Banks evolving from casinos to utilities should make for a stronger and more stable sector

News & comments21 October 2014

James Box, Equity Analyst at Brewin Dolphin looks at the type of investments banks represent today

Britain’s banks are slowly evolving to become more like utilities, characterised by low growth and more consistent returns on capital.

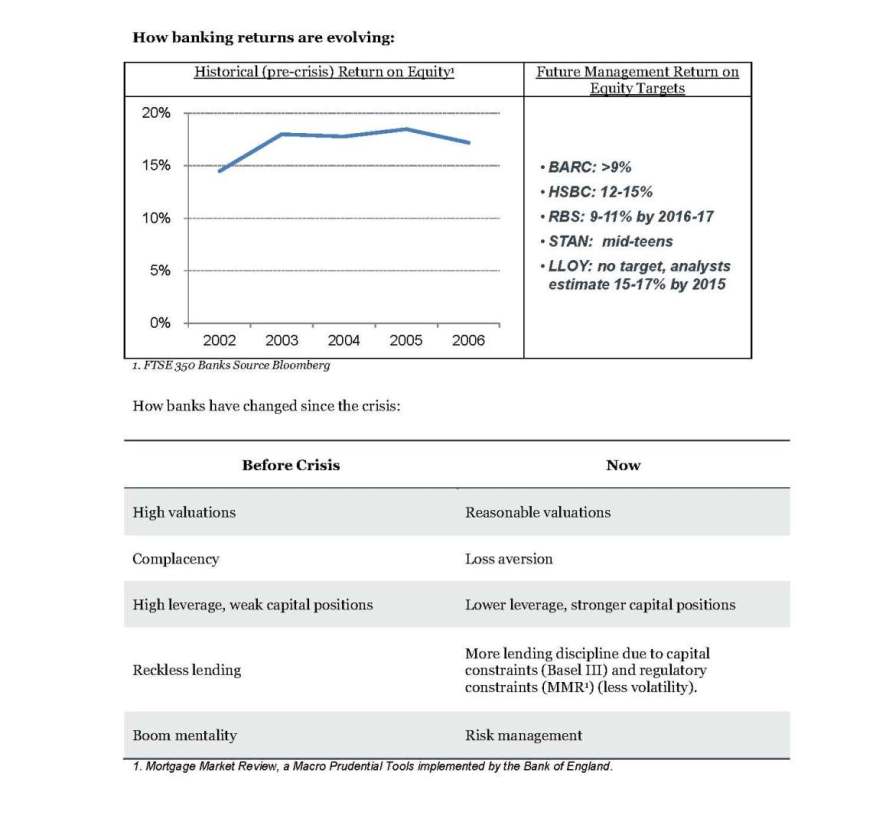

The group’s banking expert says that as the sector is now more tightly regulated, it is likely to generate lower returns on capital than it did before the banking crisis.

“Despite the broadly lower headline returns, we welcome this evolution of British banks as they begin to share some of the characteristics commonly associated with investing in utilities. This is likely to make banking a stronger and more stable sector for investment,” said James Box.

Customer centric, low cost players are likely to be the long term winners, Box suggests. A cost advantage allows more optionality and more flexibility in pricing products. We also prefer banks that provide simple products and therefore have relatively transparent balance sheets.

James favours banks with conservative management teams that are incentivised to manage for risk and return rather than growth, and is cautious about banks that have large growth aspirations. He suggests banks can easily grow but that the associated risks can take a while to transpire. He adds that fines for misconduct are not necessarily being determined on the basis of a bank’s ability to pay but are based on the size and scale of the misdemeanour.

“One way of avoiding legacy risks altogether is to invest in the challenger banks, some of which are in the process of seeking a stock exchange listing, such as Aldermore and Virgin”.

Though memories of the 2008 financial crisis and its aftermath remain vivid, it is important to be mindful of availability bias and careful not to fight the last war. The banking industry has changed for the better since 2007.

Box concludes; “the current attitude towards banking is a classic case of ‘once bitten, twice shy’. Tobacco companies faced a number of similar headwinds in the 1990s in relation to law suits and have subsequently prospered. Perhaps this tobacco analogy is wishful thinking – cigarettes are repeat purchase products with high barriers to entry. Nevertheless, if banks are evolving from casinos to utilities, investing in the sector is less likely to make investors rich but rather help them stay rich.”

-ENDS-

For further information please contact the press office on 020 3201 3330

The value of investments can fall and you may get back less than you invested.

No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us

Past performance is not a guide to future performance.