14 July 2023

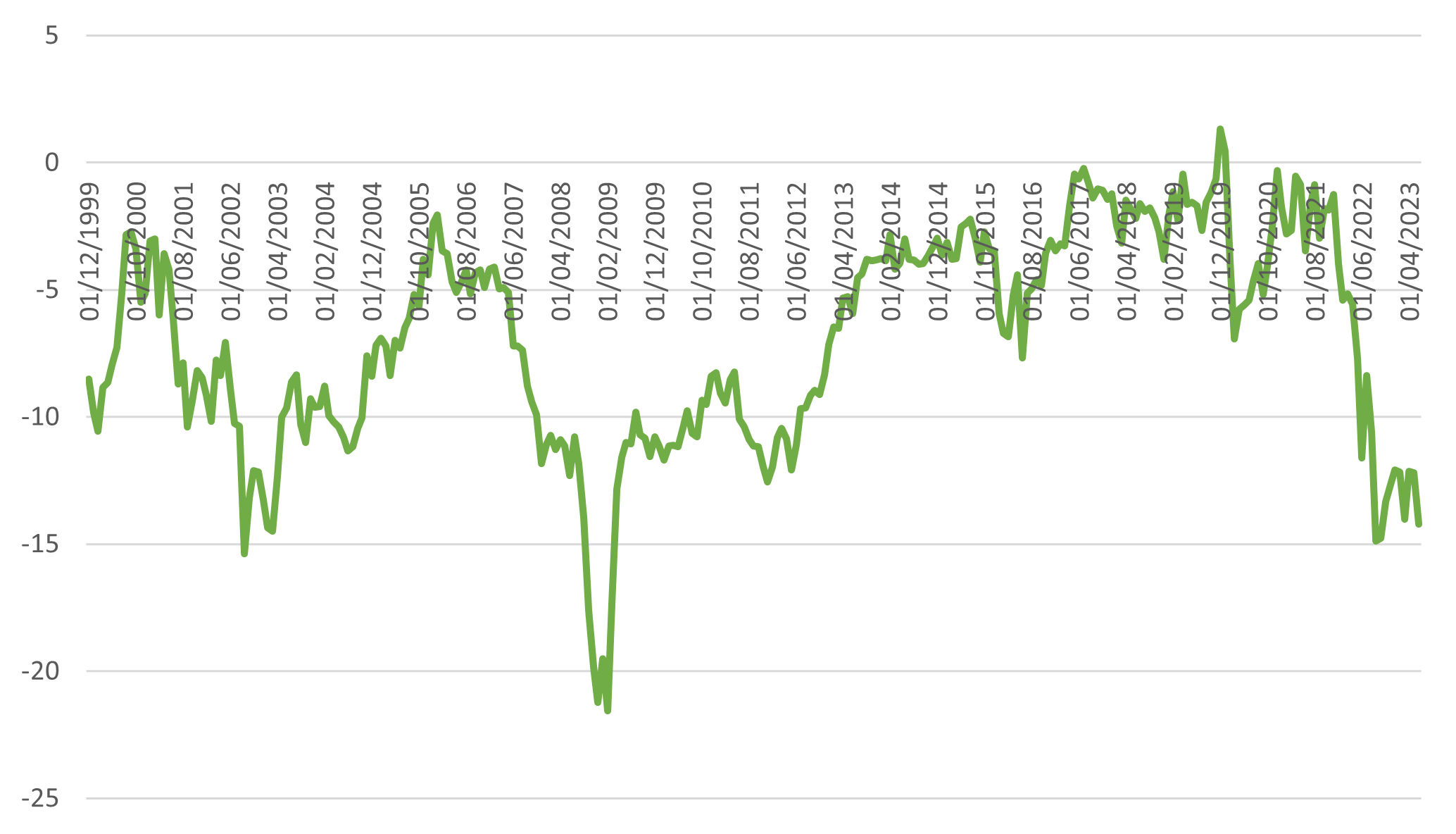

The average discount available on UK-listed closed-ended investment vehicles has grown to its highest level since 2009, according to RBC Brewin Dolphin.

The wealth manager’s analysis of data from the Association of Investment Companies (AIC) suggests 388 of the 402 companies registered currently trade at a discount to their net asset value (NAV). The average share price discount to NAV is -14.23, according to data from Datastream.

Investment trusts’ share prices are often different to their NAV – a valuation of the underlying assets they hold. If the share price trades at a ‘premium’ – or higher than NAV – it indicates more investors are willing to buy than sell. The reverse is true if the trust is trading at a ‘discount’.

Of the AIC’s main sectors (those with more than five trusts registered), ‘growth capital’ trades at the largest discount to NAV at -46.96%. UK residential property trusts trade at a similar discount of -46.38%, while private equity’s 18 trusts trade at an average discount of -28.91%.

Average UK investment trust percentage discount/premium to NAV 2000-2023:

Source: Datastream

John Moore, senior investment manager at RBC Brewin Dolphin, said: “Since 2010, the investment trust industry has changed beyond recognition. When interest rates were below 1%, income-producing assets that were not normally a part of the stock market started to be brought in – particularly in areas like infrastructure, leasing, debt, and venture capital. These sectors were an attractive proposition when you could get 5% income, when the base interest rate was 0.5%.

“That has all changed with interest rates rising. Now, you can get a similar level of income in your bank account risk-free and so many investors have decided to cut their risk exposure and sell, leading to a large derating in share prices and pushing many trusts to large discounts.

“But, there is an element of throwing the baby out with the bathwater. There is still a constituency of very high-quality trusts that investors should stick with or even see as a buying opportunity in the current circumstances – particularly where they consist of top-tier infrastructure assets, offering high yields and a degree of RPI-linkage.”

Investment trusts to stick with:

HICL Infrastructure – -25.67% discount to NAV

John Moore said: “HICL manages an international portfolio of investments in infrastructure, largely focussed on Europe but with some exposure to North America and New Zealand. Its assets are spread across the education, utilities, and health sectors, among others, including hospitals, government property, and schools.”

3i Infrastructure – -16.39% discount to NAV

John Moore said: “3i Infrastructure is another high-quality infrastructure-focussed investment trust. You can also gain exposure to it through its parent company 3i, which is now the largest investment trust in the UK. 3i Infrastructure invests in companies with exposure to areas like energy transition, transport and logistics, and digitalisation, with assets across Europe and Singapore.”

Greencoat UK Wind – -18.19% discount to NAV

John Moore said: “Greencoat UK Wind does exactly what it says on the tin: it invests in UK wind farms. The trust’s stated aim is to increase its annual dividend in line with inflation, which is an attractive proposition in the current circumstances. It has a strong track record and invests in some of the UK’s largest wind energy assets.”

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office; 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 365 3456 40.

– ENDS –

John Moore and his fellow investment managers at RBC Brewin Dolphin put together bespoke investment portfolios for clients based on their long-term objectives and their attitude to risk. The portfolios will have a mixture of hand-picked holdings in them including third party funds and individual stocks that are researched and recommended by RBC Brewin Dolphin’s in-house research team.

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £53.8* billion in assets under management, we offer award-winning, personalised wealth management services from bespoke, discretionary investment management to retirement planning and tax-efficient investing.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 30th April 2023.

Disclaimers

The value of investments can fall and you may get back less than you invested. RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number:GB 365 3456 40.