22 January 2021

A strong final quarter of 2020 saw shares in Scottish companies outperform the wider FTSE and AIM All Share indices, with the effects of the Covid-19 pandemic creating clear winners and losers from the crisis, according to analysis from Brewin Dolphin.

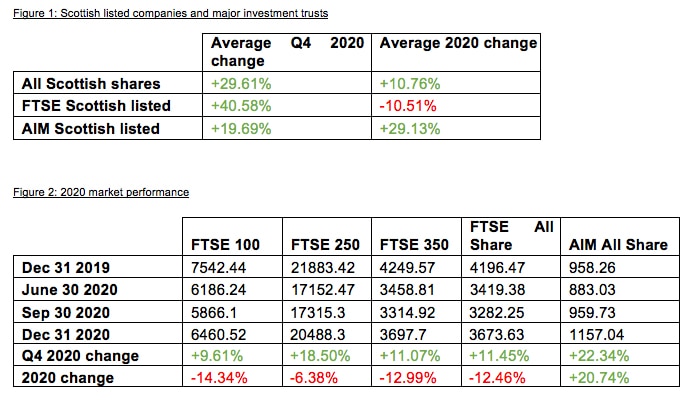

The wealth manager found that Scottish organisations on the AIM index saw their share price increase an average of +29.13% in 2020, while the wider index saw a +20.74% increase in value.

Meanwhile, Scottish shares on the FTSE averaged a share price loss of -10.51% in 2020, compared to -14.34%, -12.99% and -12.26% for the FTSE 100, FTSE 350, and FTSE All Share, respectively. The FTSE 250 registered a lower decline of -6.38% over the same period.

Shares in Scottish companies had previously lagged the FTSE indices, but following a +40.58% gain between October and December, they finished 2020 ahead of them all, with the exception of the FTSE 250.

Source: London Stock Exchange

[1] 1,2,3,4 and 5 year performance numbers can be found in the appendix

The year was a tale of polarisation for shares in Scottish businesses, with large gains for some offset by more widespread declines. Omega Diagnostics, the Alva-based life sciences company, saw its shares end the year up nearly +350% as it re-positioned itself to provide Covid-19 testing. However, the company’s shares fell nearly -18% between October and December and, earlier in 2020, had been up around +650% on the start of the year.

Braveheart Investment Group also saw its share price rise +180% in 2020, while Calnex, the telecommunications test and measurement company, saw its shares rise sharply following its initial public offering (IPO) at the beginning of the fourth quarter gaining nearly +150% by the end of 2020. Calnex’s IPO was Scotland’s first for around two years.

Meanwhile, from Scotland’s FTSE constituents, Scottish Mortgage Investment Trust finished the year with by far the largest gain at +110%, with the fund benefitting from the rising values of many of its technology holdings, including Tesla and Amazon.

Also reflecting wider investment trends and in particular their economic sensitivity, Scotland’s listed transport and financial companies were among the worst performing shares for the year. Stagecoach saw its value drop -54% during 2020, while John Menzies – the aviation services provider – and FirstGroup saw declines of -44% and -41% respectively.

NatWest (RBS) and Virgin Money (CYBG) also saw their shares finish the year down around -30%. However, all of these businesses saw their share prices sharply climb in the fourth quarter, with gains ranging from +58% (NatWest) to +131% (John Menzies).

John Moore, senior investment manager at Brewin Dolphin, said: “Shares in Scottish companies have reacted in much the same way as the wider markets, albeit with a level of amplification which reflects the smaller overall constituency and concentration that can come from this. Financial and energy companies were among the hardest hit by the effects of the pandemic and are disproportionately represented among Scotland’s FTSE constituents, which saw the average Scottish share price lag indices in the first half of 2020.

“However, we also saw the flipside of that towards the end of the year, when their share prices surged on the back of successful Covid-19 vaccinations, the US presidential election, and other macro factors. Still, while there are reasons to be optimistic, many of these companies remain challenged and the introduction of further lockdown measures are a reminder that there is still some way to go for many of them.

“Scottish Mortgage has ridden the tech wave over the last year, particularly buoyed by the substantial rise in the share prices of electric car makers Tesla and NIO. The trust provided a reminder to many investors that a combination of a permanent capital structure and a clear, long-term investment vision can win significant buy-in. Interest in Omega Diagnostics peaked with its signing of contracts with the UK Government – but concerns over the accuracy of its Covid-19 tests saw its share price drop in the second half of the year and work is required to rebuild confidence and maximise its opportunity. Calnex has performed exceptionally well since its IPO, underlining the benefits that can come from a public listing and the appetite for tech stocks – particularly with exposure to 5G.

“As an investment manager, we create portfolios that manage risk by providing exposure to a range of geographies and sectors, as well as themes that capture areas of growth within the global economy. Over the next 12 months we expect to see the polarisation that marked 2020 continue to take hold, while M&A in the UK should also maintain its momentum – Scottish companies could be among them, as we saw last year with Indigovision.”

–ENDS-

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel. +44 (0) 7412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel. +44 (0) 20 3201 3343

Siân Robertson: Sian.Robertson@brewin.co.uk / Tel: (0) 20 3201 3026

Anita Turland: anita.turland@brewin.co.uk / Tel: (0) 20 3201 4263

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

Disclaimers:

- The value of investments and any income from them can fall and you may get back less than you invested

- The opinions expressed in this document are not necessarily the views held throughout Brewin Dolphin Ltd.

- Past performance is not a guide to future performance

- We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. In addition we reserve the right to act as principal or agent with regard to the sale or purchase of any security mentioned in this document. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.

- This information is for illustrative purposes only and is not intended as investment advice.

- No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us.

- If your clients invest in currencies other than their own, fluctuations in currency value will mean that the value of their investment will move independently of the underlying asset.

- The information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

- Brewin Dolphin is authorised and regulated by the FCA (Financial Services Register reference number 124444)

About Brewin Dolphin

Brewin Dolphin is a UK FTSE 250 provider of discretionary wealth management. With £47.6 billion in total funds, it offers award-winning personalised wealth management services that meet the varied needs of our clients including individuals, charities and corporates.

We give clients security and wellbeing by helping them to protect and grow their wealth, in order to enrich their lives by achieving their goals and aspirations. Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £41.2* billion on a discretionary basis.

Our intermediary business manages £14.5* billion of assets for over 1,700 advice firms either on a discretionary basis or via our Managed Portfolio Service.

In line with the premium we place on personal relationships, we’ve built a network of 33 offices across the UK, Jersey and Dublin, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

*as at 30th September 2020