long-term family wealth planning alongside making gifts into trust to mitigate the impact of surprise inheritance tax bills triggered by the seven-year rule.

Trusts are particularly attractive to grandparents who are more exposed to the seven-year rule by virtue of their seniority. They allow donors to give away assets indirectly. Typically, a trust is held and managed by a third party known as a trustee.

Often, grandparents will set aside money for grandchildren with the parents as trustees. Money is typically released when the grandchildren are mature enough to make prudent financial decisions. Though this is at the discretion of the trustees and there is no obligation to wait until the child turns 18 or 21.

Carla Morris, financial planner at wealth manager from RBC Brewin Dolphin, commented: “Trusts can be used to ringfence funds in a way that is tax efficient for inheritance. The type of trust is important to consider.

“For example, one type of trust may give the child the absolute entitlement to the money at a certain age, while another may offer the trustees greater flexibility and discretion, even making allowances for children who have not been born yet.

“With so much to consider, it makes sense to have expert advice every step of the way.” Another option worth considering are gift inter vivos insurance policies which pay-out if the donor doesn’t survive the seven years and a tax demand lands on your doorstep.

Carla Morris, financial planner at wealth manager from RBC Brewin Dolphin, commented: “Long-term wealth planning that considers both your own cashflow needs, and your desire to pass down wealth can help to ensure your loved ones aren’t hit with an unnecessary bill. There will inevitably be occasions when this can’t be avoided and that’s when a gift inter vivos policy might come in – an insurance policy used to cover the inheritance tax liability that can arise when a person makes a gift whilst they are alive, but dies within seven years.

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 690 8994 69.

For further information contact:

Gary O’Shea – Senior Consultant, Powerscourt Group

Email: gary.oshea@powerscourt-group.com

Tel: 07814 658271

Richard Janes – Senior Communications Manager, RBC Brewin Dolphin

Email: richard.janes@brewin.co.uk

Tel: 0203 201 3343

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £51.8* billion in assets under management, we offer award-winning, personalised wealth management services from bespoke, discretionary investment management to retirement planning and tax-efficient investing.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 31st October 2023.

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 690 8994 69.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 94,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact.

[1] Inheritance tax has been crowned the most hated tax in Britain.

[2] https://ifs.org.uk/publications/reforming-inheritance-tax#:~:text=Inheritance%20tax%20revenues%20are%20small,by%20subsequent%20generations%20of%20retirees.