15 April 2013

Nearly thirty years on from the first privatisation – time to revive Thatcher’s remarkable legacy

Some privatisations are still anticipated today and should again present opportunities for investors. The opportunities to buy shares at a discount, the scope for rapid growth following flotation and the chance of premium takeover bids from larger firms, all contribute to potentially profitable outcomes.

In 2008, the economist Adam Smith in his report “Privatization – Reviving the Momentum” estimated that the government could raise as much as £20bn then from privatisation, with candidates including; the Royal Mail, Channel 4, BBC Worldwide, Scottish Water, Northern Ireland Water, and the National Air Traffic Control System.

Other options for raising funds open to the government today would be the sale of its stake in; Royal Bank of Scotland, Lloyds Banking Group, following the rescue packages undertaken during the credit crunch. The Conservatives are in favour of crystallising value from these banking holdings, with George Osborne suggesting that the government could raise funds by selling its £70bn stake in RBS and Lloyds in the form of discounted shares.

In the 1980s, Margaret Thatcher’s Government successfully developed the policy of selling nationalised industries into private ownership, or privatisation as it became known. However back then the notion of selling national assets to the public was largely untested and there was uncertainty whether the public would support the issues. There were concerns that private investors would not participate extensively in the offerings, leaving large institutional investors to pick up the shares at heavily deflated prices.

Thankfully this was not the case. In 1984, BT was the first well known public sector company to be sold and private investors welcomed the offer. More than two million people participated; keen to purchase the discounted shares offered at a price of 130p.

This success paved the way for further privatisations during the 80’s and early 90s, the majority of which were floated successfully. The wave of sell offs presented opportunities for investors, the question is now, how profitable were these issues to the investors that backed them?

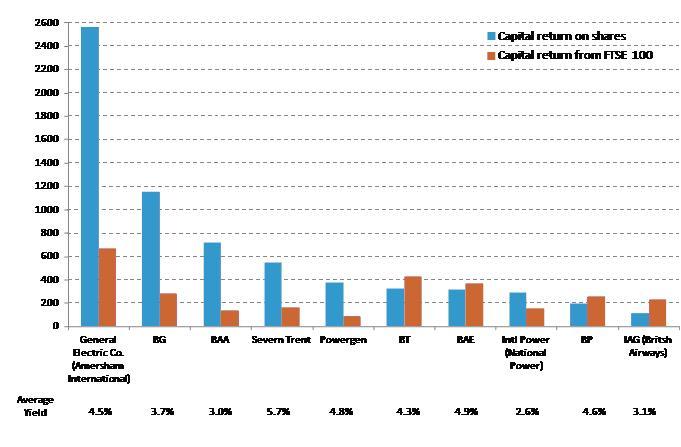

We have calculated the returns of a cross section of the most well known privatisations since floatation and compared them to the FTSE 100 over the same period. In the large majority of cases returns were in excess of the benchmark and in some cases out-performance was considerably more.

Source – Brewin Dolphin

[Returns are calculated assuming a buy and hold strategy and are based on a capital return basis, which excludes dividends. Holdings have been adjusted for corporate actions and merger and takeover activity. The returns assume shareholders held on to shares in demerged companies, and took all rights issues in cash. Where a takeover has occurred, returns include the cash value for the bid.]

This performance is impressive when you consider the renowned underinvestment in assets prior to privatisation, and the higher levels of staffing at the time of flotation. However, while not actually given away, they were deeply discounted floats and when the companies were exposed to the full force of competition; they certainly improved their performance, resulting in very rapid growth from a low base.

In the majority of cases returns were good with significant out-performance. Investments from six out of nine privatisations out-performed the FTSE 100. Furthermore, many of the companies have an average dividend yield exceeding that of FTSE, therefore including income from dividends would have enhanced relative performance.

Particularly profitable privatisations were General Electric (Amersham International) and British Gas, which was memorably sold to “Sid” in 1986. An investment of £100 in British Gas would now be worth £1,246, an increase of 1146% and that is not including any dividends and Amersham International shares doubled that return.

Strong management assisted in transforming British Gas into a global integrated Oil & Gas company and investors have reaped the rewards. British Gas has had a series of corporate restructurings; in 1997 Centrica was demerged, and in 2000 Lattice was spun out and was later bought by National Grid. This has enabled investors to benefit from the outperformance of two of the UK’s largest utilities, Centrica and National Grid, which contributed to the staggering overall returns.

Many of the other privatised UK electricity, gas and water companies also performed well and have been taken over by larger European utilities, or infrastructure funds resulting in investors receiving cash, usually on a premium valuation.

Investments in Severn Trent, Powergen and National Power would all have outperformed the market.

However, a buy and hold strategy for the duration would not have worked on all stocks, with the relative return from BT the most disappointing. An investment of £100 in BT at IPO would have been worth £113 at the end of 2011, although the shares did rise to over £10 during the dot-com boom.

Investors would have also underperformed the market had they participated in the British Airways float. Poor relative performance would have been made worse by the below market dividend yield. Why the underperformance? In contrast to British Gas, British Airways faced stiff competition from the industry. The swath of low budget airlines entering the market has restricted the potential for growth. Also British Airways has been troubled by their historically high cost base, left over from their state ownership days. Staff costs are still some of the highest in the industry.

-ENDS-

The value of investments can fall and you may get back less than you invested.

No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us.

Past performance is not a guide to future performance.

Any tax allowances or thresholds mentioned are based on personal circumstances and current legislation which is subject to change.

The opinions expressed in this article are not necessarily the views held throughout Brewin Dolphin Ltd. No Director, representative or employee of Brewin Dolphin Ltd accepts liability for any direct or consequential loss arising from the use of this document or its contents.

For further information please contact the Press Office on 020 3201 3026