Japan’s forgotten decade – is 2023 the time to reconsider investing in the Land of the Rising Sun?

News & comments6 January 2023

Many investors’ views about Japan are still shaped by the asset bubble that emerged in the country between 1986 and 1991, but it may be time to reassess, according to RBC Brewin Dolphin.

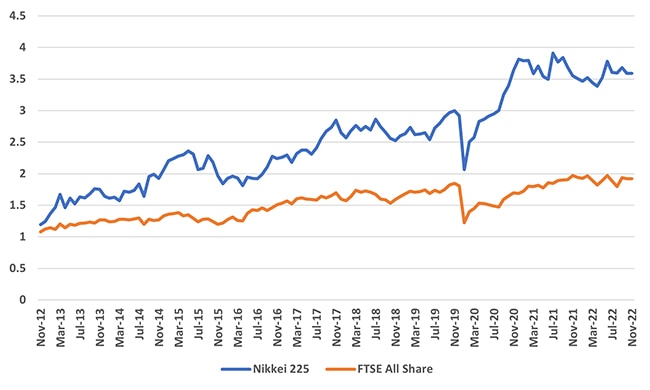

The wealth manager found that returns from the Nikkei 225 index of Japan’s top-rated companies comfortably outperformed the FTSE All Share over the last decade, despite negative perceptions of the economy fuelled by persistent deflation, scandals at some of its largest companies, and more recently a shock decision from the Bank of Japan to change its yield curve control policy1.

The Nikkei 225 delivered a total return – capital appreciation and dividend income – in sterling terms of +171% from the beginning of 2013 to the end of 2022, compared to +91% for the FTSE All Share. This is equivalent to an annualised return of +10.57% and +6.72%, respectively.

Source: Bloomberg

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “Japan has done relatively well since 2013, but it has remained off the radar for many investors who think back to the asset bubble that developed in the country during the late 1980s. While it is true the Japanese stock market is yet to fully recover from that period, it is also in a very different place to where it was.

“Japan has a very deep culture of companies listing and some high-quality companies – Toyota is still the world’s largest car manufacturer and Sony is an incredibly diverse company.

“However, that means the market also comes with a lot of ‘lobster pots’ – small, poorly researched companies that appear cheap and tend to stay cheap for a very long time. There is also no particular culture of shareholder activism to bring about change.

“Nuances like these are why we always recommend taking professional financial advice before making any significant investment decisions – especially when it comes to international markets.”

Japan-focussed funds:

Shin Nippon Investment Trust – “Shin Nippon is managed by Baillie Gifford is predominantly made up of smaller companies, the majority of which will mean little to the average UK-based investor. Despite the recent sell-off that has affected smaller caps, Shin Nippon has delivered an annualised equivalent return of nearly +15%, placing it among the better performing Japanese funds.”

Jupiter Japan Income Fund – “The Jupiter Japan Income Fund contains some of the largest companies in the country, many of which will be familiar. Among its top holdings are the likes of Toyota, Softbank, and Sony. The fund’s performance has more or less mimicked the wider Japanese market, with an annualised return of +9.61%, but with more of a bias towards income.”

Man GLG Japan Core Alpha Fund – “The Man GLG Japan Core Alpha Fund is extraordinary for being just about the most value-oriented fund you can find. This means it comes with a few quirks – for instance, it tends to do the opposite of what the wider Japanese market is doing. Over the past 10 years it has delivered annual performance of +9.62%, which is by no means sloppy, but it has gone through periods of massive under and over performance.”

iShares MSCI Japan UCITS ETF – “iShares Japan tracks the MSCI Japan index and is a cheap and cheerful option for those who want exposure to the country. Its relative underperformance, at an annualised equivalent of +8.3%, compared to its actively managed peers, underlines the fact that Japan is a market that favours active management.”

– ENDS –

Rob Burgeman and his fellow investment managers at RBC Brewin Dolphin put together bespoke investment portfolios for clients based on their long-term objectives and their attitude to risk. The portfolios will have a mixture of hand-picked holdings in them including third party funds and individual stocks that are researched and recommended by RBC Brewin Dolphin’s in-house research team.

1On December 20 2022 the Bank of Japan said the 10-year Japanese Government Bond yield would be allowed to veer plus-or-minus 50 basis points from its 0% target. This compares to its previous 25 basis points threshold, in a sign widely believed to suggest that inflation is unlikely to be tamed in the country and interest rates may be set to rise.

Disclaimers

The value of investments can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444).

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £51.7* billion in assets under management, we offer award-winning, personalised wealth management services from bespoke, discretionary investment management to retirement planning and tax-efficient investing.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 30th June 2022.

Disclaimers

The value of investments can fall and you may get back less than you invested. RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444).