28 September 2020

By Alasdair Ronald, consultant at Brewin Dolphin

There are a range of well-worn phrases and sayings that have been used in investment circles since the beginning of my career in the 1980s. They have stood the test of time, despite going through multiple booms, busts, and other vagaries of the economic cycle.

There are a range of well-worn phrases and sayings that have been used in investment circles since the beginning of my career in the 1980s. They have stood the test of time, despite going through multiple booms, busts, and other vagaries of the economic cycle.

Below is a selection of the best-known investment sayings and a take on whether they have made the grade at a time of market volatility and economic stress:

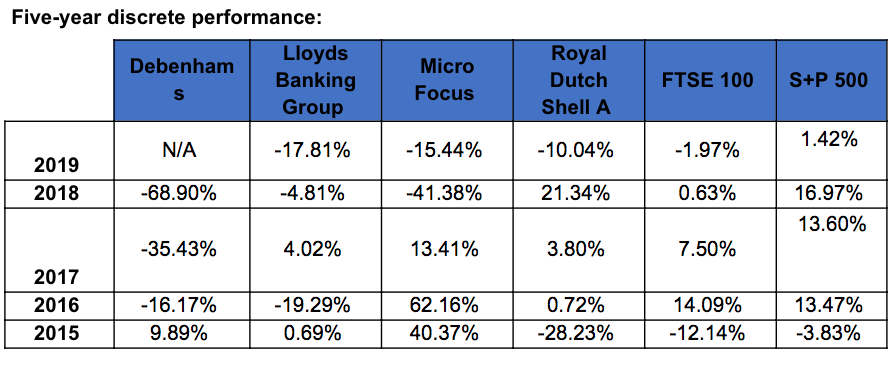

- The first cut is the cheapest – No one likes to take a loss, but sometimes it’s necessary to take short-term pain to avoid even steeper declines to come. If a company is on the brink of collapse, it can be better to accept an initial loss rather than risk losing your entire investment if it goes all the way. The economic impact of Covid-19 has laid entire sectors low, with travel, hospitality, and bricks and mortar retailers largely still languishing in share price terms compared to how they started the year. The banking sector has been among them and, through the pandemic, has gradually moved from being a standalone set of businesses to proxies for government policy.

- A profit is never a profit until it is taken – A profit on paper doesn’t mean anything until you sell the share or fund in which you’re invested – few investors get anywhere by holding on to a stock for too long in a bid to eek every bit of value out of it. If it has had a solid run and you’re happy with your return, sell it, take the money, and run. For example, from flotation 15 years ago to November 2017 the shares of Micro Focus, the technology company, rose more than 10-fold; but one acquisition led to numerous problems and, in July 2020, the group reported it had become loss-making. The share price is now little more than a tenth of its peak.

- Never fall in love with a share – I was told early in my career not to fall in love with a stock. Put simply, it won’t love you back. In fact, it more often than not ends badly. Lots of people loved Royal Dutch Shell, leading to the well-known phrase ‘never sell Shell’. However, this year the company had to cut its dividend for the first time since World War Two, on the back of collapsing oil prices, and its share price remains around half of what it was at the start of the year.

- Never try to catch a falling knife – When a share or a commodity starts to drop, it’s tempting to see a buying opportunity. But that doesn’t mean you should pile in. Many of the banks’ share prices looked cheap even before the crisis hit – now they are even cheaper and do not pay a dividend. Lloyds Banking Group started the year at around 63p per share, but now sits at around 27p. Given the role many of them will have to play in helping economies get back on their feet, their share prices may remain low for some time yet.

- If in doubt, do nowt – There are times when an investment opportunity may appear attractive, but there’s something leaving you unconvinced. And, if you’re not 100% sure, then you shouldn’t do anything. Tobacco stocks were gaining in popularity not long ago, with renewed interest in them brought about by vaping and other products. Yet, these shares are effectively bond-proxies – stocks that, like bonds, offer predictable returns with a higher yield – and with interest rates so low, they are only likely to go in one direction; even if it is not for some time yet. Add to that the increase in socially responsible investing and regulatory interest in vaping, and there are too many imponderables to factor into the investment case for these companies.

- Be fearful when others are greedy and greedy only when others are fearful – At the height of the pandemic, the FTSE 100 dropped as much as 34% from the start of the year – the S&P 500 fell a slightly more modest 25%. However, along with other indexes, they have since staged varying degrees of recovery with the FTSE 100 up around 18% on its low point in March and the S&P 500 gaining more than 50%. If you had bought into the market at peak fear, you would be sitting on quite a profit now.

- When your taxi driver gives you stock tips, it may be time to sell – Everyone is talking about the success of tech companies – the value of many of them has reached new heights, despite the economic impact of Covid-19. Some see tech as the only area in which you can make money; but, are current valuations justified? In the case of Apple, its market value is now more than the whole of the FTSE 100, but some remain concerned about the market penetration by other brands in the smartphone market. Only time will tell whether tech companies can deliver on their lofty valuations.

- Buy on the first bid… – The idea with this saying is that, usually when a bid comes in for a company, negotiations begin and there could even be a bidding war that drives the share price up. However, there has been little in the way of merger and acquisitions following the coronavirus outbreak, with companies understandably focussing on steadying the ship rather than planning expansion. That provides little evidence to work with, but up until March it remained true.

- …Sell on the first profits warning – Debenhams remains the case in point for this adage. Back in 2018, the department store chain announced four profits warnings in little over twelve months and three weeks ago announced that restructuring experts have been appointed to draw up plans for its potential liquidation.

- No one rings a bell when the market peaks and no green light shines when it’s at its low point – At some point it will be a very good time to buy, but nobody will know exactly when. For example, if we have a no-deal Brexit and, simultaneously, there is no vaccine for Covid-19, the market could take a tumble. Equally, while there were many uncertainties when the FTSE 100 peaked in May 2018, it is only with the benefit of hindsight that one could have realised that the market was facing some very difficult times ahead.

- This time it’s different – John Templeton is widely credited with saying these are the four most dangerous, or expensive, words in investing. As recent sell-offs have suggested, some market watchers say the tech boom that has lifted stock markets of late could run out of legs. But others believe otherwise…

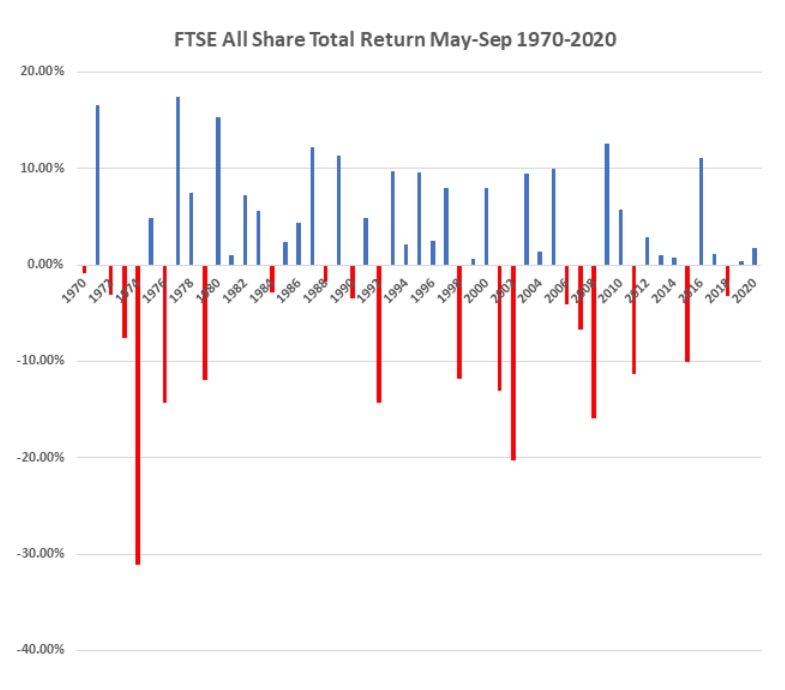

- Sell in May and go away – don’t come back till St Leger Day – In more normal times, this cliché came about because the prevailing logic was that trips to Ascot, Wimbledon, and other sporting events means that trading tended to take a back seat and markets remain flat or start to drift. But a myriad of studies have suggested that this theory doesn’t hold up in reality – these days, technology means that fund managers can be contacted at any time and decisions made. As the chart below demonstrates, over the past 50 years it has only been correct 36% of the time – and in this year of extreme volatility you would even have made a small gain if you had stayed invested.

Source: Thomson Financial Datastream

– ENDS –

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel. +44 (0) 20 3201 3343

Anita Turland: anita.turland@brewin.co.uk / Tel: (0) 20 3201 4263

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

Source: Thomson Financial Datastream

NOTES TO EDITORS

Disclaimers:

- The value of investments and any income from them can fall and you may get back less than you invested.

- The opinions expressed in this document are not necessarily the views held throughout Brewin Dolphin Ltd.

- Past performance is not a guide to future performance

- We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. In addition we reserve the right to act as principal or agent with regard to the sale or purchase of any security mentioned in this document. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.

- This information is for illustrative purposes only and is not intended as investment advice.

- No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us.

- If your clients invest in currencies other than their own, fluctuations in currency value will mean that the value of their investment will move independently of the underlying asset.

- The information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

- Brewin Dolphin is authorised and regulated by the FCA (Financial Services Register reference number 124444)

About Brewin Dolphin

Brewin Dolphin is a UK FTSE 250 provider of discretionary wealth management. With £46.7* billion in total funds, it offers award-winning personalised wealth management services that meet the varied needs of our clients including individuals, charities and corporates.

We give clients security and wellbeing by helping them to protect and grow their wealth, in order to enrich their lives by achieving their goals and aspirations. Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £40.6* billion on a discretionary basis.

Our intermediary business manages £14.2* billion of assets for over 1,700 advice firms either on a discretionary basis or via our Managed Portfolio Service.

In line with the premium we place on personal relationships, we’ve built a network of 33 offices across the UK, Jersey and Dublin, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

*as at 30th June 2020