26 October 2011

With the dramatic highs and lows in the global stock markets, it is incredible how stable the income returns from equities have been. Against a backdrop of historically low interest rates and inflation, Rob Burgeman, a Director of Investment Management at Brewin Dolphin discusses the merits of a balanced portfolio when trying to retain income levels.

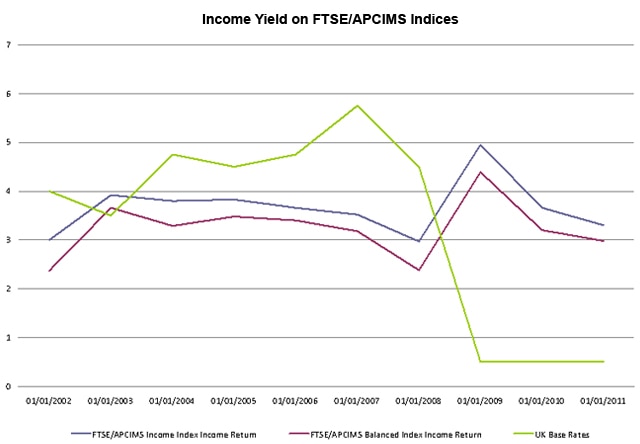

Research carried out by Rob at Brewin Dolphin has produced some interesting data (see table below), which adds to the debate. Key findings include:

- Income returns have been surprisingly consistent over the last ten years

- Well constructed and diversified portfolios deliver decent capital growth and a stable income stream

- Portfolios not constructed for ‘income at any cost’

- Value of the APCIMS indices as a benchmark over FTSE 100

Looking at data using the Indices produced by APCIMS, the Association of Private Client Investment Managers and Stockbrokers, and FTSE, we have looked at the consistency of income returns over the last ten years. The FTSE/APCIMS Indices are designed to represent the reality of the way in which a portfolio might be constructed. So, for example, the Income Index consists of 35% in UK Government Bonds, 40% in UK Shares, 15% in International Shares and 10% in Cash and other Alternative Investments (such as Commercial Property and Hedge Funds). The FTSE/APCIMS Balanced Portfolio Index consists of 20% in UK Government Bonds, 42.5% in UK Shares, 25% in International Shares and 12.5% in Cash and other Alternative Investments.

These are clearly far more representative benchmarks than, say, the FTSE-100 Index and also reflect our belief that all investors should have suitably diversified portfolios.

One of the most important things to look at when establishing portfolios is how long one’s time frame is. By their nature, equity and bond markets are inherently more volatile than cash deposits where, subject to the financial stability of the institution, your capital is safe. They are, accordingly, not suitable for investors who have a short time frame and who may need access to the capital.

However, for those who have the capacity to take a longer term view, a well constructed portfolio of assets can deliver decent returns and, as importantly, a stable income stream. Data for the last ten years – hardly a vintage period for stock market returns – show how this long term approach pays – if you will pardon the pun – dividends.

| FT APCIMS Income Index | FT APCIMS Balanced Index |

| |||

| Total Return | Income Return | Total Return | Income Return | UK Base Rate | |

| 2002 | -9.8% | 3.0% | -16.0% | 2.4% | 4.0% |

| 2003 | 10.5% | 3.9% | 14.7% | 3.7% | 3.5% |

| 2004 | 7.8% | 3.8% | 8.3% | 3.3% | 4.8% |

| 2005 | 13.4% | 3.8% | 15.9% | 3.5% | 4.5% |

| 2006 | 11.9% | 3.7% | 14.7% | 3.4% | 4.8% |

| 2007 | 7.5% | 3.5% | 9.9% | 3.2% | 5.8% |

| 2008 | -21.2% | 3.0% | -26.3% | 2.4% | 4.5% |

| 2009 | 24.5% | 5.0% | 26.8% | 4.4% | 0.5% |

| 2010 | 9.4% | 3.7% | 9.7% | 3.2% | 0.5% |

| 2011 | 2.3% | 3.3% | 1.2% | 3.0% | 0.5% |

|

|

|

|

|

| |

| 5.6% | 3.7% | 5.9% | 3.2% | 3.3% | |

| Average | Average | Average | Average | Average | |

As pointed out above, what is particularly interesting is the relative consistency of income returns over this period, particularly over a period in which interest rates have collapsed. It is also worth pointing out that this also covers a period in which dividends from the banking sector (which in mid 2007 represented more than 26% of the yield on the FTSE 100 Index) have also collapsed.

It is interesting that this is not an “income at any cost” portfolio, but rather a well constructed and diverse list of investments. There are many blue chip equities that have delivered phenomenal growth in their dividends over the last few years against a difficult economic backdrop. Consider Glaxo SmithKline, the pharmaceutical company as case in point, where the dividends have risen from 43.33p per share per year in 2002 to 74.44p this year. Income orientated unit and investment trusts have also proved to be useful investments. Investment Trusts have the advantage that they establish reserves in the good years that enable them to smooth the income flow, while unit trusts are restricted to distributing the income that they receive. The final chart highlights how simply picking one share can have severe implications for the income seeking investor. During the banking crisis of 2008, Barclays was forced to suspend dividend payments altogether and are only now resuming payments. BP, too, was forced to suspend payments after the Gulf incident.

This highlights why, when constructing income portfolios, diversification is key. Putting all one’s eggs in one or two baskets is a dangerous course of action. However, a well balanced approach can pay dividends, over the longer term.

-ENDS-

The opinions expressed in this document do not necessarily represent the views held throughout Brewin Dolphin Ltd. No Director, representative or employee of Brewin Dolphin Ltd. accepts liability for any direct or consequential loss arising from the use of this document or its contents.

The value of your investment may fall and you may get back less than you invested. Past performance is not an indication of future performance.

For further information please call the Brewin Dolphin Press Office 0203 201 3026 or Rob Burgeman on 0203 201 3772