22 July 2023

RBC Brewin Dolphin analysis suggests they don’t necessarily lead to better performance

Long equity funds with performance fees have generally underperformed their markets, but they may be worth the extra cost in certain regions, according to analysis by RBC Brewin Dolphin.

Research from the wealth manager on long-only equity funds found that, in the majority of cases, funds with performance fees attached to them underperformed their respective markets. Performance fees are typically associated with hedge funds and absolute return funds, but some managers do tend to employ them on their more traditional investment products.

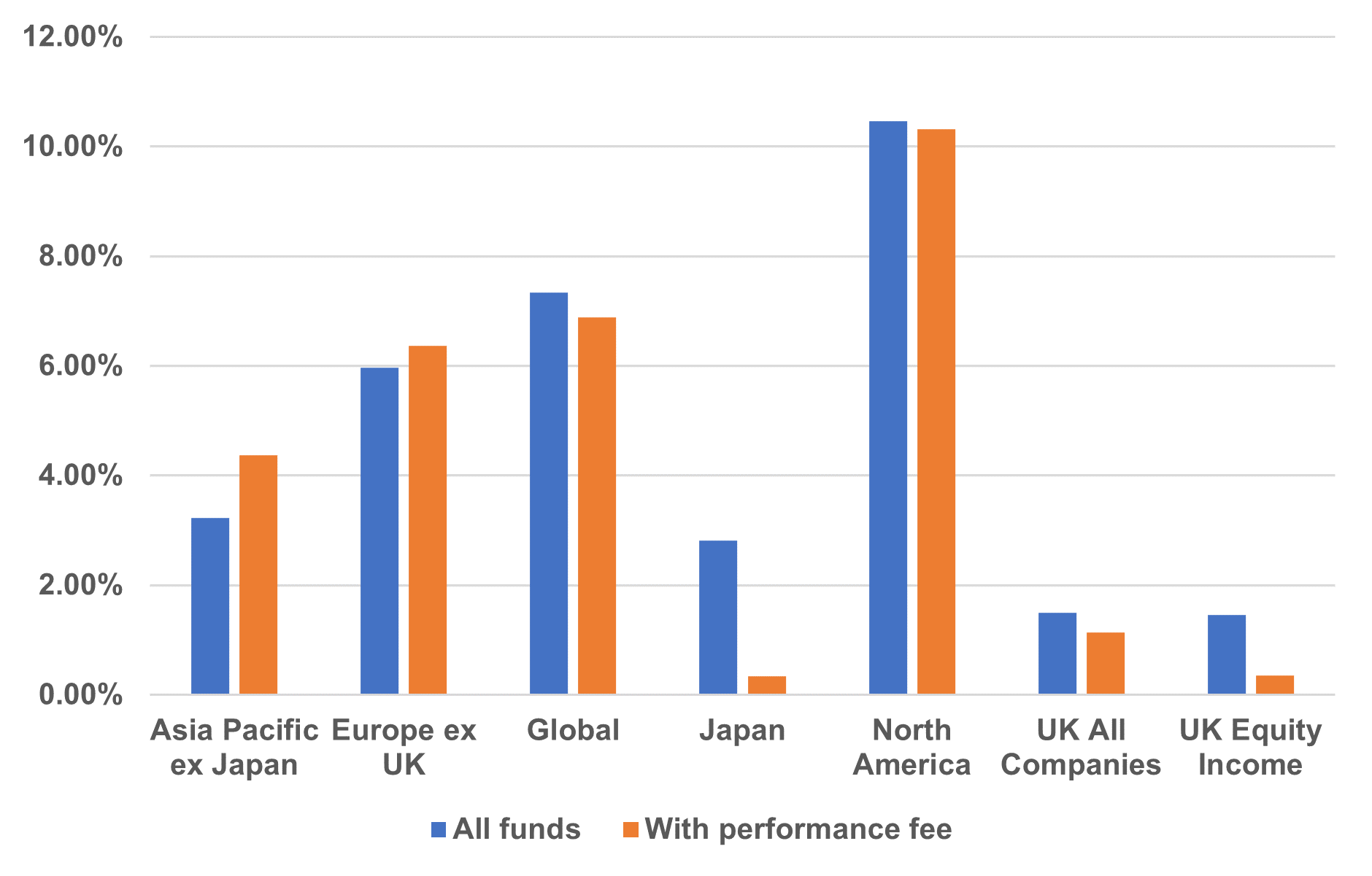

The average annualised return from global, Japan, North America, UK all companies, and UK equity income funds with performance fees failed to keep pace with their peers. The biggest difference in performance was Japan. Funds with performance-related fees delivered an average annual return of just 0.34% compared to 2.81% for all 66 Japanese funds.

However, the story was different in Asia Pacific, excluding Japan, and mainland Europe. Funds in Asia Pacific with a performance fee delivered an average annualised return of 4.37% compared to a sector average of 3.22%, while European funds with a performance fee returned an average of 6.37% against 5.96% for the overall market.

Table 1: Average annualised returns over five years from long-only funds

Source: Datastream

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “A bit like with active management, there are certain regions where it is worthwhile considering funds with a performance fee and others where it is not. In markets like North America it is notoriously difficult to consistently outperform the benchmark indices, which is one of the reasons why there are so few bothering to attach a fee and passives have grown in popularity.

“It also underlines why it’s so important to understand what you’re paying for with a performance fee. There absolutely should be a high watermark – in other words, the fund’s returns must meet its performance threshold over a set period of time, so any underperformance must be earned back first before any performance fee is charged -– or it is simply not worthwhile. A good example is Pershing Square, which comes with a 10% performance fee, but it has delivered you a return of more than 100% over five years, which is a lot more than a comparable passive.

“The key question is, does the fund offer something different? It should really only be considered where there are specific strategies or the fund offers exposure to specialist areas. In those instances, it might even be a good thing and align managers’ and investors’ interests. The other side of the coin is that it may also encourage managers to take excessive risk if the right checks and balances are not in place.

“Either way, it’s important to not become too fixated on costs. If you reject anything with an above average cost attached to it, you might be giving up an opportunity for significantly higher gains. The trick is to not be frightened by high charges, but don’t be ignorant of them either – a professional adviser will be able to guide you through what you will actually pay.”

Funds and trusts with a performance fee worth a look

Odyssean Investment Trust – Rob said: “Odyssean’s approach is quite different to what you get elsewhere, owing in part to its managers’ backgrounds in private equity. The trust holds a relatively concentrated portfolio of stocks that are bought at what the managers feel is a cheap price and then sold for more at a later date. The Odyssean team takes all its performance fees in shares, giving them significant skin in the game and aligning their own interests with other shareholders’.”

Pershing Square – Rob said: “Pershing Square is constantly mentioned for its charging structure, which on the face of it looks expensive. But, in the last five years it has delivered annualised returns of 22.6% in sterling terms after costs, around double the historic annualised average for the S&P 5001. On its current discount to net asset value (NAV), you are paying 64p for £1 of assets – a -36% discount. It looks a compelling proposition, even if you are paying for performance.”

Five-year discrete performance:

Source: Bloomberg

Rob Burgeman and his fellow investment managers at RBC Brewin Dolphin put together bespoke investment portfolios for clients based on their long-term objectives and their attitude to risk. The portfolios will have a mixture of hand-picked holdings in them including third party funds and individual stocks that are researched and recommended by RBC Brewin Dolphin’s in-house research team.

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 365 3456 40.

– ENDS-

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £53.8* billion in assets under management, we offer award-winning, personalised wealth management services from bespoke, discretionary investment management to retirement planning and tax-efficient investing.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 30th April 2023.

1 Source: https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp