What is Bespoke Retirement Solution?

One of the main difficulties in establishing a client’s retirement strategy is ensuring they have enough income to last throughout their life. BRS is designed to mitigate these risks and provide a structured, effective, and flexible investment approach tailored to each client’s specific needs in retirement. Our BRS is specifically built to address the limitations of traditional accumulation/decumulation strategies.

Helping you navigate retirement risks for your clients

Retirement income planning is more complex than ever. With people living longer—many needing income for 30 years or more—advisers face growing challenges in ensuring their clients’ wealth lasts. Risks such as sequencing risk, longevity risk, and inflation risk can significantly impact retirement outcomes.

Our Bespoke Retirement Solution (BRS) helps mitigate these challenges. With a tailored, structured, and holistic approach, BRS aims to reduce the risk of clients running out of money while aligning portfolios with their goals. Backed by decades of expertise, it empowers you to deliver greater confidence, and compliance in your retirement planning strategies.

Advisers are also under increasing pressure to meet Consumer Duty obligations, ensuring solutions avoid foreseeable harm and are suitable for clients’ needs. Sequencing risk, for example, can deplete portfolios if income is withdrawn during market downturns. Longevity risk means funds must last decades, while inflation risk erodes purchasing power over time.

Why choose our Bespoke Retirement Solution?

Tailored to your clients’ needs

BRS is fully customisable to your clients’ unique goals, offering a personalised approach to retirement planning.

Protects against market risks

Mitigates sequencing risk and ‘pound cost ravaging’ by setting aside income in cash and fixed-income assets, so clients aren’t forced to sell during market downturns.

Helps your retirement funds go further

Designed to extend the life of your retirement savings beyond traditional strategies.

Holistic retirement planning

Supports advisers with cashflow modelling tools and insights into pre- and post-retirement behaviours to optimise client outcomes.

Meets your Consumer Duty

Helps you fulfil Consumer Duty obligations with a strategy that reduces the risk of clients running out of money, backed by robust data.

Expert support at every step

Backed by an experienced investment management team, BRS offers ongoing support and flexibility to meet your clients’ evolving needs.

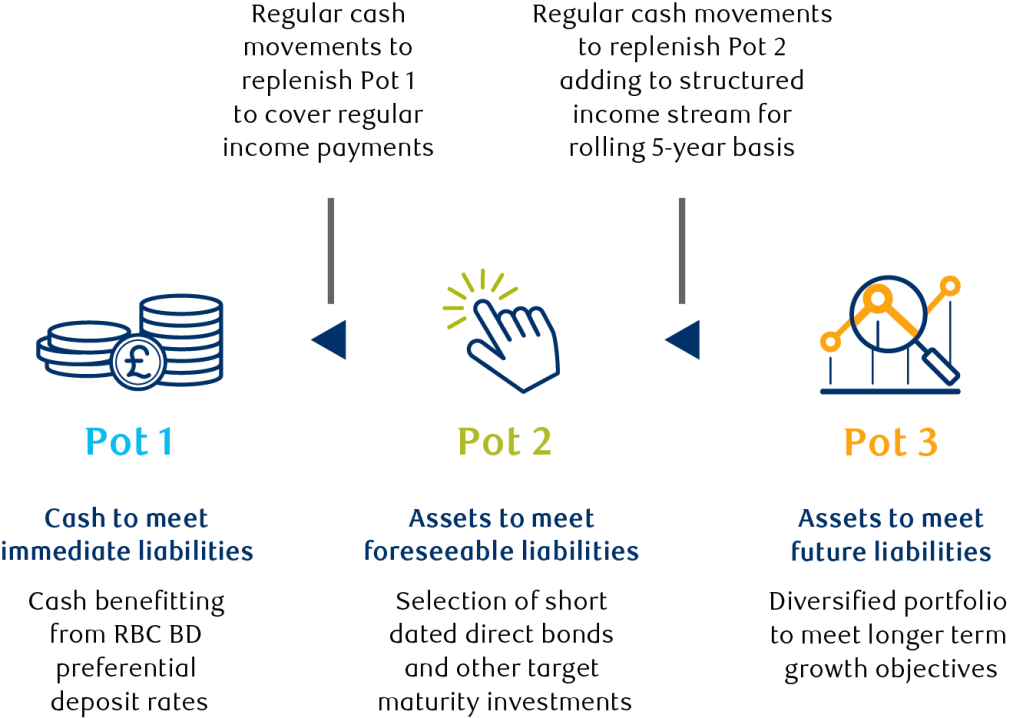

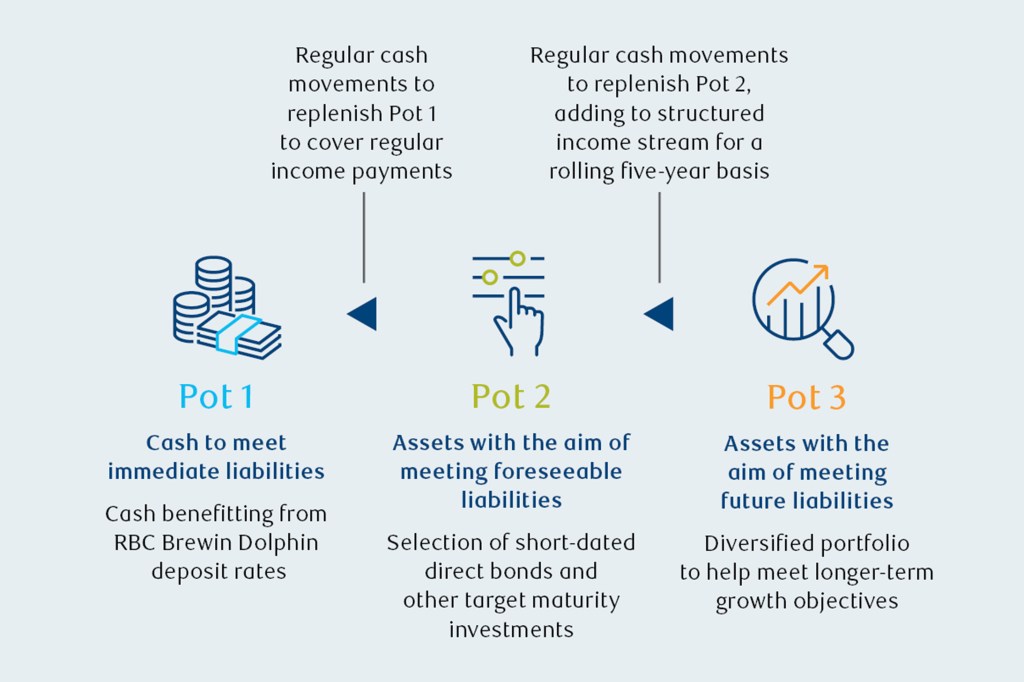

Three pot structure

Three pot structure

Key features

Blended

Blends traditional assets with more sophisticated financial instruments to create targeted maturity pots for each stage of your client’s retirement journey.

Timely

Supports immediate liquidity, medium-term income security, and long-term investment growth.

Bespoke

Tailored to each client’s unique circumstances, considering their income needs, capacity for loss, and risk appetite.

Flexible

Offers the flexibility to adapt the portfolio over time to reflect the client’s evolving needs.

Expert

Managed by experienced investment managers with decades of experience in financial markets.

Why choose RBC Brewin Dolphin?

Trusted

1,700 adviser partners

Expert

Voted top of our field

Established

Our firm dates back to 1762

Your clients’ investments are in safe hands

Gold rating for our Discretionary Fund Management service

A five star rating for our DFM MPS on Platform service

A five diamond rating for our DFM MPS (Platform) Family service

A five star rating for our Bespoke Discretionary Fund Management Service

Your client relationships are, and will remain, yours

Rest assured that your client always belongs to you. We rely on you for information about your clients’ investment requirements, goals, ambitions, attitude to risk and capacity for loss, which helps to inform us about the type of portfolio they require. We only supply investment management services in accordance with your instructions.

Research team

Our research team’s investment philosophy and process forms the foundation for all our services.

Research philosophy

Our in-house research team identifies, analyses and monitors the best investments to enable us to preserve and grow your clients’ money over the long term and respond quickly to market events.

Find out moreResearch investment process

Discover our rigorous, independent and dynamic investment management process, which reduces the regulatory and compliance burden, so you can focus on your clients.

Find out moreOur services

We offer a range of services to help you meet the needs of each client.