10 June 2025

Even a moderate market fall in the first year of decumulation can make a significant difference over time

The benefits of gradually investing over time to build wealth and smooth out periods of volatility are well known, in a process known as ‘pound-cost averaging’, but the impact timing can have on the withdrawal of that money may come as a surprise.

Insights from RBC Brewin Dolphin, the wealth manager, show that what happens in the first years of retirement could have a significant impact on the longevity of a pension pot or other form of savings.

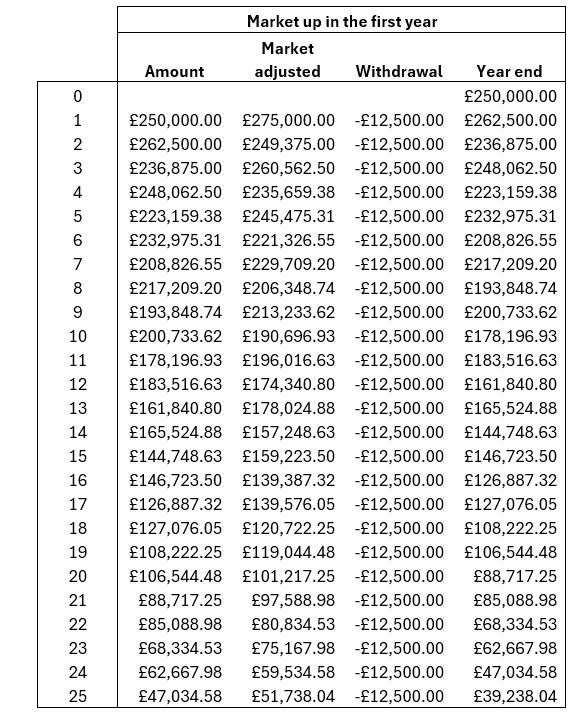

Assuming markets rise 10% and fall -5% in alternating years over 25 years – averaging out at an annual return of 5.23%, net of any costs or investment fees – and making 5% withdrawals of the original sum every year (£12,500), a retiree with a £250,000 fund could expect to still have £39,238 by the end of that period. That is equivalent to more than three years’ worth of further withdrawals.

Figure 1: What’s left after 25 years of 5% withdrawals from retirement pots

| £100k | £250k | £500k | |

| First year up | £15,695.22 | £39,238.04 | £78,476.08 |

| First year down | £1,855.02 | £4,637.55 | £9,275.09 |

| Difference | £13,840.20 | £34,600.49 | £69,200.99 |

Source: RBC Brewin Dolphin

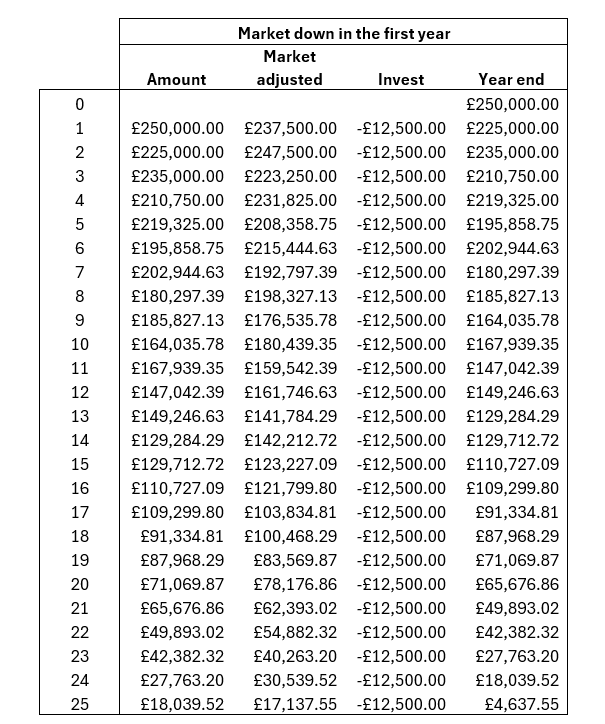

Crucially, however, that assumes the value of the assets held in the pension pot rise in the first year of retirement. If it were to drop by -5% – and follow the same pattern of rising 10% and falling -5% in subsequent years – the amount left a quarter of a century later would be a much smaller £4,637, or not even half of a single year’s withdrawal amount.

The same is true regardless of the size of the pot. A £100,000 retirement fund could be diminished to £1,855 by its 25th year following a -5% in the first 12 months, compared to £15,695 if markets were to rise. For those fortunate enough to have £500,000 saved up, the difference is £69,200 (£78,476 compared to £9,275).

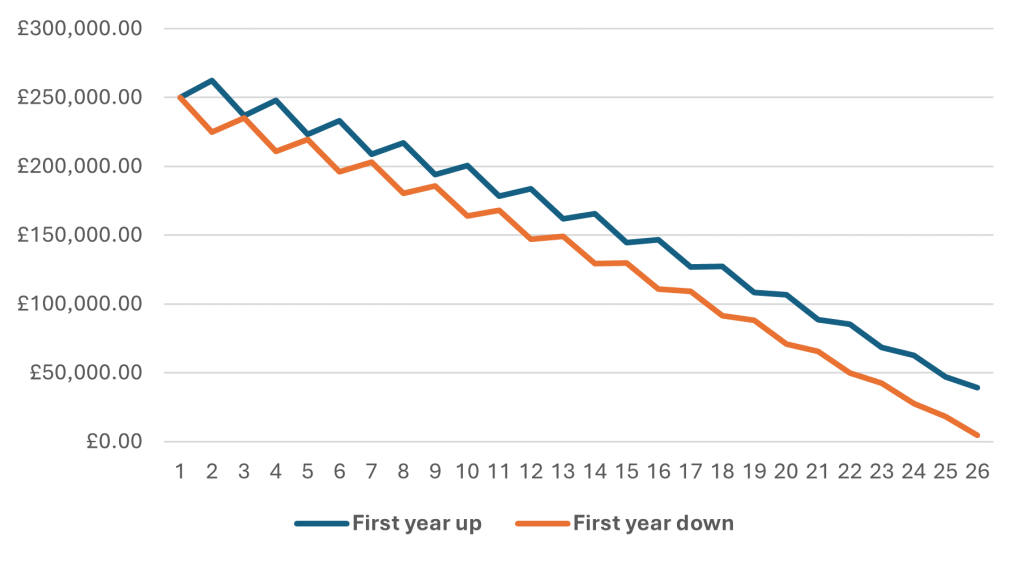

Chart 1: Withdrawing £12,500 from a £250,000 retirement pot over 25 years

Source: RBC Brewin Dolphin

Rob Burgeman, wealth manager at RBC Brewin Dolphin, said: “Most people will have heard about the benefits of pound-cost averaging – investing over time to take the edge off market volatility and gradually build wealth. What they may be less familiar with is pound-cost ‘ravaging’, which demonstrates how taking money out at the wrong times can have a big impact on your retirement pot in the long term.

“If markets fall in the first year, it can create a hole in your retirement plan that only grows over time. But that example is merely illustrative of a much wider point – if the value of your investments declines over an extended period, the effects will be amplified because you have to sell more of your assets to maintain your withdrawal amount. And that runs the risk of leaving you short towards the end of retirement.

“Markets do not move in straight lines. A bad first couple of years can make all the difference, which people retiring in 2007 or 2019 may have been unfortunate enough to find out. And if you had retired in 1999, the three-year bear market that followed may have scuppered your plans altogether. Once retired, market conditions become really important to you and the adage about time in the market is still important, but has a different relevance.

“Scenarios like this are why having a financial plan, and taking professional advice, can make a significant difference to your retirement. This will allow you to take steps, such as keeping a year or two of cash aside, to build in flexibility and avoid making withdrawals when markets are down, ensuring your savings last as long as they possibly can.”

– ENDS –

Disclaimers

The value of investments can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

Figures relevant to Chart 1:

PRESS INFORMATION

For further information, please contact:

Peter McFarlane, Syncopated Comms, PR Consultant, Tel: 07412 739 093

Siân Robertson Sian.Robertson@brewin.co.uk / Tel: +44 (0) 20 3201 3026

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.6bn* billion in assets under management, it offers award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Its qualified investment managers and financial planners are based in over 30 offices across the UK, Jersey and Republic of Ireland, with a commitment to high standards of client service, long-term thinking and absolute focus on clients’ needs at the core.

As part of Royal Bank of Canada (RBC), RBC Brewin Dolphin is now able to draw on the strength of a global financial institution to enhance the services it provides to clients and to drive further innovation across the business.

*as at 31st October 2024.

Disclaimer

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence.