5 February 2021

Despite a rally in shares from the most hard-pressed sectors following the development of successful Covid-19 vaccinations, the gap between these stocks and their more glamorous ‘growth’ counterparts has remained as wide as it has ever been, according to Brewin Dolphin.

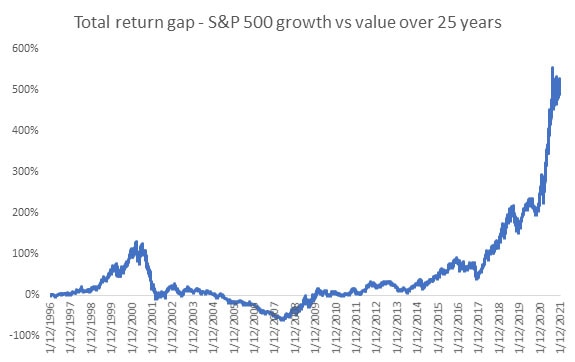

The wealth manager’s analysis found that the difference in total returns – capital gain and dividend income combined – from value and growth shares on the S&P 500 over the past 25 years remained at around the 500% mark. The returns gap more than doubled in 2020, from 219% on January 1st to 523% by the end of the year.

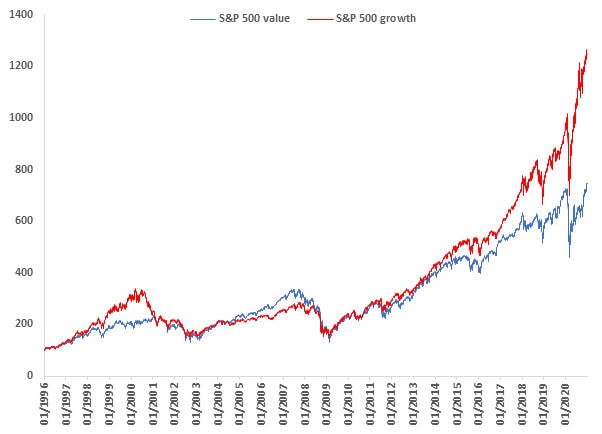

Growth’s total returns advantage over value peaked at 534% in November 2020 and briefly hit 523% in January this year before falling closer to 500%. Over 25 years, value stocks delivered a total return of +648% compared to +1,146% for growth.

Value stocks are typically categorised as under-priced or under-researched publicly-listed companies, while their growth counterparts are more likely to outperform their peers through expansion and scale.

Source: Thomson Financial Datastream

Source: Thomson Financial Datastream

Rob Burgeman, senior investment manager at Brewin Dolphin, said: “The pace of change since the turn of the millennium has increased dramatically. The Covid-19 pandemic has been a hugely disruptive event from that perspective, only serving to intensify this process even further. The speed of delivery of vaccinations is, perhaps, emblematic of that fact. Companies like Zoom have burst onto the scene and made mainstream what was largely only a theoretical area of growth just months before. Even here, Microsoft has come along and offered a competitive alternative in the form of Teams. Leadership does not last long.

“Value indices and funds tend to be a mish-mash of different types of companies. Some of them are cyclically depressed and it seems likely that their current situation will be temporary – for example, hotels and airline operators are still some way off previous valuations, but it is likely that people will use their services again in the future. Other companies may be in more structurally-challenged areas – for instance, those with large exposure to the decline of the high street. After all, some shares are cheap for a good reason and the majority of companies do not endure forever.

Still a place for value stocks

“Nevertheless, there is still a place for value stocks in well-diversified portfolios. While value has lagged growth, there will be a switch back at some point – it wasn’t that long ago that stocks classified as value outperformed their growth peers. As governments look to boost economic activity, there could be an upturn in fortunes for sectors such as infrastructure, construction, and materials – many of the constituent companies within these sectors would be considered value stocks.

“However, it seems unlikely that there will be a sea change, with value making a more meaningful and permanent period of outperformance – the world is a very different place now. For UK investors, this is an important point to consider. The main FTSE indices are, largely speaking, classic value plays, heavily made up as they are of financials, oil and gas, and miners. There are a few notable exceptions to that rule; but, typically, technology companies – in their broadest sense – have looked to the US to raise money and, therefore, its stock markets have greater exposure to growth industries.

Why value should matter to growth investors

“Of course, value matters to growth investors as well – they want to get the stocks at the right price and recycle profits into new positions when the time is right. We have seen that recently with Baillie Gifford, which began selling Amazon shares in its Scottish Mortgage Investment Trust last year. The move underlines the fact that the categorisation of stocks under these two labels is not always a straightforward process and companies can move from one to the other over time.

“A good investment manager will ensure that you have suitable exposure to different types of stocks that match your financial goals and appetite for risk. The trick is to take a balanced approach, blending different investments together however they are classified. This diversification might dilute returns if one particular sector or company goes on a strong run, but it also reduces the possible downside when you get a sudden swing in sentiment in stock markets.”

Source: Thomson Financial Datastream

– ENDS –

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel. +44 (0)7412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel. +44 (0) 20 3201 3343

Siân Robertson: Sian.Robertson@brewin.co.uk / Tel: (0) 20 3201 3026

Anita Turland: anita.turland@brewin.co.uk / Tel: (0) 20 3201 4263

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested., Neither simulated nor actual past performance are reliable indicators of future performance., Investment values may increase or decrease as a result of currency fluctuations., Information is provided only as an example and is not a recommendation to pursue a particular strategy., We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. In addition we reserve the right to act as principal or agent with regard to the sale or purchase of any security mentioned in this document. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk., Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

About Brewin Dolphin

Brewin Dolphin is a UK FTSE 250 provider of discretionary wealth management. With £51.4* billion in total funds, it offers award-winning personalised wealth management services that meet the varied needs of our clients including individuals, charities and corporates.

We give clients security and wellbeing by helping them to protect and grow their wealth, in order to enrich their lives by achieving their goals and aspirations. Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £44.6* billion on a discretionary basis.

Our intermediary business manages £15.8* billion of assets for over 1,700 advice firms either on a discretionary basis or via our Managed Portfolio Service.

In line with the premium we place on personal relationships, we’ve built a network of 34 offices across the UK, Jersey and Dublin, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

For more information, visit: www.brewin.co.uk

*as at 31st December 2020