1 March 2023

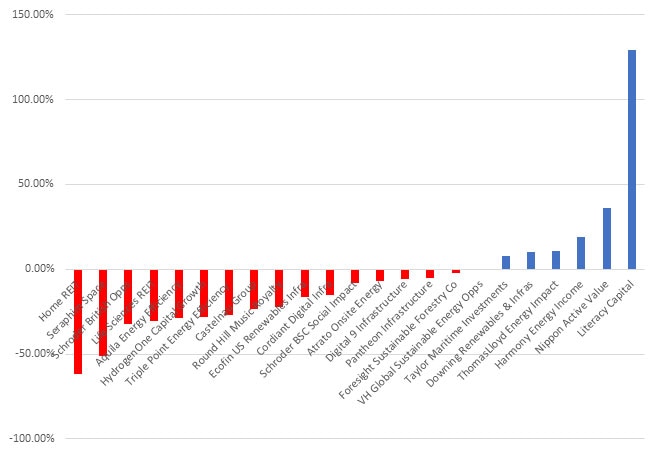

Three-quarters of investment trusts launched since the start of the Covid-19 pandemic are trading below their IPO price, according to analysis from RBC Brewin Dolphin.

The wealth manager’s research found that there were 24 investment trusts launched during 2020-2021, with none in 2022 as the conflict in Ukraine, rising interest rates, and high inflation saw increased stock market volatility. While six of those investment trusts are trading above their IPO price, 18 have seen their share prices drop.

Source: Bloomberg

Home REIT, the embattled investor in sheltered housing, tops the list of fallers at a -61.95% decline since its market debut and with the shares suspended there is the potential for worse. Next up is Petershill Partners, the diversified private equity group, with a -53.49% decline and Seraphim Space Investment Trust, which has lost -51.25% of its value.

Among the few investment trusts trading in positive territory are specialist private equity house Literacy Capital – up 129.38%; Nippon Active Value, which invests in Japanese smaller companies with change potential; and renewable infrastructure investor Harmony Energy Income Trust.

Six of the nine investment trusts launched during 2020 and 2021 are trading below their IPO price, while all three infrastructure trusts are also in the red. Similarly, all three growth capital trusts are substantially below their IPO price, with losses ranging between -32.50% and -53.49%.

John Moore, senior investment manager at RBC Brewin Dolphin, said: “The Covid-19 pandemic period will likely be looked back upon as an extraordinary time in financial history. We can see some of the themes that characterised it in the list of investment trust that launched in its first two years – namely, the increased focus on renewable energy, infrastructure, and growth companies.

“Since the pandemic, the interest in those sectors has gone into reverse. Double-digit inflation, rising interest rates, and increased political risk have combined to create a very different environment where long-term optimism is very much a secondary consideration.

“However, circumstances change and, with good execution, many trusts can show short-term relevance until the longer term drivers behind them become more easily recognised again. Investments go through periods of over and underperformance and taking professional advice will help you navigate through these times.”

Pandemic investment trusts to watch:

Digital 9 Infrastructure – John Moore said: “As its name suggests, Digital 9 Infrastructure owns data centre assets, subsea cabling and modern internet-led infrastructure with a focus on helping to decarbonise and connect the future. On top of changes in markets, the trust suffered the uncertainty of a management change too which knocked sentiment. If the new manager can bring stability and execution, then the focus will again return to a modern infrastructure play that offers an attractive income.”

Petershill Partners – John Moore said: “Petershill Partners is a diversified investment vehicle that owns stakes in leading specialist alternative asset managers. This is a vibrant area, but it is also difficult for investors to access and gain reasonable diversification within. Consistent with the private approach to investment, there is not the same level of transparency as you might get with public markets, which is another uncertainty. Following its initial difficult start to life on public markets, Petershill will want to prove the value in the portfolio and pipeline.”

Life Sciences REIT – John Moore said: “Property has been one of the main areas of pain in the aftermath of rising inflation and interest rates – the impact on the Life Sciences REIT has been similar to many in the wider sector. However, there are reasons to be more optimistic, as the focus on life sciences aligns with long-term tenants in a growing industry – in the past, this has led to superior rental growth. With some execution on the portfolio and future pipeline, along with suggestions interest rates could be peaking, investor attention might return to the long-term potential of this REIT.”

Source: Bloomberg

John Moore and his fellow investment managers, at RBC Brewin Dolphin put together bespoke investment portfolios for clients based on their long-term objectives and their attitude to risk. The portfolios will have a mixture of hand-picked holdings in them including third party funds and individual stocks that are researched and recommended by RBC Brewin Dolphin’s in-house research team.

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. The criteria for a sustainable investment are still under development and can change. Please make sure you understand the objective and environmental, social and governance (“ESG”) characteristics of the product or service you invest in. Be aware a strategy, based on securities of companies which maintain strong ESG credentials, may result in a return that compares unfavourably to similar investments without such focus. RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444).

– ENDS –

Five year discrete performance:

Company | |||||

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £51.7* billion in assets under management, we offer award-winning, personalised wealth management services from bespoke, discretionary investment management to retirement planning and tax-efficient investing.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 30th June 2022.

Disclaimers

The value of investments can fall and you may get back less than you invested. RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444).