20 March 2024

Individuals earning the UK average wage would need to contribute around 14% for a comfortable retirement.

Everyone wants a ‘comfortable’ retirement1, but to reach that goal while making only the minimum pension contribution would mean you have to be among the UK’s top earners, according to figures from wealth manager RBC Brewin Dolphin.

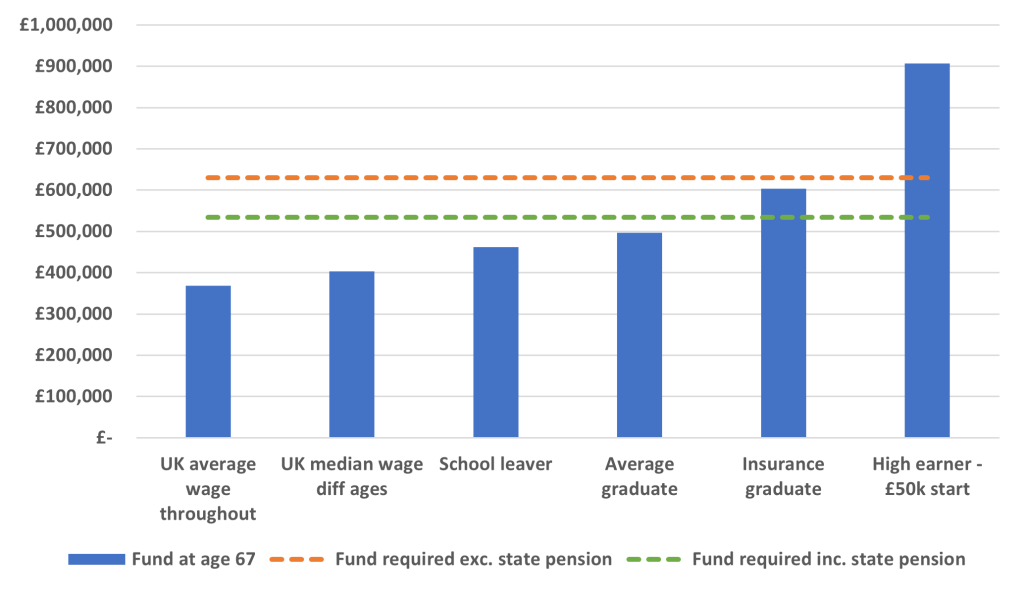

The Pensions and Lifetime Savings Association (PLSA) defines a comfortable retirement income as £37,300 per annum outside of London – and £40,900 in the capital – which would require a pension pot of £630,000 and £691,000 respectively, assuming annual drawdown of 5%2. Only higher-earning professionals would reach this figure by the age of 67, contributing 8% of their salaries (5% personal and 3% from their employer – the legal minimum required by auto-enrolment), RBC Brewin Dolphin’s analysis found.

All of the assumptions are based on an individual choosing to draw down their pension. Another option would be to take out an annuity, which provides a guaranteed level of known income for the rest of your life, regardless of how long you live and removing the investment risk of underperforming funds.

A high earner starting on £50,000 straight out of university, a starting salary that could be associated with investment banking and averaging £105,000 over the course of their career3, would accumulate a pot comfortably beyond the £630,000 required at around £907,000 – excluding any additional payments from bonuses and other forms of remuneration. The figures assume average annual earnings growth of 3% on starting salaries and pension savings growing at an average rate of 4%, net of charges.

Including the state pension would reduce your required pot. How much you receive depends on the number of years you have worked – a minimum of 10 and a maximum of 35 – and you can only currently begin claiming it at the age of 66. The maximum amount you are eligible for is £10,600, which would reduce the required personal pension pot to around £534,000 outside of London for an annual income of £26,700, or £612,000 for an income of £30,600 in the capital, based on drawdown of 5%.

‘Average’ earners need to up their contributions

However, a person earning the average UK wage of £34,9634 throughout their career would accrue £369,057 by the time they are 67 years-old – equivalent to just 59% of the £630,000 pot required for a comfortable retirement, and 78% if you include the maximum state pension. Earning the median UK wage5 throughout your career leaves you in a similar position, with a pot of just over £403,000.

Salary data from graduate-jobs.com suggests that the insurance sector had the highest average starting graduate salary at £33,2506. Even with the growth assumptions outlined, which would see them earn an average annual salary of just shy of £70,000 over the course of their career, a minimum pension contribution would leave them £27,000 off the required pot, at £603,000. Albeit, the figure is well above the £500,000 required when income from the state pension is included.

The ‘average’ graduate, starting with a salary of £27,401 and averaging £57,483 annually through their career, could accumulate a pension pot just shy of £497,000 by 67 years-old – £133,000 short of the £630,000 target, but close to the £500,000 required outside of London. However, with graduate jobs increasingly concentrating in the capital7, more people who come under this bracket will need to achieve the £612,000 required for a comfortable retirement in London.

Despite extra time in work, someone starting from the age of 18 could have a pot worth £461,565, assuming they start on £20,3758 and see their wage grow an average of 3% per annum, leaving them more than £168,000 away from the comfortable retirement amount and some £40,000 off the figure required for those living outside of London. They would average just under £46,000 in annual earnings throughout their working lives.

Smart advice – even small additions can make a big difference

If, however, a person in the ‘average graduate’ scenario upped their pension contributions by just 2% – taking them to a combined 10% between personal and employer – they would be within touching distance of the £630,000 target, with a potential pot of £621,000. This is well above the £534,000 required when a full state pension is included. An individual earning the UK average wage throughout their career would need to contribute around 14% of their salary – between their own contributions and their employer’s – from the very beginning of their working life to reach or exceed £630,000.

Potential pension pots at 67 years-old with minimum contributions:

| Group | Fund at 67 |

| UK average wage (£34,963) throughout | £369,057 |

| UK median wage at different ages9 | £403,156 |

| School leaver (18+) | £461,565 |

| Average graduate salary | £496,938 |

| Insurance graduate | £603,014 |

| High earner – £50k start | £906,788 |

Daniel Hough, financial planner at RBC Brewin Dolphin, said: “These figures demonstrate that, for the vast majority of people, contributing the auto-enrolment minimum to their pension pot isn’t going to be enough to provide them with a comfortable retirement. If you want to have a good standard of life when you stop working, and if you can afford to, you really need to put more into your pension each month to allow the powers of time and compound interest to work in your favour.

“Even for those who earn relatively well, unless they make a larger personal contribution, they may well find themselves short. For the average graduate, an extra 2% added to their pension contribution over the course of their career could equate to around £124,000 extra in their final pot – the equivalent of a 25% increase.

“It is notoriously difficult to say what the best amount people should save towards their pension pot should be – a lot depends on individual circumstances. Many people assume the minimum is enough because it has been set by government, but the reality is that the auto-enrolment means the onus is on each individual to ensure they have enough saved for their retirement. Saving as much as you can is a good starting point for coming up with a number.

“While the assumptions we have made here are about a retiree choosing to draw down their pension, it is also worth exploring other options. Annuities, in particular, are good value at the moment and provide a greater level of security over income in retirement, removing the risk of individual funds underperforming and being unable to provide the income or capital growth you need to withdraw from your retirement pot.

“Everyone’s financial objectives and expectations for retirement will be different. Taking professional advice is the best way of making sure you have a plan for retirement and are making the necessary financial arrangements to achieve it.”

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 690 8994 69.

– ENDS –

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £51.8* billion in assets under management, we offer award-winning, personalised wealth management services from bespoke, discretionary investment management to retirement planning and tax-efficient investing.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 31st October 2023.

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 690 8994 69.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 94,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact.

1 As defined by the Pensions and Lifetimes Savings Association: https://www.retirementlivingstandards.org.uk/

3 Indicative investment banker starting salary sourced from: https://www.glassdoor.co.uk/Salaries/london-investment-banker-salary-SRCH_IL.0,6_IM1035_KO7,24.htm

4 Source: https://www.statista.com/statistics/416139/full-time-annual-salary-in-the-uk-by-region/

5 Source: https://www.statista.com/statistics/802183/annual-pay-employees-in-the-uk/

6 Source: https://www.graduate-jobs.com/booklet/graduate-salary-salaries

8 Taken from the average of male and female median salaries: https://www.statista.com/statistics/802183/annual-pay-employees-in-the-uk/

9 As taken from: https://www.statista.com/statistics/802183/annual-pay-employees-in-the-uk/