15 June 2020

It might be out of favour following the poor performance of some its highest-profile funds and managers, but value investing could still have a role to play for long-term investors according to Brewin Dolphin.

The wealth manager said that despite Mark Barnett’s recent departure from Invesco and criticism from some quarters of Warren Buffet’s move towards a more conservative investing style, no single approach was always the right fit for investors and a mixture of core, growth, and value underpinned the best outcomes.

Value funds typically look for under-priced or under-researched stocks, while growth funds focus on companies that will outperform their peers. A core approach is typically aware of market or benchmark construction and, thereafter, sits between the two poles, taking parts of both to balance out the extremes.

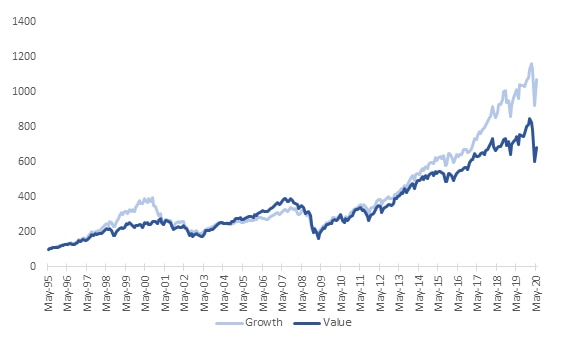

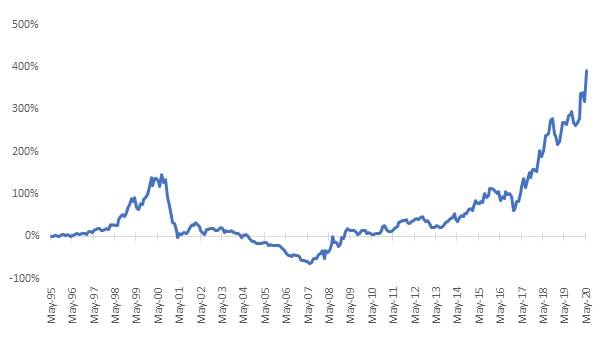

Data from Thomson Financial Datastream shows that value funds returned +624% since May 1995, compared to +1,072% from growth funds (chart 1). The Covid-19 crisis has created a greater divide between the performance of these two types of funds, rising to 448% in favour of growth companies (chart 2) – the widest gap over the 25-year period.

Total returns from growth vs value stocks

Source: Thomson Financial Datastream

% difference in total return between value and growth

Source: Thomson Financial Datastream

John Moore, senior investment manager at Brewin Dolphin, said: “There is little black and white about investing – our advice is always that a diverse portfolio of investments will balance out the risks involved in taking a single approach. While a value investor might pick up shares in a well-known bank, which look cheap on a price-to-earnings ratio, a growth investor may look more to a fintech company that is threatening to disrupt the entire industry. The latter approach, however, usually comes with more risk attached and, so, relies on a handful of winners to deliver outsize returns.

“As time goes by and businesses and sectors evolve, the categorisation may naturally shift: For example, Fever-Tree, was once an all-out, blue-sky growth stock, but is now far from it in many people’s eyes. The transition has led to a de-rating of valuation and expectation but does not mean that the business is finished as an investment proposition. Rather, it is moving to a different phase, as can perhaps be seen from the recent purchase by Nick Train.

“Similarly, value does not mean dead end, and, in certain situations, these companies also evolve. Take, for example, AstraZeneca: at the time Fever-Tree was debuting on the Stock market, the pharmaceuticals company was coming out of a period of flat performance for the previous 14 years – much comment at the time was on how shareholder return aspirations may sit around collecting the high dividend but not much growth. Now, in 2020, it is one of the best performing FTSE 100 stocks.

“However, the Covid-19 pandemic has created a new set of circumstances that turbo-charged the gradual changes that were coming in. There appears to be little to be gained in many of the stocks normally categorised as ‘value’ companies, and that has caught some investors out. It will force many value investors to re-think how they look at companies, but it should also force management to reconsider how they take the business forward too. The best value managers will engage and encourage this process.

“Traditionally, for value investors the focus has often been on the tangible assets on a company’s balance sheet, and how this relates to the economic cycle and current share prices. Growth investors, broadly speaking, have acknowledged the growing role of the intangible assets, focussing more on intellectual property and business agility. Optimism and an unbridled clarity about the future are typically found with such an investment style.

“Nevertheless, at times you need cyclicality and economic sensitivity in a portfolio – sometimes pessimism is misplaced. It is not that long ago that value investing outperformed a growth-oriented approach and, while it may not be any time soon, the same could happen again in the future.”

Growth funds:

Scottish Mortgage Investment Trust – Despite its name the trust has nothing to do with mortgages and invests globally, rather than in Scotland. Managed by James Anderson, it focusses on growth companies, with a handful of investments driving the majority of returns. Its top holdings include Tesla, the electric cars company; Chinese e-commerce giant, Alibaba; and Netflix, the home entertainment streaming platform1. John Moore said: “Scottish Mortgage is all about investing in businesses that challenge what the world will look like in the future. It is at the extreme end of growth investing, perhaps best encapsulated by its relatively large position in Tesla – a business many people struggle to value.”

Mid Wynd Investment Trust – Named after a street in Dundee, the Artemis-managed trust aims to deliver capital and income growth by selecting companies from across the world. Among its largest holdings are Thermo Fisher Scientific, the life sciences company; Citigroup, the US-based bank; and Microsoft. More than half of its exposure is to North America, with 16.5% focussed on Europe excluding the UK, and another 13.4% in Japan2. John Moore said: “Mid Wynd has one foot in some core stocks, but it is predominantly a growth fund. The managers haven’t been afraid to sell positions in companies such as Amazon to redeploy the proceeds in smaller businesses to help growth. The fund has held up well since the pandemic and looks well placed to remain robust.”

A core fund:

Liontrust Special Situations – Liontrust’s Special Situations fund looks for strong companies that will generate returns over the long-term. Its top holdings include well-known names such as the oil majors BP and Royal Dutch Shell, but it also includes companies such as RELX, the business data group. 18.9% of the fund is invested in companies listed on the Alternative Investment Market (AIM)3. John Moore said: “Liontrust Special Situations is a good blend of approaches, with some household names providing a base while smaller companies provide growth. It has the characteristics of a core fund, but with a slight edge in growth businesses and sectors.”

A value fund:

Threadneedle UK Equity Income –Threadneedle UK Equity Income looks for an income from under-researched, misunderstood or simply under-valued businesses. There is some balance to the value approach, with long-term holdings such as AstraZeneca and Rentokill helping those that have not done so well such as GlaxoSmithKline, 3i, Phoenix Life and Marks & Spencer. John Moore said: “Richard Colwell, the fund’s manager, has managed to maintain positioning to the value style and some of the more contrarian investments in the UK by balancing this approach with running winners, such as AstraZeneca and Rentokill. Whilst the value approach has made for a more difficult 2020 than the market, the approach has demonstrated value-added over a range of market conditions.”

1 Source: https://www.bailliegifford.com/en/uk/individual-investors/funds/scottish-mortgage-investment-trust/performance/portfolio/

2 Source: https://www.fundslibrary.co.uk/FundsLibrary.DataRetrieval/Documents.aspx/?type=packet_fund_class_doc_factsheet_private&id=0aac1f82-cc41-415c-8660-9e8cd4e66c35&user=b%2bWc7ibzxGwcLde%2fceiU2W70zdzo%2bCzbV0DHdC88wiNYomXmufF%2bVHAtnih%2bXcBq&r=1

3 Source: https://www.fundslibrary.co.uk/FundsLibrary.DataRetrieval/Documents.aspx/?type=packet_fund_class_doc_factsheet_private&id=f95c2d9f-06b9-4934-8691-841b67067397&user=dbcEJnDxaYRvy2dm90mxFM%2fLka56t3ulwtYTMtzsiLfxlzejn7xsMfcxUYvmYBOh&r=1

https://www.trustnet.com/factsheets/o/g7cj/threadneedle-uk-equity-income-z-inc-gbp

– ENDS –

Five-year discrete performance for value and growth:

PRESS INFORMATION

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

Anita Turland: anita.turland@brewin.co.uk / Tel: (0) 20 3201 4263

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

Disclaimers:

- The value of investments can fall, and you may get back less than you invested

- The opinions expressed in this document are not necessarily the views held throughout Brewin Dolphin Ltd.

- Past performance is not a guide to future performance

- This information is for illustrative purposes only and is not intended as investment advice.

- No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us.

- The information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

- We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. In addition, we reserve the right to act as principal or agent with regard to the sale or purchase of any security mentioned in this document. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk

- Please note that this document was prepared as a general guide only and does not constitute tax or legal advice. While we believe it to be correct at the time of writing, Brewin Dolphin is not a tax adviser and tax law is subject to frequent change. Tax treatment depends on your individual circumstances; therefore, you should not rely on this information without seeking professional advice from a qualified tax adviser

- Brewin Dolphin is authorised and regulated by the FCA (Financial Services Register reference number 124444)

About Brewin Dolphin

Brewin Dolphin is a UK FTSE 250 provider of discretionary wealth management. With £41.4* billion in total funds, it offers award-winning personalised wealth management services that meet the varied needs of our clients including individuals, charities and corporates.

We give clients security and wellbeing by helping them to protect and grow their wealth, in order to enrich their lives by achieving their goals and aspirations. Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £35.7* billion on a discretionary basis.

Our intermediary business manages £12.5* billion of assets for over 1,700 advice firms either on a discretionary basis or via our Managed Portfolio Service.

In line with the premium we place on personal relationships, we’ve built a network of 33 offices across the UK, Jersey and Dublin, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

*as at 31st March 2020