6 February 2017

Brewin Dolphin, one of the UK’s leading independently-owned wealth managers, is today launching a new passive portfolio range for IFAs, called MPS Passive Plus, to add to its successful Managed Portfolio Service (MPS).

The MPS Passive Plus range encompasses five core risk-rated models (cautious, income, balanced, growth and global equity). The asset allocation is set by Brewin Dolphin’s Asset Allocation Committee and the underlying funds are selected by the Group’s MPS Investment Committee. The five models are re-balanced monthly to ensure the asset allocations are updated to reflect key developments in the investment markets.

The ‘Plus’ element of the product refers to the fact that the team can allocate to active funds where they believe it would benefit the portfolio and passive funds might not offer effective replication e.g. in absolute return. Passive fund usage will vary over time, and by the five portfolios, but it is currently between 79% and 100%.

With the launch of its MPS Passive Plus service, Brewin Dolphin harnesses the benefits of passive investing, which is increasingly seen as an attractive, cost-effective and streamlined way for IFAs to manage their clients’ investment needs. The underlying TERs for the passive portfolio are between 0.12% and 0.30%.

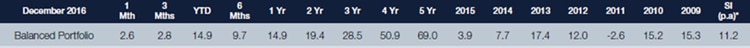

Brewin Dolphin is responding to the needs of advisers that are looking to outsource their investment decisions by further enhancing their MPS service. Brewin Dolphin was named the most used discretionary fund manager by IFAs (according to Defaqto’s 2016 survey). MPS assets under management have grown from £16m in September 2012 to £1,200m as at 30th September 2016 and have continued to grow. The MPS Balanced Portfolio has 1 year performance of 14.9%, 3 year performance of 28.5% and 5 year performance of 69%*.

Individual performance for the years 2009-2015 is also given below:

*All income is reinvested. Performance is shown inclusive of underlying fund charges but gross of Brewin Dolphin’s investment management charge. Deduction of this charge will have the result of reducing the illustrated performance. Performance is calculated through Morningstar direct and provided for illustrative purposes only and should not be viewed as the performance of a specific client account.

The cost advantages of MPS Passive Plus will be translated to the end-investor in terms of a lower overall fee structure levied at 0.2% plus VAT for Brewin Dolphin’s management charge. Both MPS and MPS Passive Plus have a low minimum investment of £2,000 across all platforms.

IFAs can now choose between Brewin Dolphin’s MPS Passive Plus, MPS and the full IFA bespoke discretionary service, dependent on the specific needs of their client. At all times, the end client relationship resides with the IFAs with Brewin Dolphin responsible for the investment management.

Gareth Johnson, Head of Brewin Dolphin’s Managed Investment Services, said: “The launch of Brewin Dolphin’s MPS Passive Plus range is good news for IFAs, as it will mean they can make another investment option accessible to a wider range of people. MPS Passive Plus will enable IFAs to choose the best possible investment strategy to fit with their clients’ expectations and investment needs.”

“Brewin Dolphin’s new MPS Passive Plus range gives IFAs the best of both worlds with us actively reviewing asset allocation but using underlying cheaper passive funds to get the relevant market exposure. We’ve also ensured that as they launched, the major third party risk ratings are available from inception to further assist advisers.”

Brewin Dolphin employs 17 regional based Business Development Managers to specifically service the IFA market.

Brewin Dolphin’s Managed Portfolio Service and MPS Passive Plus is available on Aegon, Ascentric, Aviva, Fusion James Hay, Novia, Nucleus, Standard Life, Transact and Zurich. In addition, performance figures are available via Defaqto Engage, FE DFM Transmission and Asset Risk Consultants (ARC). IFAs can use Distribution Technology, eValue, Finametrica and Synaptic for risk profiling.

The value of investments and any income from them can fall and you may get back less than you invested.

No investment is suitable in all cases. If you are unsure about the suitability of a particular investment please contact us for advice.

Past performance is not a guide to future performance. Performance is shown before charges which will have the effect of reducing the illustrated performance.

The opinions expressed in this document are not necessarily the views held throughout Brewin Dolphin Ltd.

PRESS INFORMATION

For further information, please contact:

Richard Janes richard.janes@brewin.co.uk Tel. +44 (0) 20 3201 3343

Payal Nair payal.nair@brewin.co.uk Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

About Brewin Dolphin

Brewin Dolphin is one of the UK’s leading independently-owned providers of discretionary wealth management. With £36.4* billion in funds under management, we offer award-winning personalised wealth management services that meet the varied needs of over 100,000 account holders, including individuals, charities and pension funds.

We give clients security and well-being by helping them to protect and grow their wealth, in order to enrich their lives by achieving their goals and aspirations. Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £30.1* billion on a discretionary basis.

In line with the premium we place on personal relationships, we’ve built a network of 28 offices across the UK, Channel Islands and Ireland, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

We are proud of our success and have the vision and ambition to grow into the UK’s leading provider of discretionary wealth management. We were awarded a 5 star Defaqto 2016 rating for DFM Managed Portfolio, the City of London Wealth Management Awards for Best Discretionary Service Award 2015 and the Portfolio Adviser Gold Award for Best Cautious Portfolio Manager 2015 – Large Firm. We are committed to building on our strong track record and delivering continued value to both our clients and shareholders.

*as of 31 December 2016