Bonds and equities failed to beat inflation only once in two decades – Brewin Dolphin research

News & comments5 November 2022

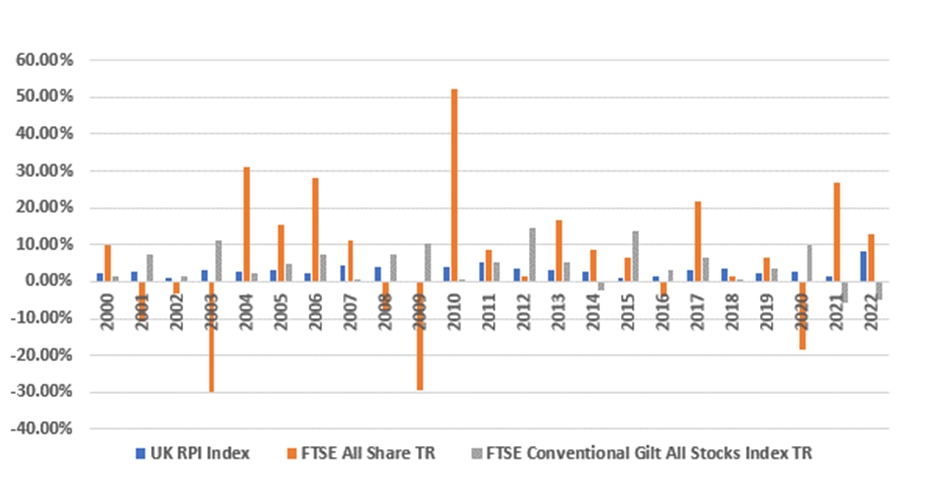

Since the turn of the millennium, gilts and equities have only failed to outpace inflation once in the same year (April to March), according to new research from Brewin Dolphin.

The wealth manager found that April 2017 – March 2018 was the only time inflation outpaced both asset classes – during every other year gilts, equities, or both have managed to maintain savers’ purchasing power. Past performance, however, is not a guide to future returns.

Since April 1999, equities have beaten inflation in 13 years, with gilts doing so during 14 of the 23 years analysed. Both equities and gilts have beaten inflation at the same time on only five occasions in that time.

Brewin Dolphin said that, although bonds are generally thought to suffer during periods of inflation, the findings underlined the importance of a balanced, multi-asset portfolio in times of uncertainty.

Total returns from the FTSE All Share and gilts vs inflation, 2000-2022 April to March

Source: Bloomberg

Rob Burgeman, senior investment manager at Brewin Dolphin, said: “It is intuitive that when equities are down, bonds should go up – and vice-versa. While it doesn’t always exactly work out that way, a combination of the two has proved to be a good way of protecting the purchasing power of your savings over the last two decades.

“Including bonds in a portfolio may optically reduce the potential returns in relative terms – and it is difficult to argue that tying up your money at 1.9% for 10 years is a great opportunity. But they are also a good way of adding ballast to your equity portfolio by reducing volatility and likely its maximum potential fall.

“These are just two of the many reasons why it is important to take professional advice when it comes to building a portfolio, making sure it matches your financial objectives now, and in the years ahead.

“The bond market is significantly larger than the equity market, but it is less talked about. Many of the same rules apply when it comes to investing in bonds: one bond fund is like having one equity fund – we would never recommend it. It is also worth bearing in mind that there are different types of bonds and that is also reflected in their performance: inflation-linked bonds tend to be costly, while corporate bonds often perform like equities.

“For that reason, many bond funds are complementary to one another: one might offer less volatility, while the other may offer better scope for outperformance against its benchmark. Remember that the whole purpose of diversification is that covariance – or a low correlation – of asset classes can reduce risk of your portfolio.”

Passive bond fund options

iShares Global Inflation Linked Government Bond UCITS ETF – Rob Burgeman said: “The ETF replicates the performance of a broad basket of government bonds, with exposure to countries ranging from the US and Japan to the UK and Italy. With that comes a degree of currency risk, in that the majority of assets are not denominated in sterling.”

iShares Core UK Gilts UCITS ETF – Rob Burgeman said : “This ETF is completely UK-focussed and invests in a mix of long and short-dated gilts. It is very cheap at a cost of just 0.07% – but, with more than half of its bonds maturing after 10 years or more, it does come with a level of volatility.”

Active bond fund options

Allianz Strategic Bond Fund – Rob Burgeman said : “The strategic bond market is interesting, as the fund managers tend to have more scope for differentiation through their decision-making. They can invest in conventional, inflation-linked, high quality corporate, emerging market, or low quality corporate bonds as they see fit. The Allianz fund invests across this spectrum and has performed well over the long term, but has proven to be among the most volatile of its peers[1].”

Jupiter Strategic Bond Fund – Rob Burgeman said : “The Jupiter Strategic Bond Fund is a good foil for its Allianz equivalent. While it had delivered a lower total return over the last five years, it has also been much less volatile. It offers exposure to a mix of corporate and government debt – combined, around 90% of its holdings[2] – with some more esoteric products in its remaining 10%.”

Disclaimers:

The value of investments, and any income from them, can fall and you may get back less than you invested., Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance., Investment values may increase or decrease as a result of currency fluctuations., Information is provided only as an example and is not a recommendation to pursue a particular strategy., We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. In addition we reserve the right to act as principal or agent with regard to the sale or purchase of any security mentioned in this document. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk., Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness; Brewin Dolphin is authorised and regulated by the FCA (Financial Services Register reference number 124444)

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

NOTES TO EDITORS

About Brewin Dolphin

Brewin Dolphin is a UK FTSE 250 provider of discretionary wealth management. With £59.0* billion in total funds, we offer award-winning, personalised wealth management services that meet the varied needs of our clients including individuals, charities and corporates.

Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £52.0* billion on a discretionary basis.

Our intermediary business manages £19.0* billion of assets for over 1,700 advice firms either on a discretionary basis or via our Managed Portfolio Service, the MI Brewin Dolphin Voyager fund range and Sustainable MPS.

In line with the premium we place on personal relationships, we’ve built a network of 33 offices across the UK, Jersey and Republic of Ireland, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

For more information on the recommended cash acquisition of Brewin Dolphin by RBC Wealth Management announced on 31 March 2022, visit: https://www.brewin.co.uk/group/investor-relations

*as at 31st December 2021.

[1] Source: https://www.trustnet.com/factsheets/o/ti16/allianz-strategic-bond

[2] Source: https://www.trustnet.com/factsheets/o/09q3/jupiter-strategic-bond-i-acc

Disclaimer:

The value of investments can fall and you may get back less than you invested. RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444).